This article provides an update of the 2014 Ebola outbreak relating to other past outbreaks of this disease. It provides demographic and economic insights into both the disease and the regions affected. It highlights lessons learnt and those that need to be learned. Which sectors are most impacted by this outbreak, and what is the potential economic loss of the most affected countries? As you may have observed, companies specializing in Ebola peaked in fall around October with concerns related to the expansion of the outbreak. Since, the fever has settled. It would be wrong to say that the risk is controlled. But it is clear that proven case’s number changed little (with even a disappearance in countries such as Nigeria) and the mass media are turning away. The result: Only a few specialized titles are spared.

The current situation in regards of the last few months

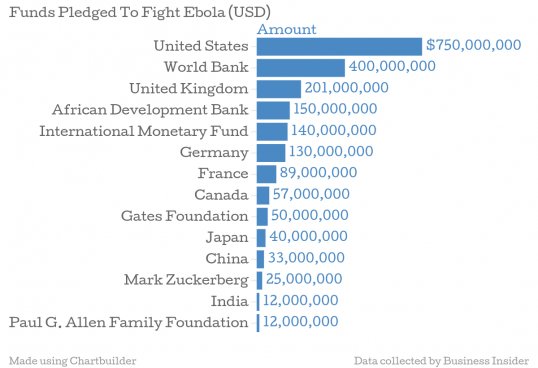

Ebola has infected in 2014 nearly 16,000 people, causing nearly 5,700 deaths mainly across West Africa with a handful of incidents in some developed countries. Developed countries have responded to the Ebola crisis by donating more than $2 billions along with several other private donations (Figure 1). While the loss of lives and impaired work ability due to epidemics lead to evident economic costs, in poor and poorly educated societies the fear and psychological impact may be even greater.

The most affected sectors due to Ebola are the export-generating commodity sectors like cocoa and coffee, as we will discuss later in this article. The other affected sector is pharmaceuticals & biotechnology, which is working mainly on vaccines and treatments for the disease.

Ebola has rapidly spread, within few months and caught the attention of global leaders, due to several reported instances of affected patients in the developed world too.

Figure 1. International funds pledged to fight Ebola (USD)

As we discussed in a previous article, “Ebola, the true story” (https://www.labiotech.eu/review-ebola-true-story/), the virus is not new and was first identified in the Democratic Republic of Congo in 1976, but the 2014 Ebola Outbreak in West Africa has been the most severe, prolonged and complicated so far with the highest impact on the populations as shown on the Table 1. Over the past 40 years, the World Health Organization (W.H.O) has reported 17,425 cases (6,830 deaths).

Table 1. Ebola Outbreaks since 1976

| Year | Location | Reported Cases No | Deaths No (%) |

| 1976 | Zaire | 318 | 280 (88%) |

| 1977 | Zaire | 1 | 1 (100%) |

| 1994 | Gabon | 52 | 31 (60%) |

| 1995 | DRC | 315 | 250 (81%) |

| 01/1996 – 04/1996 | Gabon | 37 | 21 (57%) |

| 07/1996 – 01/1997 | Gabon | 60 | 45 (74%) |

| 1996 | South Africa | 1 | 1 (100%) |

| 10/2001 – 03/2002 | Gabon | 65 | 53 (82%) |

| 10/2001 – 03/2002 | DRC | 59 | 44 (75%) |

| 12/2002 – 04/2003 | DRC | 143 | 128 (89%) |

| 11/2003 – 12/2004 | DRC | 35 | 29 (83%) |

| 2007 | DRC | 264 | 187 (71%) |

| 12/2008 – 02/2009 | DRC | 32 | 15 (47%) |

| 07/2012 – 08/2012 | Uganga | 24 | 17 (71%) |

| 11/2012 – 12/2012 | DRC | 77 | 36 (46%) |

| 12/2012 – 01/2013 | Uganda | 7 | 4 (57%) |

| 2014 | Guinea, Liberia, Sierra Leone, Nigeria, Mali, Senegal, USA, Spain | 15,935 | 5,683 (36%) |

