The hedge fund Kerrisdale Capital just published a report explaining its position in Bavarian Nordic, showing that the Danish company’s lead candidate has ineffective results. Kerrisdale is inviting other investors to leave their shares in the company before it’s too late.

Bavarian Nordic is under attack! Kerrisdale Capital, an hedge fund with track records in short selling –a financial technique lowering the price of shares before repurchasing it– has Bavarian Nordic in focus and is ready to shoot. Kerrisdale’s research indicates that Prostvac’s phase II results stem from misleading comparisons, not real efficacy.

In the early 2000s, a company called Therion failed in a test of Prostvac, an immuno-oncology therapy, in men with metastatic castration-resistant prostate cancer (mCRPC). As result, Therion went out of business.

Bavarian Nordic, however, gained control of Prostvac and dubbed it a success, since a subsequent follow-up analysis showed that the treatment group experienced an improvement in median overall survival of 8.5 months, higher than the control group. However, according to Kerrisdale’s report, this gap in survival stemmed not from good results in the treatment group but from bad results in the placebo group. The control group in the vaccine’s Phase II study was older and sicker than the treatment group. This underperformance of the controls allowed the treatment-group results to look good by comparison. The hedge fund is now asking question about the outcome of the undergoing Phase III of Prostvac.

Last March, Bavarian Nordic signed a big €880.4M deal with Bristol-Myers Squibb to license and commercialize Prostvac, arousing investors’ appetite with a 30% increase of Bavarian’s shares price. But now Kerrisdale is also doubting this partnership.

Bavarian Nordic and BMS recently tried Prostvac in combiantion with BMS’s monoclonal antibody Yervoy. In a 30-patient trial with no control group, median survival was 31.6 months, little better than the 30-month survival seen in the control groups of other late-stage prostate-cancer studies, suggesting that Prostvac was completely ineffective. Even for the most optimistic people, this study can destroy hopes that combination treatments will rescue Prostvac from weak standalone Phase III data.

“While misleading Phase II results have allowed Prostvac to masquerade as a plausible treatment, when put in proper context the evidence implies the opposite,” said Sahm Adrangi, Chief Investment Officer of Kerrisdale Capital. “Prostvac appears to be yet another ineffective cancer vaccine in a long line of ineffective cancer vaccines.”

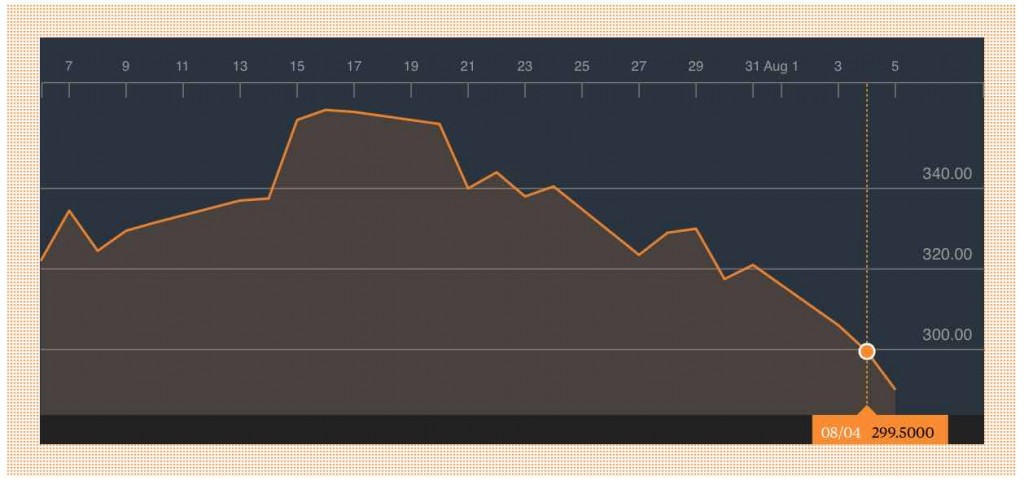

Even if Kerrisdale’s interests are questionnable, this analysis is raising doubts from investors. Despite the defensive position of Bavarian Nordic’s CEO Paul Chaplin in an interview with Bloomberg, the company’s stock price is falling today.

Coincidence or bad sign, Bavarian Nordic announced that James B. Breitmeyer, has today resigned his position as Executive Vice President and Chief Development Officer in the company due to personal reasons. Regardless of the reason given, the news will not help Bavarian Nordic to regain confidence from its investors.