U.S. biopharma company ZyVersa Therapeutics, Inc., and Larkspur Health Acquisition Corp., a blank-check special purpose acquisition company, have entered into a definitive business combination agreement.

The transaction is expected to provide ZyVersa with access to the public equity market, which the parties believe will escalate development of ZyVersa’s renal and inflammasome product candidate pipelines.

Upon the business combination transaction closing, which is expected to occur in the fourth quarter of 2022, the combined company is expected to be named ZyVersa Therapeutics, Inc., which will continue to operate under the ZyVersa management team, led by Stephen C. Glover, co-founder, CEO, and chairman.

“We are delighted to partner with Larkspur in this business combination. Their management and board have vast experience as investors and operating executives in the biopharmaceutical industry,” Glover said.

“This merger and entry into the public markets will enable us to escalate development of our pipeline drug candidates for targeted patients with renal and inflammatory diseases, who have the need for disease-modifying drugs that are well tolerated and safe. We believe our drug candidates in development for these patients have potential to meet these needs and help drive improved health outcomes.”

“ZyVersa’s management team has deep scientific and operational experience, and the company has two exciting assets, IC 100 for inflammatory diseases and VAR 200 for renal diseases,” said Daniel J. O’Connor, chairman and CEO of Larkspur.

IC 100 and VAR 200

O’Connor said IC 100, an inflammasome ASC inhibitor, blocks upstream intracellular initiation of the inflammatory cascade and extracellular perpetuation of inflammation, leading to potential for application in numerous, diverse inflammatory conditions.

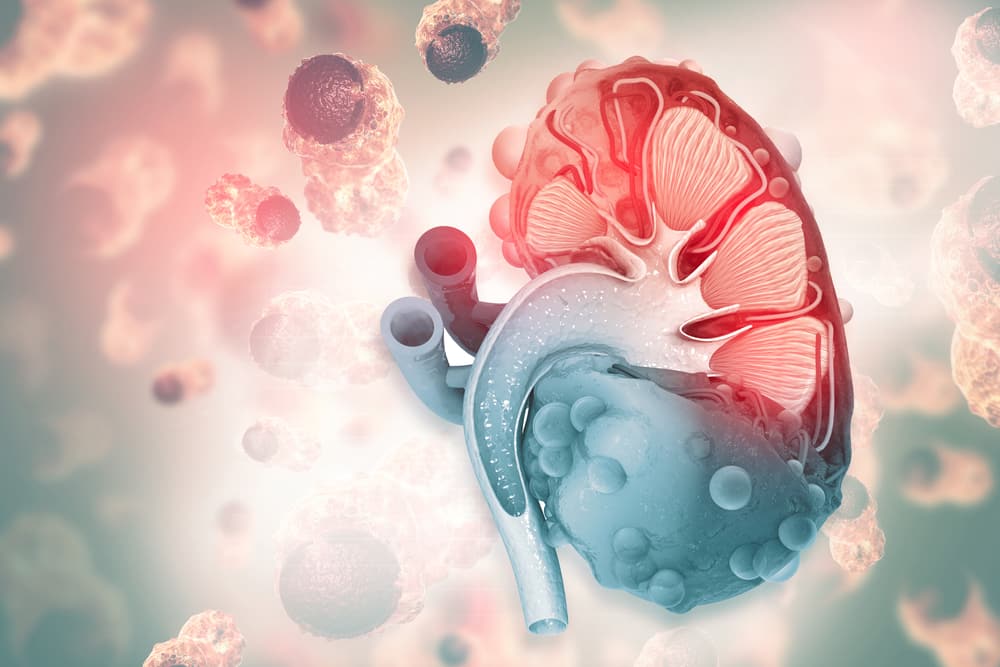

VAR 200, 2-hydroxypropyl-beta-cyclodextrin, is a cholesterol efflux mediator intended to reduce renal lipid accumulation that contributes to glomerular diseases and their progression. VAR 200’s lead indication is orphan focal segmental glomerulosclerosis. It also has potential to treat orphan Alport syndrome and diabetic kidney disease.

Transaction overview

The combined company will have an estimated pro forma enterprise valuation of approximately $108.92 million. Cash proceeds from the transactions contemplated by the business combination agreement are expected to consist of up to approximately $77.67 million of cash held in Larkspur’s trust account (before any redemptions by Larkspur’s public stockholders and the payment of certain expenses) and approximately $7 million attributable to a private investment anchored by new institutional investors.

Proceeds from the PIPE Investment are expected to be used as working capital and to advance the clinical evaluation of VAR 200 and progress IC 100 into the clinic.

The PIPE Investment expected to close in connection with the business combination is conditional upon ZyVersa obtaining an additional interim financing, and also subject to the satisfaction of other customary closing conditions and a NASDAQ listing.

After the closing of the transactions and assuming no redemptions by Larkspur’s public stockholders, existing ZyVersa shareholders will retain 100% of their equity ownership and will own approximately 44.20% of the pro forma combined company.

The transactions, which have been approved by the boards of directors of both ZyVersa and Larkspur, are subject to, among other customary closing conditions, approval by shareholders of Larkspur, and shareholders of ZyVersa.