| TOTAL | 17,425 | 6,830 (39%) |

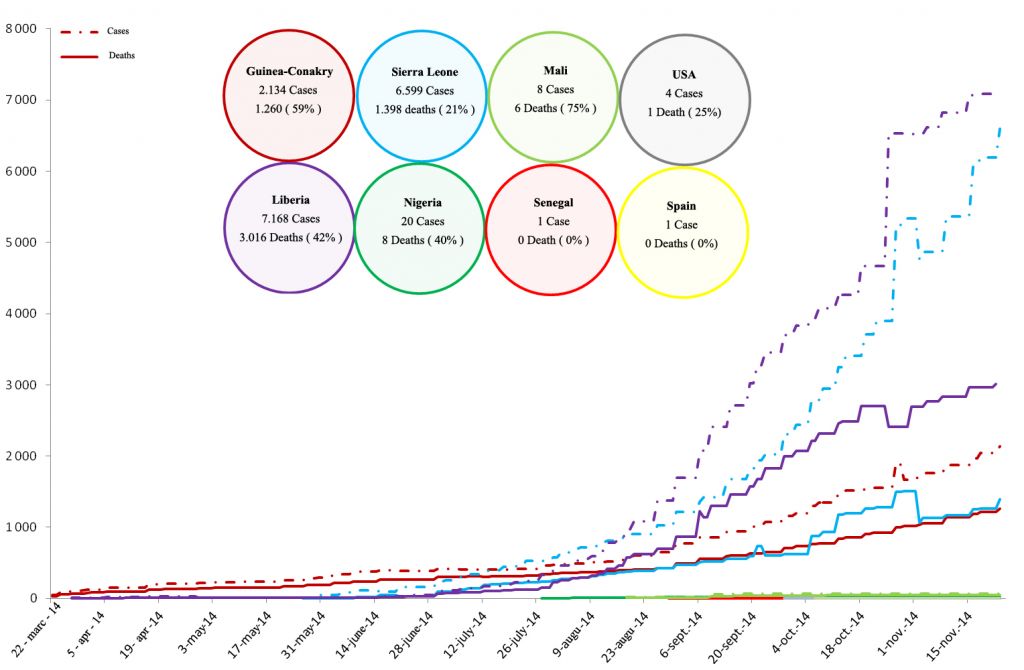

In regard to the W.H.O. report dated of November the 29th, a total of 15,935 confirmed, probable, and suspected cases of Ebola virus disease have been reported in five affected countries (Guinea, Liberia, Mali, Sierra Leone and the United States of America) and three previously affected countries (Nigeria, Senegal and Spain) as shown on Figure 2. There have been 5,689 reported deaths. Cases and deaths continue to be under-reported in this outbreak. Reported case incidence is stable in Guinea (148 confirmed cases reported in the week to 23 November), stable or declining in Liberia (67 new confirmed cases in the week to 23 November), and may still be rising in Sierra Leone (385 new confirmed cases in the week to 23 November). The total number of cases reported in Sierra Leone since the outbreak began will soon eclipse the number reported from Liberia.

The number of infected people has increased during the last month by 2,232 cases and “only” 767 deaths. We can observe a decrease of the contamination rate as reported in the last W.H.O report.

Figure 2. Cumulative mortality from Ebola virus in West Africa since January 2014. (Adapted from: www.thomas.guiraud.co)

Isolation of patients with EVD in Ebola Treatment Centres (ETCs) and Community Care Centres (CCCs) is necessary to prevent further transmission of the disease. CCCs provide an alternative to care in ETCs in areas where there is insufficient ETC capacity, and remote areas that are not yet served by an ETC. Compared with ETCs, CCCs are smaller, with 8 to 15 beds per facility. This means they are easier to set up, which enables response coordinators to provide more rapid, flexible coverage dispersed over a wider geographical area.

The bodies of patients who have died from Ebola are extremely infectious. Therefore, conducting burials in a safe and dignified manner is a crucial component of efforts to halt the transmission of the disease.

An estimated 370 trained burial teams are needed to provide adequate coverage across the three countries with widespread and intense transmission. As of 9 November, 131 trained teams were operational: 50 teams in Guinea, 57 teams in Liberia, and 24 teams in Sierra Leone. All reported burial teams in Guinea are organized by the International Federation of Red Cross and Red Crescent Societies (IFRC). Burial teams in Sierra Leone and Liberia are coordinated by multiple organizations, including the IFRC, the ministries of health and international non-governmental organizations.

Why such a difference in the number of cases in this outbreak compared to the previous ones?

The present effect of Ebola is much more severe than in the past on account of both cultural/historical factors and structural factors. Traditional funeral practices in these regions involving physical contact with the dead make people particularly vulnerable to contracting the disease. Local governments, in West African countries, which have hardly had time to establish their credibility after decades of civil war, have found persuading the population to follow their guidance on dealing with the dead and good public health practices difficult. Also, monitoring the spread of the disease has not been easy for them. Some indicators can explain this lack of efficacy.

