Learn about the biotech industry in Europe

Dive into our report and…

- Learn about the pandemic’s impact on European biotech

- Get an overview of investor and European biotech company fundraisings

- Review impactful M&A and partnerships activity shaping the therapeutic landscape

- Examine current trends in the biotech industry in Europe and what to expect in 2021

More about this report:

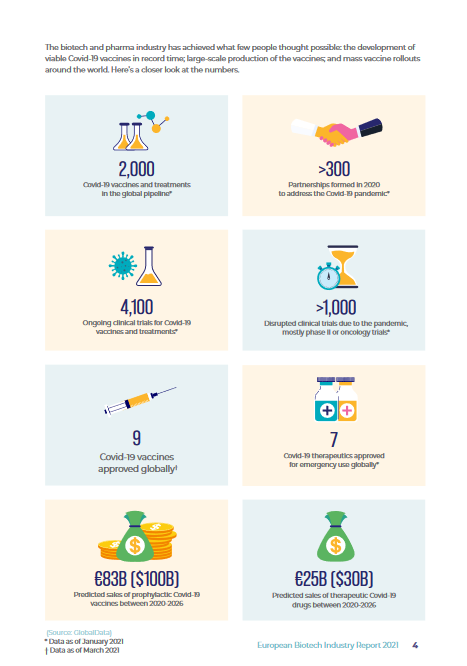

The year 2020 was a rollercoaster ride for the life sciences. This report discusses how the Covid-19 pandemic has impacted Europe’s biotech and pharma industries and covers notable market trends, investments, fundraisings, mergers and acquisitions, and collaborations that occurred in 2020.

It also contains exclusive insights by leading industry experts and provides an overview of the European biotech startup landscape in 2020. Lastly, this report takes a look at how the biotech industry could evolve in 2021.