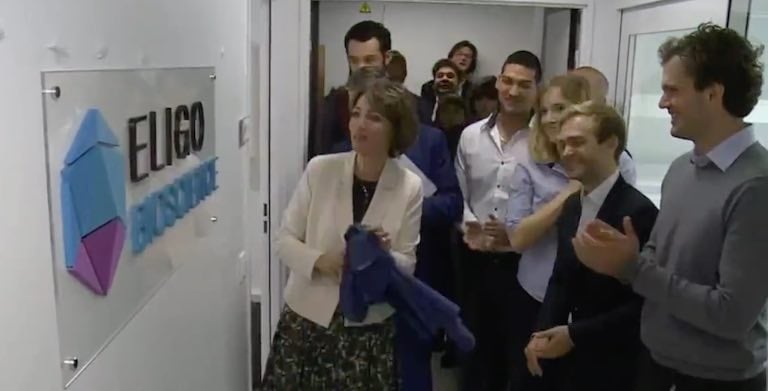

French Health Minister Marisol Touraine visited Eligo Biosciences on Monday, one of the most promising French Biotechs start-ups. Co-founded by young bio-entrepreneurs Xavier Duportet, they inaugurated their brand new office space at Paris’ Institut Pasteur (See our exclusive interview with Duportet here: ‘Meet Eligo’, the Startup which Raised €2M to Redefine Antibiotics using CRISPR’).

French Health Minister Marisol Touraine visited Eligo Biosciences on Monday, one of the most promising French Biotechs start-ups. Co-founded by young bio-entrepreneurs Xavier Duportet, they inaugurated their brand new office space at Paris’ Institut Pasteur (See our exclusive interview with Duportet here: ‘Meet Eligo’, the Startup which Raised €2M to Redefine Antibiotics using CRISPR’).

For the opening, Marisol Touraine joined the party and, as a true politician, she made a speech to accounce the start of a €100M Biotech Fund. The goal is to “help French startups to cross the financial death valley before reaching the market. Because of a lack of access to capital, [French Start-ups] falter by continuously looking for money.”

This is clearly a sign that she doesn’t fully understand how the Biotech ecosystem really works. As they need a huge amount of capital to grow, Biotech companies have to continuously sell their stories to investors. This sort of publicity actually functions to attract capital and has been proven a good way to create a dynamic ecosystem (just look how Boston companies are tied up with their venture capitalists). The VC money is then put towards the astronomical cost of clinical trials with the hope of one day selling the company to a Big Pharma and/or bring a drug to the market. Therefore this kind of business model ultimately leads the investor to reap a 10-100 times return on their initial investment.

Will an additional public fund solve the problem, or is the problem residing somewhere else?

France is already the world champion in public funding. According to Dow Jones Venture Source, the French Public Bank (BPI) was the third biggest investor in Europe for 2014’s Q3. At a micro level, it’s good for entrepreneurs to be granted easier access to capital, but at a macro level it shows that the French private investment ecosystem is deeply broken.

Rich French people leave the country because of astronomical taxes, give up investing in new assets and are instead replaced by public investors (financed by the citizens). This leads to even higher tax levels and therefore further stimulating the ‘Great Exodus’ of the rich. A disastrous negative feedback loop in sum.

Of course, there are several reasons for this, such as very high capital taxes (way higher than the UK or Germany) and less well-established tradition of venture capitalism.

The president of France Biotech, Pierre-Olivier Goineau, aptly responded to the proposed Biotech fund by Touraine to reflect this vicious cycle in France:

Such a fund is [just] not up to the challenge”….”Private money must return to venture capital investment“.

By this, Goineau meant the fund value of €100M is simply not high-enough to break this cycle, and it would instead be more effective to use the money for a different cause – i.e. to facilitate the development of successful venture capitalists in France in order to therefore indirectly finance and develop these Biotech startups.

That’s the real issue here, even if France does already count several successful Biotech VCs from its financial ranks (i.e. Sofinnova, Edmond de Rothschild, Truffle or Seventure).

Other negative comments arose from the 5 major French pharma companies, which were meeting at the “G5 Health” (nice name …) in Paris. The CEO of Ipsen stated “some recent regulation taken against innovation shows a contradiction of the government between acts and wishes.” For another CEO, the regulation for clinical trials should be facilitated and the “important administrative dysfunction” should be fixed first.

Again and again, after London’s Mayor announced an over-ambitious £10Bn Biotech fund, European politicians show they really lack an understanding of all the dynamics of start-ups, innovation & Biotech. I think it would be better if they made the life of Biotech start-ups and larger companies easier (regulation/taxes), instead of trying to do the job of someone else (venture capitalists).

What do you think? I would be curious to hear your opinion in the comments below and see whether you agree with me…