Economic and social indicators such as Population, Human Development Index (HDI), Gross National Income (GDP), provide context to the background in these countries. Liberia is also the poorest (GDP per capita) and smallest in population amongst the worst affected countries. On a Human Development Index (quality of life) basis these countries rank amongst the lowest in the world, with Guinea and Sierra Leone exhibiting a low relative ranking on the Corruption Index too.

From a structural standpoint, the indicators above highlight the underdevelopment of this region. This is seen by noting that the access to basic sanitation facilities such as soap and running water is limited. Underfunded, underequipped and understaffed hospitals/medical centres mean that a lot of patients cannot be quarantined properly. For those who managed to stay in hospital, they are unable to receive proper care as the hospitals lack the essential equipment and skilled healthcare workers to diagnose the disease and treat them. Urbanization and high population mobility further complicate the efforts to contain the disease, making it easier for the disease to spread and harder to track.

For the African countries, the full potential of their “demographic dividend” are (1) health and hygiene and (2) political stability and rule of law. Due to their lack of logistics and organisations, at the beginning of the outbreak, these countries failed to report to the W.H.O. immediately, preventing the international community from acting promptly and decisively to the crisis.

What to expect in the coming months?

As of today, there is hope that Ebola could be contained soon. The Spanish nurse who was the first case contracted out of Africa is now recovering and the people were cleared of being virus-infected in Dallas (USA). This shows that Ebola can be contained with efficient healthcare and institutions. President Obama has recently announced that he was “optimistic” about the situation in the US. As the Canadians, the Americans decides to reduce the traffic to and from West Africa, thus the probability of new cases outside Africa is becoming slimmer. Moreover, government authorities are now prepared and are aware of the disease thereby allowing potential contaminated patients to be immediately taken into quarantine.

The challenge now is to develop a treatment and vaccine that will prevent the disease from spreading and will cure patients. According to the W.H.O. and as reported in the article “Ebola, the true story” (https://www.labiotech.eu/review-ebola-true-story/), two vaccines (and probably more) could be ready by the end of the year 2015 and the quantity of vaccines available should be large enough to have a real impact. The disease existed prior to 2014, but no major pharmaceuticals company invested in finding a treatment, as the market was deemed too small. The situation has improved as Ebola is gaining wider attention today, thanks to the mass medias. Companies such as GlaxoSmithKline (GSK), NewLink Genetics Corp, iBio, Johnson&Johnson and Tekmira are reported to have begun testing vaccines designed for this disease. And the French? Are they totally out? No … because it is the International Infectious Diseases Research Centre (CIRI) in Lyon that created the basis of two of these vaccines that are currently in development. And a new experimental vaccine is being developed by the french team with US partners in the Molecular basis of viral pathogenicity department (University Lyon 1/Inserm/CNRS/ENS). However, significant obstacles such as the dose safety and efficacy of these vaccines remain.

Ebola’s economic consequences

1) West Africa

The current Ebola crisis has already been imposing huge economic costs on Guinea, Liberia and Sierra Leone. It reduces workers’ productivity by making them too ill to work or prevents them from going to factories. It greatly decreases the supply of food, which pushes up food prices and lowers the purchasing power of household income.

Note that food makes up the bulk of household expenditure in poor economies and contributes more majorly to inflation than in richer countries. In addition, Ebola also creates a significant fiscal burden for the governments by increasing healthcare expenditure and social protection spending and reducing tax revenue from trade and economic activities.

Indirect costs that arise from psychological fear are even higher and a lot harder to measure. Behavioural changes such as reduced participation in the labour market, reduced travel, reduced trades for fear of contagion have significant impacts on all the major sectors including agriculture, transport, manufacturing and services.

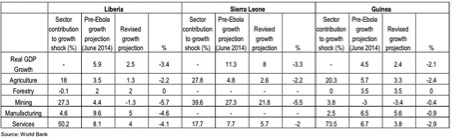

Table 2. Estimated GDP impact of Ebola by sector, 2014

We can see on Table 2 that Liberia is the most Ebola affected country, with its GDP growth forecast reduced by 3.4%. Sierra Leone and Guinea are likely to see their GDP growth reduced respectively by 3.3% and 2.1%, respectively.

