[Update] Bloomberg announced that they make wrong conclusions from their discussion with AstraZeneca’s CEO Pascal Soriot. The CEO was not talking about the specific acquisition of Juno Therapeutics but about a potential acquisition of a CAR-T expert. Juno’s shares rose as much as 15.8 % just after the rumor was released by Bloomerg.

Here is the first version of our article which stays untouched:

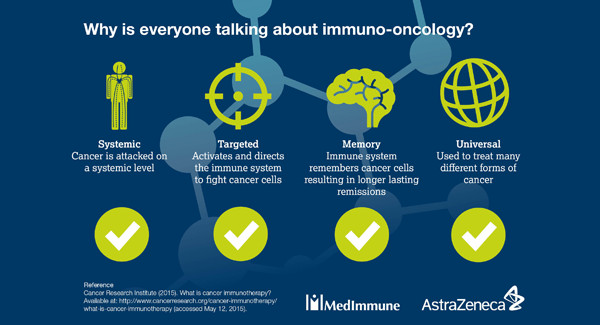

The immuno-oncology race is a never-ending source of news. One particular event hit the tabloids yesterday when Bloomberg reported that AstraZeneca might be considering buying a CAR-T expert biotech to strengthen its immunotherapy pipeline. Rumors say, the UK company is thinking big and has set its eyes on Juno Therapeutics, the rising star of the American biotech horizon.

The two companies are already collaborating to combine Juno’s groundbreaking CAR-T technology with MEDI4736, AstraZeneca’s immunotherapy in development for the treatment of non-small cell lung cancer. The London-based company has been, in fact, inking several deals in this field lately. The most recent one was signed with Eli Lilly to join their cancer candidates against solid tumors.

Juno Therapeutics, on the other hand, is the perfect example of a successful company having benefited from the biotech bubble in America. The Seattle-based company raised more than €270M in less than 12 months, combining the cash raised in its Series A and B. Juno is part of the new wave of immunotherapies developers using novel gene-editing tools to customize the patients’ own T-cells. Their innovative approach consists in using single chain variable fragments (scFv) to recognize a protein of interest, in this case, a cancer protein. When scFv is expressed on the surface of a CAR-T cell and, subsequently, binds to a target protein on a cancer cell, it is able to trigger the activation of the T-cell that will kill the tumorous cell.

Juno is also building the specificity of its technologies, basing it on a deep understanding of mechanisms of immune evasion used by cancer cells. Its bispecific CAR technology includes a second binding domain on the CAR-T cell that can regulate the response, inhibiting or amplifying the signal. This way, the specificity of the CAR-T cells can be increased and differentiate cancer cells from normal cells.

Big and small companies are all rushing to get the bigger piece of the immune-oncology cake, no matter what it costs. For instance, AstraZeneca is already on the front page after being tangled in the middle of Bristol-Myers Squibb’s litigation against a former BMS executive. The British biopharma hired the oncology expert although the former BMS employee was subject to non-competition covenants. Information is power and knowing the secrets of the competiors will certainly make a significant difference in this multibillion field.