Update (15/05/2020): The Swiss biotech ADC Therapeutics has priced its IPO on the New York Stock Exchange far above the initial target of €172M, raising a total of €215.2M ($232.7M).

ADC Therapeutics ended up offering more than 12 million shares at a price of €17.57 ($19) per share, which was higher than the €16.65 ($18) maximum it expected per share.

While the IPO beat expectations amid the uncertainty caused by the Covid-19 pandemic, it remains to be seen how the company’s stock prices perform in the coming months.

Published 14/05/2020

The Swiss company ADC Therapeutics will attempt to raise up to €172M in an IPO on the New York Stock Exchange (NYSE), following its Nasdaq IPO withdrawal last October.

According to the company’s latest update, ADC Therapeutics had an initial maximum target of around €120M. However, MarketWatch and Renaissance Capital today reported that ADC Therapeutics is offering more shares, increasing its maximum target to €172M.

The funds will be used to complete a pivotal phase II trial of the company’s lead candidate Lonca in patients with the blood cancer diffuse large B-cell lymphoma, and ultimately bring the drug to the US market.

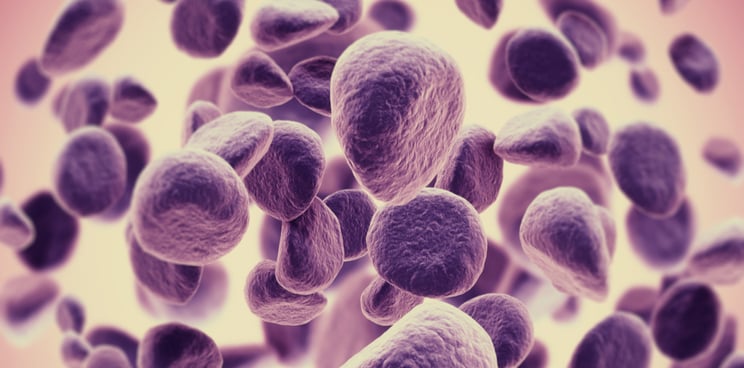

Lausanne-based ADC Therapeutics specializes in the development of antibody-drug conjugates, in which an antibody is attached to a chemotherapy drug. The antibody is designed to selectively bind to tumor cells, and once bound, the drug is internalized by the tumor where it releases its toxic effects. The specificity to the tumor means the treatment minimizes toxicity to healthy cells, reducing potential side-effects.

The company has a number of other candidates, targeting both blood cancers and solid tumors, in either the preclinical stage or early clinical trials. The funds raised from the IPO will also be used to further the development of these products.

Despite closing a €271M ($303M) Series E funding round in July 2019, adverse market conditions in October 2019 led ADC Therapeutics to withdraw its Nasdaq IPO.

The biotech’s IPO accompanies a €106M loan agreement made with the US firm Deerfield Management Company at the beginning of this month. Of the total loan, ADC Therapeutics can expect €60M upon completing its IPO, and another €46M once Lonca gets regulatory approval, amongst other conditions.

ADC Therapeutics might now be hoping that, despite current financial uncertainty due to the Covid-19 epidemic, the IPO funds are sufficient to grow the company. And if the first few months of 2020 are anything to go by, it may have little need for concern.

Pierre Kiecolt-Wahl, Partner and Managing Director of Equity Capital Markets at UK investment firm Bryan, Garnier & Co, told me that it’s pretty much “business as usual” for biotech companies issuing IPOs at the moment.

Overall, “volumes are slightly down, but this is not a market that has closed at all,” he said, noting that pricing discounts have widened, which is likely a result of slightly increased risk.

Indeed, four healthcare companies made it into the top 10 largest IPOs of the past three months. These include the US firms Oric Pharmaceuticals, Imara, and Passage Bio, along with the Israeli oncology company Ayala Pharmaceuticals.

Ayala in particular raised 10% more than expected from its Nasdaq IPO last week, with a final total of €51M ($55M).

Kiecolt-Wahl also noted that IPOs have slowed, but continue to be issued in both Europe and Asia, including Hong Kong and China. He suggested that, in Europe, the slowing may be due in part to the fact that it is annual general meeting season. In Hong-Kong, meanwhile, the due diligence process requires the sponsor to visit the laboratory, which is currently difficult due to travel restrictions relating to Covid-19.

European public markets have also provided some post-IPO windfalls for biotech companies in recent weeks. This month, for example, the Swedish company Oncopeptides raised an impressive €133M in a share issue on Nasdaq Stockholm.

Image from Shutterstock