Paris based Sanofi has pulled out of a €176M deal with Californian clinical stage biotech Ardelyx. A licensing deal for a program of pre-clinical candidates treating renal diseases and IBS-C, similar to Tenapanor, was revoked.

In February 2015, Fresno County’s Ardelyx announced its pharma-baby, Tenapanor, had passed its stage IIB clinical trials in successfully reducing serum levels of phosphate. Excess phosphate in circulation can be a result of renal failure and certain endocrine disorders. If allowed to accumulate, it can cause various other imbalances, including hypocalcemia, therefore resulting in conditions such as renal osteodystrophy.

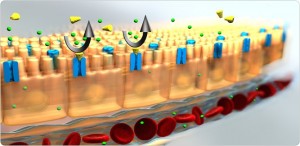

Tenapanor works as an inhibitor of phosphate carrier molecules, such as the NaP2b protein, which is primarily expressed in the upper intestinal tract. Its safety is partly attributed to its ability to remain within the lumen of the gut without absorption, up to 98% of which is eventually excreted (as shown in rats). It has been developed as a treatment for chronic kidney disease patients on dialysis, end-stage renal disease (ESRD) and also irritable bowel syndrome (specifically IBS-C).

Indeed, Ardelyx was so committed to Tenapanor’s efficacy that they bought back their baby from AstraZeneca following a €53M IPO back in 2014. So, Tenapanor is a fabulous sounding drug – why not continue to investigate the other potential applications of NaP2b inhibitors with full-gusto? French pharma giant, Sanofi, initially showed its enthusiasm for Tenapanor by offering up a €1.15M fee to license some similar pre-clinical NaP2b inhibitors, with €175M promised later.

However, ‘later’ never came, and instead, Sanofi pulled out of the deal, handing back the potential candidates and leaving Ardelyx in the cold without compensation. Perhaps Sanofi has decided that the future of NaP2b inhibitors are doomed to live in Tenapanor’s shadow?

Despite this, Sanofi has left one toe dipped in the pre-clinical NaP2b pond with one potential group of phosphate inhibitor candidates, the RDX002 program, remaining under their license.

Ardelyx has put on a brave face, re-branding this recent disappointment with a surprisingly optimistic spin. Their Executive Vice President and CSO, Jeremy Caldwell, claims this, in fact, allows them to regain control of their NaP2b research, which was partially inhibited by Sanofi’s involvement.

Maybe then it is better all round that Tenapanor and like NaP2b inhibitors stick with their Mother-Pharma? After all, Ardelyx appears to be the only biotech who isn’t treating them like a market hot-potato and are committed to seeing them through clinical trials.