There is a lot of talk about how cell and gene therapy are going to change medicine, so why have only a few of them reached the market?

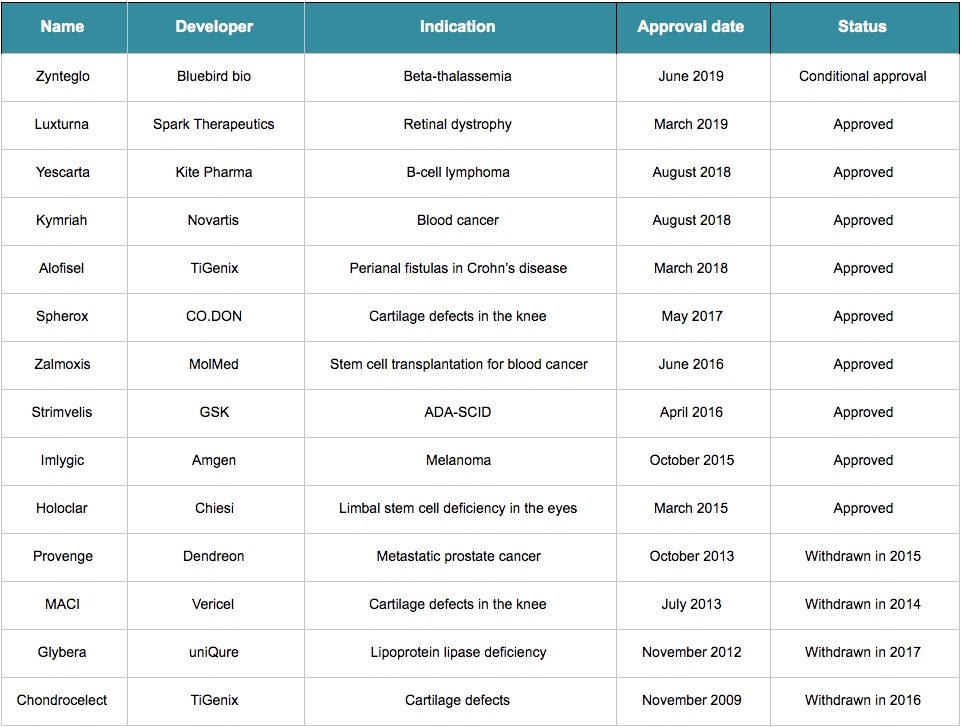

Over the last decade, only 15 advanced therapy medicinal products (ATMPs) – that is, cell and gene therapies – have received approval in Europe. With four withdrawals, only 11 of them still have a valid marketing authorization.

That is a stark contrast with the fact that there have been over 500 clinical trials using ATMPs in the EU since 2009. But the reality is that it’s a bit too soon to be expecting results – many of these technologies are brand new and decades-old discoveries are only just reaching the market. For example, the development of Strimvelis, approved in 2016, took more than 20 years. The approval of Chondrocelect in 2009 took nine years since its developer, TiGenix, was founded.

Holoclar initially seemed like an exceptional case: research and development started around 1996 and the first clinical results were published just a year later. But one of its developers, Graziella Pellegrini, reported the product was under development for a total of 25 years. So those excited about CRISPR therapies, based on a gene-editing technology that was only developed in 2012, will still have to wait.

If the time scale wasn’t daunting enough, research and development also burns cash quickly. A big chunk of the total money invested goes into meeting the quality, safety, and efficacy standards set by the regulatory authorities. This step seems to represent one of the biggest challenges for developers.

In fact, when regulations for ATMPs were first released in Europe, it appeared that authorities and researchers were on different wavelengths. “In 2007, new European Union (EU) regulations on advanced therapies came in, which added more, very frustrating years to the development,” said Pellegrini. “It seemed that we had to start from scratch.”

Thanks to frequent stakeholder consultations, these requirements are constantly being simplified, following the EMA’s goal of fostering development and expanding patient access. But even with dynamic regulations, some products may only be authorized at the national level and not for the whole continent.

For example, there is a dedicated pathway to exceptionally approve and commercialize ATMPs only locally as hospital exemptions. This status includes several limitations: this designation is only for non-routine products and those custom-made for individual patients, and importing or exporting them is illegal – which can lead to the dangerous practice of stem cell tourism.

If so much work goes into regulation, why are there so many withdrawals?

It seems complicated enough to reach the market with a cell or gene therapy, but the struggle isn’t over at that point. The EMA can still withdraw a marketing application due to safety issues or if the company doesn’t apply (and pay) for a renewal of the marketing authorization after five years.

That was the case of Glybera, the first gene therapy to receive approval in Europe. Its developers decided to not renew its market authorization after the therapy’s commercial failure in Europe and difficulties reaching the US market. With a very small target market and a price of one million euros, it was the most expensive treatment back in 2012, making it hard to convince governments and private insurance companies to pay for it.

In fact, only one person was treated with Glybera after its approval. Elisabeth Steinhagen-Thiessen, the doctor who prescribed it, had a lengthy fight with the German authorities and the insurance company to make them pay for the treatment. After the withdrawal, three doses left were given to patients for one euro each.

A big challenge for cell and gene therapies is that they often target conditions that affect a very small number of patients. “Pharmaceutical companies are not much interested in unprofitable rare disease,” commented Pellegrini.

In the case of Strimvelis, there are only about 14 people per year in Europe and 12 in the US diagnosed with its target disease, a rare form of genetic immune deficiency called ADA-SCID. The numbers are better for Holoclar, with around 1,000 people annually in Europe being eligible — burn victims who have become blind but whose eyes have not been too extensively destroyed. Still, it is far short of a blockbuster.

There are exceptions, such as Imlygic, a therapy from Amgen approved in 2015 for the treatment of late-stage melanoma, with over 56,000 new cases across the EU each year.

It’s fair to say that the majority of withdrawals have been made for business reasons, not safety issues. This highlights the fact that receiving EMA approval does not guarantee commercial viability – the product can still be an economic failure.

Clearly, we have a lot of lessons to learn from past failure and success stories. As regulators and insurance companies become more familiar with cell and gene therapies, and developers avoid the mistakes made by others in the past, we can expect a future where cell and gene therapies become commonplace and no longer a futuristic hope.

Cover illustration by Elena Resko, images via Pharma Boardroom and the author. This article was published in April 2018 and has since been updated to reflect the latest EMA approvals.