The World Bank Group in a recent report proposed two possible scenarios in measuring the overall Ebola’s economic impact. The “low Ebola” case where rapid containment could be achieved by the end of 2014 is estimated to cost these three countries and West Africa $129mn and $1.6bn respectively. If left unconstrained and the situation worsened in 2015, it can cost up to $32.6bn for West Africa by the end of 2015. This could impose a significant strain on the West Africa economy, which has an estimated GDP of $750bn in 2014.

Many sectors are expected to suffer a loss of growth :

– Across the three countries, the biggest impact is felt in the agriculture sector. With a huge population works in agriculture, the loss of agriculture output is substantial. This has resulted in food shortage and higher prices, making it necessary for international aids to be coordinated and adequate food supply ensured.

– Service sectors are severely impacted as well, as hotels see their occupancy rates plummet because flights are cancelled and inbound number of tourists drastically decreased.

– Mining which also occupies a large share of the national economy of these countries is adversely affected. Liberia, for example, saw its largest mining company ArcelorMittal postponed its expansion plan while China Union, the second largest, closed its operation since August.

– Commodities: In Sierra Leone, 90% of exports come from coffee and cocoa beans yet 40% of farmers have abandoned their land because they have been contaminated by the virus. This could lead to a serious decrease in export revenues. Nestle is currently speeding up cocoa shipments from this region to protect the company from buying costlier cocoa in the near future and avoid increasing prices on retail products.

2) Worldwide

Pharmaceutical and Biotech sector is most likely to be affected. As governments and international organizations step in to fund research and development efforts, biotech and pharmaceutical companies are likely to see an increase in government procurement contracts for vaccines. Pharmaceuticals and biotech have the best potential among the sectors in a demographically changing world. This is not only due to the developed world’s populations that are living longer and have to deal with Alzheimer’s, Parkinsons, Multiple Sclerosis, among others but also the vast potential for unleashing the Africa promise by conquering the biggest mortality causes there such as Tuberculosis, diphtheria, tetanus, diarrhoea. It necessitates a certain sense of charity from this sector and the world, to ensure a “decent human standard of living in the world’s poorest continent”.

Another problem that the international community has to address is the market failure present in the pharmaceuticals industry. Ebola has been around for 38 years without the development of any effective vaccines to counter it. The market is too small to motivate the pharmaceutical companies to invest in research and development (R&D). If the private sector’s lack of financial placement is understandable, governments and the international community should step in. The W.H.O. is currently trying to address this issue through an initiative called “Consultative Expert Working Group on Research and Development” which seeks to examine current financing and coordination, as well as proposals for new and innovative sources of financing to stimulate R&D related to diseases in the developed countries.

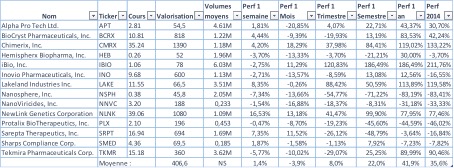

Currently, in parallel to big pharma and big biotech compagnies, fifteen pharmaceutical start-ups have been listed and identified in the Ebola universe that the french Sacha POUGET, Kalliste Biotech Funds Manager, created this year. Eleven are related to therapy, including the Canadian Tekmira Pharmaceutical (+ 81% for action since early January, peaking at + 286% in October), three are in medical facilities and one is in diagnosis. This Universe regroups only US listed companies and has been calculated by “equal weighted” base 100 on June 1st 2014.

Table 3. Ebola Universe by industrie (Source: S. POUGET)

| Company | Ticker | Industrie | Pays |

| Alpha Pro Tech Ltd. | APT | Medical Appliances & Equipment | Canada |

| BioCryst Pharmaceuticals, Inc. | BCRX | Biotechnology | USA |

| Chimerix, Inc. | CMRX | Biotechnology | USA |

| GeoVax Labs | GOVX | Biotechnology | USA |

| Hemispherx Biopharma, Inc. | HEB | Biotechnology | USA |

| iBio, Inc. | IBIO | Biotechnology | USA |

| Inovio Pharmaceuticals, Inc. | INO | Biotechnology | USA |

| Lakeland Industries Inc. | LAKE | Medical Instruments & Supplies | USA |

| Nanosphere, Inc. | NSPH | Medical Instruments & Supplies | USA |

| NanoViricides, Inc. | NNVC | Drug Manufacturers – Major | USA |

| NewLink Genetics Corporation | NLNK | Biotechnology | USA |

| Protalix BioTherapeutics, Inc. | PLX | Biotechnology | Israel |

| Sarepta Therapeutics, Inc. | SRPT | Biotechnology | USA |

| Sharps Compliance Corp. | SMED | Waste Management | USA |

| Tekmira Pharmaceuticals Corp. | TKMR | Biotechnology | USA |

Table 4. Ebola Small Cap Index Universe (Source: S. POUGET, On November 30th)

