Newsletter Signup - Under Article / In Page

"*" indicates required fields

Cerenis therapeutic’s lead candidate CER-001 has failed Phase II for the treatment of patients with post-acute coronary syndrome (ACS).

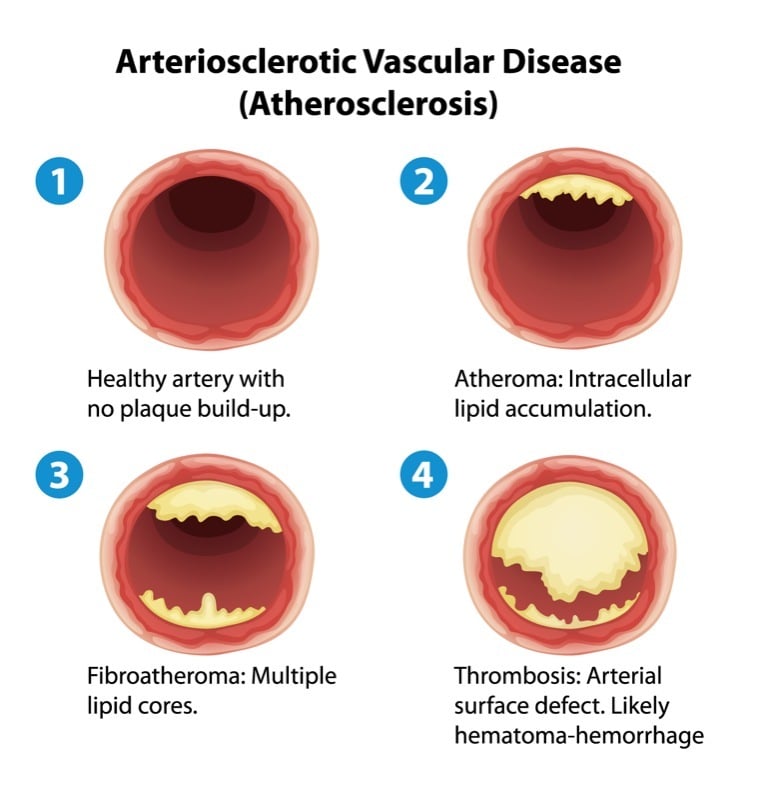

The French-based Biotech Cerenis is developing therapies for the treatment of cardiovascular and metabolic diseases. The company now presented data on its lead candidate CER-001, which was investigated in a Phase II study for the treatment of patients with post-acute coronary syndrome (ACS). CER-001 failed to to reach its primary endpoint of regression of atherosclerotic plaques in post-ACS patients.

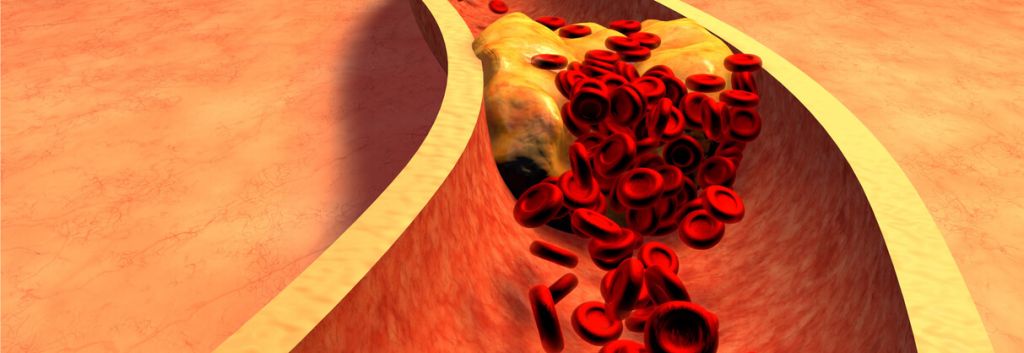

CER-001 is an engineered lipoprotein complex, which mimics the structural and functional biological properties of HDL. This naturally occurring lipoprotein is the primary mediator of the ‘reverse lipid transport’ – a pathway by which excess cholesterol is removed from arteries and eliminated from the body.

The inconsistency of results challenges our understanding of the mechanism of action of CER-001 previously observed in the past studies and compared to early efficacy signals.” commented Stephen Nicholls, Principal Investigator of the study.

This is not the first Phase II failure for CER-001, which already failed to reduce atherosclerotic plaques in patients with ACS in 2014. Still, the company was determined to go on with clinical development of CER-001 based on the learnings of this first trial and was still able to raise a massive sum of €53M with its IPO on Euronext in 2015.

Despite the new Phase II failure in post-ACS patients, the candidate has already reached Phase III for the treatment of patients with genetic HDL deficiencies. Cerenis still has its hopes up since this trial reflects a different patient population, with a different dose and administration schedule.

The company has previously been able to gain a lot of trust from private investors, who have chipped in more than €100M in private funding before its IPO. The high promises of Cerenis’ pipeline seem to be cloudy now and since the biotech announced its recent Phase II results in early March, its shares dropped from almost €8 to a low of 1.70€. Cerenis Market Cap is now at a poor sum of €32M.

The biotech only has one more candidate in the pipeline, an oral P2Y13 receptor agonist, which increases the elimination of lipids in the liver. Cerenis received IND approval from the FDA for CER-209 in the end of 2016, allowing the company to start up clinical development.

It seems like the company now has to clinge to its current Phase III trial for CER-001, or it may loose its most important lead candidate. One step ahead, Sanofi and Regeneron are already investigating their PCSK9 inhibitor, Praluent, in a huge Phase III trial in patients with ACS. This compound reduces the levels of LDL in the blood, a lipoprotein that plays a major role in atherogenesis.

Images via shutterstock.com / BlueRingMedia and Ralwel