Astellas Pharma Inc., through Berry Merger Sub, Inc., a wholly-owned subsidiary of Astellas US Holding, Inc., has agreed to acquire 100% of the outstanding shares of Iveric Bio, Inc., for $40 per share in cash for a total equity value of approximately U.S. $5.9 billion.

Iveric Bio will become an indirectly wholly-owned subsidiary of Astellas. The total equity value of Iveric Bio in the acquisition assumes that there are approximately 148.2 million outstanding shares of Iveric Bio common stock on a fully diluted basis. The purchase price represents a premium of 64% to Iveric Bio’s unaffected closing share price of $24.33 on March 31, 2023, and a premium of 75% to Iveric Bio’s 30 trading day volume weighted average price as of March 31, 2023. The boards of directors of both companies have unanimously approved the transaction.

Astellas looks to deliver for patients

“We are pleased to reach an agreement with Iveric Bio, a company with exceptional expertise in the R&D of innovative therapeutics in the ophthalmology field,” said Naoki Okamura, president and CEO, Astellas.

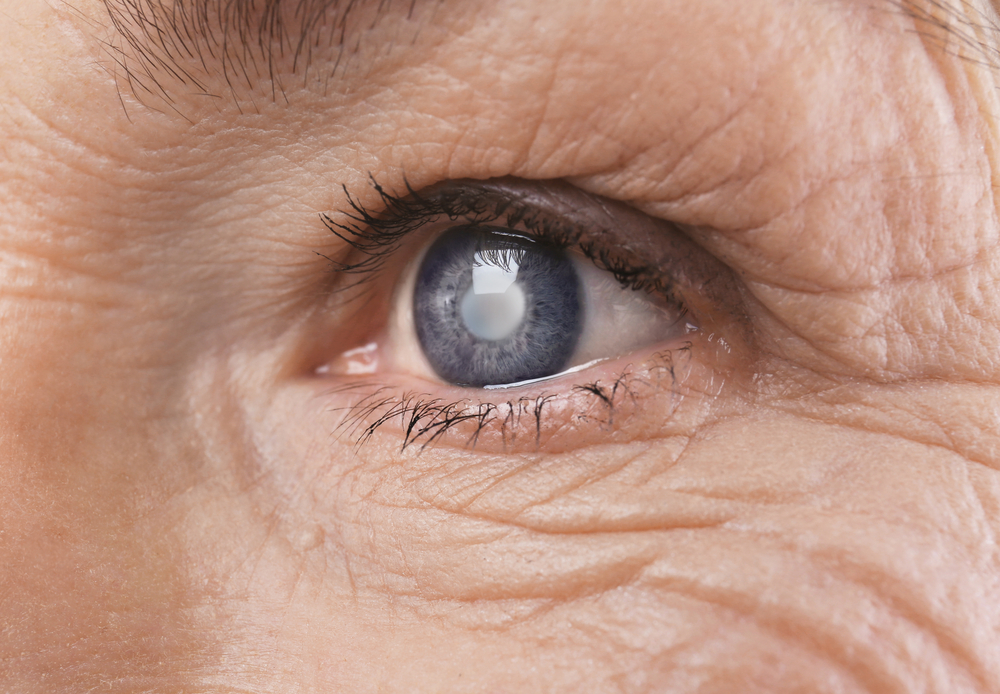

“Iveric Bio has promising programs including Avacincaptad Pegol (ACP), an important program for geographic atrophy (GA) secondary to age-related macular degeneration (AMD), and capabilities across the entire value chain in the ophthalmology field. We believe that this acquisition will enable us to deliver greater value to patients with ocular diseases at high risk of blindness.”

“This transaction with Astellas, a highly respected pharmaceutical company, demonstrates the significant value that we have built for our stockholders and recognizes the tremendous work by our dedicated team at Iveric Bio,” said Glenn P. Sblendorio, chief executive officer of Iveric Bio.

“The opportunity to create a world-class entity with the ophthalmology expertise and capabilities of Iveric Bio and the global reach and resources of Astellas is unique and has the potential to benefit patients worldwide, suffering from blinding retinal diseases, including GA,” said Pravin U. Dugel, president of Iveric Bio.

Astellas strategic objectives

Iveric Bio focuses on the discovery and development of novel treatments in the field of ophthalmology. The company announced in February 2023 that the U.S. Food and Drug Administration (FDA) accepted for filing a new drug application (NDA) for ACP for the treatment of GA secondary to AMD. The NDA has been granted priority review with a Prescription Drug User Fee Act goal date of August 19, 2023.

About ACP

ACP, a complement C5 inhibitor, is an investigational drug for GA, secondary to AMD and has the potential to deliver value to a large and underserved patient base. ACP met its primary efficacy endpoint (reduction of the rate of GA progression) with statistical significance across two pivotal clinical trials, (GATHER clinical trials) and has received breakthrough therapy designation from the FDA for this indication.

Astellas said it expects that the acquisition of Iveric Bio will not only contribute to Astellas’ FY2025 revenue targets, but also that ACP, in conjunction with fezolinetant and PADCEV, is anticipated to be a revenue-generating pillar to help compensate for the decline in sales of XTANDI due to anticipated patent expiration later this decade.

In addition, the acquisition of Iveric Bio will provide a foundation of ophthalmology-focused capabilities, including a multi-faceted commercial team, expansive network of experts in the ophthalmology field, established relationships with medical institutions, and the infrastructure and experience to drive its combined ophthalmology business going forward.

The completion of the acquisition is not subject to a financing condition. Astellas does not anticipate making any change in its dividend policy following the acquisition.

The closing of the proposed acquisition is subject to approval by Iveric Bio’s stockholders and other customary closing conditions, including receipt of required regulatory approvals. The companies expect to complete the acquisition in the third quarter of 2023.