Sanofi is joining the biosimilars trend to challenge Roche’s best-selling biological with a partnership that aims to take over the Chinese cancer market.

Sanofi is going after the €6.8B ($7.3B) that Roche’s Rituxan/MabThera (rituximab), the second top-selling biological, made last year in revenues. The French pharma has signed a deal worth up to €219M ($236M) with Taiwan’s JHL Biotech for exclusive rights to commercialize its rituximab biosimilar in China.

Sanofi will make an upfront payment of €19M ($21M), invest €74M ($80M) in JHL shares and take charge of commercialization in China. By providing a price discount in the 20-30% range, a biosimilar of Roche‘s blockbuster could take a big chunk out of leukemia, lymphoma and rheumatoid arthritis markets in China.

In Europe and the US, however, Novartis‘ Sandoz has taken the lead and is already under review for FDA and EMA approval for its rituximab biosimilar. Amgen and Pfizer also have their own versions in clinical development, so the competition will be strong.

Interestingly, Sanofi seems to have an old beef with Roche over Rituxan after losing a lawsuit in 2012 that claimed Roche’s Genentech was using Sanofi’s technology to produce the antibody.

Independently of any rivalries, this is yet another example of how big pharma are starting to join the fight to take over the biosimilars market. Boehringer Ingelheim is one of the most recent additions to the biosimilar war; the German pharma is going after Roche’s Avastin and AbbVie’s Humira, the top-selling drug.

The reason behind this shift is clear: by 2020, the biosimilars global market is expected to reach an overwhelming €250B. With Sanofi now joining the growing team of biosimilar developers, the whole drugs market will likely see huge changes in the next few years. Ultimately, this will bring patients ever more effective and affordable medications.

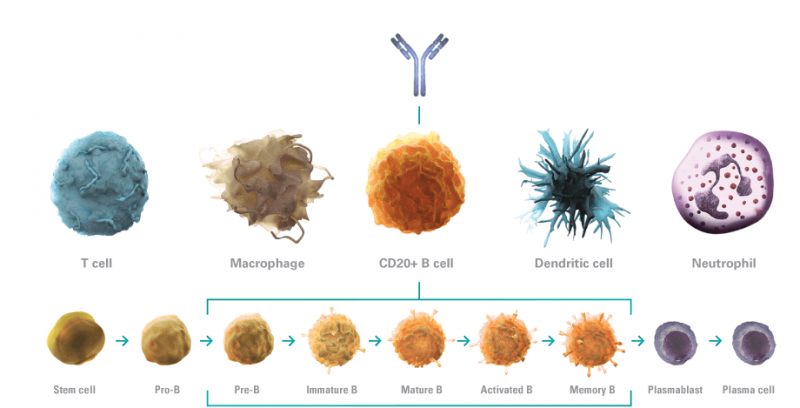

Featured image by Areporter/shutterstock.com; figure from Rituxan