As you can see from the Table 4 above, only a 1/3 of companies specialized in Ebola have a positive capitalisation over 1 month and 3 months. Only four companies have more than +50% over 6 months (Lakeland, Chimerix, NewLink and iBio). In general, it is falling back to the levels of the beginning of October.

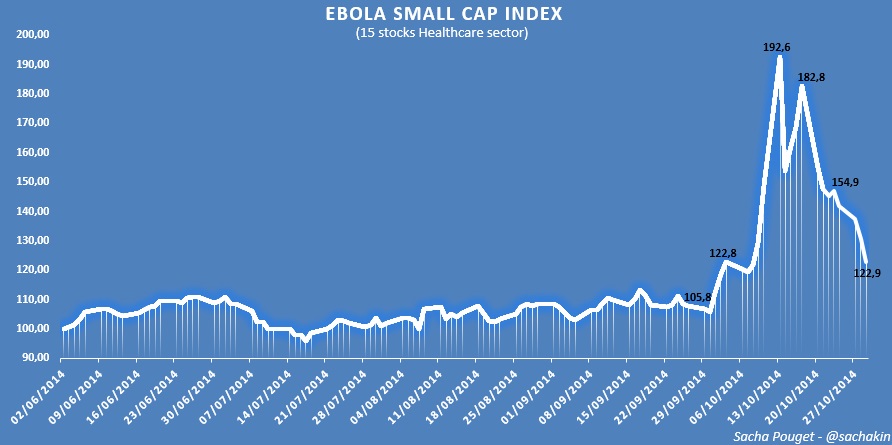

Figure 3. Evolution of the Ebola Index Small Cap Index (updated on November 30th)

The Small cap index created by S. POUGET, reflects investor enthusiasm for the values of this universe and shows us that there has been a surge in October, which matches with reported cases in the US and Spain. The mass media enhanced this phenomenon by highlighting and over-covering, over-rating, in a word by monopolizing the news, with this outbreak and the few occidental cases. The first two weeks of October, the index increased by 82.05% (from 105.8 points to 192.6 points from Sept 30th to Oct 13th). As we can see, it has reached a high peak on this index on October 13th. Then, between Oct 13th and Oct 29th, the Ebola index lost 36.2% of its value (from 192.6 points to 122.9 points). In late October, the price of the Ebola index was back as on Oct 3rd. In November, Ebola index lost 4.11% after taking 11.05% in October.

Ebola will not be the last infectious disease. According to the WHO, 30 new communicable diseases have emerged over the past 20 years. The low income countries are the ones that are particularly susceptible to this. In the long run, the key to preventing disease from spreading is through investment in basic health infrastructure, more resources should be allocated to educating people about how to deal with diseases and how to prevent them. In times of health crisis, health education makes it possible for early identification and encourages population to take correct preventive measures. It also helps to limit the irrational fear these diseases create.

The effects of the Ebola crisis pictured in the mass media are overstated in global terms. The most important reasons for the spread of the disease are culture differences, lack of education and poor public health infrastructure.

The projected costs of the Ebola outbreak for West African countries are likely to be high. Liberia is projected to see its GDP decrease by 3.4%, Sierra Leone by 3.3% and Guinea 2.1% in terms of lost output. Commodity sectors such as cocoa and coffee are likely to be the most affected and sectors like agriculture, mining, manufacturing and services are also likely to see a significant growth decrease. But as quite often the misfortune of some makes the fortune of others. The Pharmaceutical and biotechnological industry grew up in this field, this outbreak allowed to point our weakness, to develop new therapeutics, to move the medical research forward and do not let this to happen again. We all hope this will serve as a lesson for our future. Every country should individually have better health policies, firstly to educate their population on basic hygiene principles and secondly to have in place better health infrastructures allowing them to tackle any diseases outbreak. There is also an increasing need for effective partnership across international institutions and governments to create a better epidemic control programme and have a better coordinated response towards potential crisis. This is absolutely crucial in the globalized world.