Many new biotechs start off as virtual companies. But at each stage of development, you always end up asking whether you should stay virtual or build your own in-house wet labs. What are the pros and cons of being virtual? And is there a more pragmatic “semi-virtual” approach?

Pros and Cons of being Virtual

Biotechs are high risk, so investors insist you remain frugal. Low fixed costs keep you nimble and flexible, utilising your capital efficiently. If much of your annual burn is fixed, you will struggle to adapt in the face of the many scientific and commercial uncertainties.

Some venture investors like Atlas and Medicxi (the former Index Life Sciences) favour fully-virtual asset-centric companies set up to develop just one asset, with fixed costs well below 20% of their burn rate.

For example, since its founding, the biotech XO1 (Hatfield, UK) operated virtually, working on a single anti-thrombin antibody until it was acquired by Janssen in March 2015. This was a clean sale without having to worry about layoffs, which is very attractive for investors.

Another argument for staying virtual is the easily-accessible global ecosystem of contract research organisations (CROs). Ruthless Big Pharma downsizing fed demand for CRO services and spawned, through organisational spinouts, new CROs filled with experienced scientists and top quality equipment.

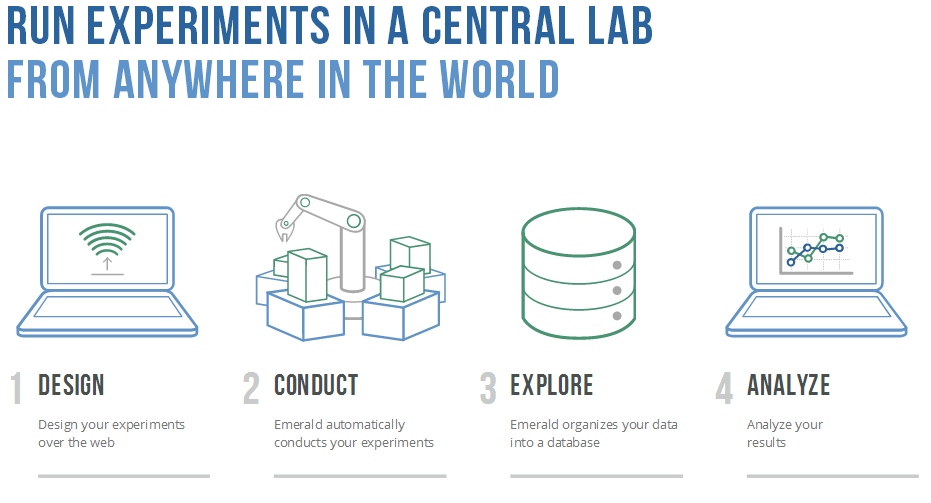

Most recently, new players like Emerald Cloud Lab (San Francisco) and Transcriptic established the cloud laboratory concept, enabling almost anyone to set up and run their own experiments in a hosted offsite wet lab—a real boon to prospective scientific entrepreneurs and startups.

On the downside, you worry if your CROs have the same urgency, motivation and willingness to go the extra kilometre compared to your own people…

And working with many CROs is a communication and logistics nightmare – coordinating multiple CROs over different geographies and timezones while managing the gulf in organisational culture.

Some virtual biotechs minimise this complexity by strategically allying with just a select few CROs. For instance, the antibiotic specialist Auspherix (Stevenage, UK) partners with Domainex in Cambridge for chemistry and DMPK, and with Evotec (in Hamburg, Germany) for in vivo pharmacology.

Arguments for going Semi-Virtual

Most biotechs are built around some distinctive know-how, represented by patented intellectual property combined with related scientific expertise and skills. Sometimes this can be applied effectively without an in-house wet lab.

More often than not however, in-house groups exploiting this distinctive know-how give you a major competitive advantage by showcasing differentiation. In this case, your best approach is to go ‘semi-virtual’ with in-house scientific operations centred around your distinctive know-how while relying on external partners for the rest.

For example, if you major in a specific biological pathway, you might develop and maintain proprietary assays in-house while collaborating with chemistry CROs and antibody technology providers to create drug molecules.

It’s rare for your distinctive know-how to be fully developed at startup. An in-house group can strengthen and extend this know-how over time by tapping the creativity from a critical mass of scientists, and learning from hard-won experience.

It’s rare for your distinctive know-how to be fully developed at startup.”

An in-house group can also generate revenue from service/technology provision in parallel to driving proprietary R&D. This improves cash flow and enables more flexible partnering. Many “classic” semi-virtual biotechs adopt this hybrid model.

For instance, companies such as F-Star and Kymab (both in Cambridge) focus in-house on their antibody technologies while working with partners who have the relevant drug target and pharmacological expertise, via both service/technology provision and co-discovery alliances.

The same logic also works in reverse. Companies that started out as CROs such as Ergomed (in the UK) and Selvita (in Poland) now operate a hybrid model, using their in-house strengths to or conduct their own discovery programmes.

Last but not least, you are more likely as a semi-virtual biotech to evolve into a sustainable and fast-growing biopharma product company, creating many new jobs in your local economy along the way. In contrast, virtual biotechs are inevitably acquired quickly by large companies if their projects are successful.

Whereas biotechs that do everything in-house are weighed down by fixed costs and struggle to survive in rapidly changing circumstances…

A Trap to Avoid

A common trap for biotechs taking the semi-virtual route is taking on too much in-house. When helping biotechs develop their operational and organizational strategies, I encourage them to be very disciplined about defining which in-house know-how truly confers real strategic advantage and is thus “distinctive”.

Some operations, although very important scientifically, can nevertheless be conducted just as effectively and often more efficiently by external collaborators.

Every time you add even one person in-house, there is a penalty in increased capital utilisation and decreased flexibility that must be outweighed by the incremental benefits.

About the Author

About the Author

Robert Thong consults and writes on bioscience business strategy, collaborations and change. He is the author of ‘Biopharma R&D Partnerships: From David & Goliath to Networked R&D‘, a new book on collaborations between small biotechs or academia with large pharma, based on the practical experiences of over forty different organizations.

Robert is neither employed by, nor an adviser to, the companies mentioned in this article.

Feature Image Credit: Pixabay (Remixed by Labiotech)

In-text Illustrations: Courtesy of Frits Ahlefeldlt – Hiking Artist (www.hikingartist.com)

About the Author

About the Author