Galecto Biotech has presented positive data from a Phase II study with its pulmonary fibrosis candidate, giving BMS the option of take over the biotech.

In 2014, Denmark’s Galecto Biotech has signed an option agreement with US-based pharma Bristol-Myers Squibb (BMS) for its lead asset TD139, which is under development for the treatment of pulmonary fibrosis. Now that Galecto Biotech has presented positive results from its Phase Ib/IIa trial, BMS has an exclusive 60-day option to buy the Danish biotech that it hasn’t yet taken.

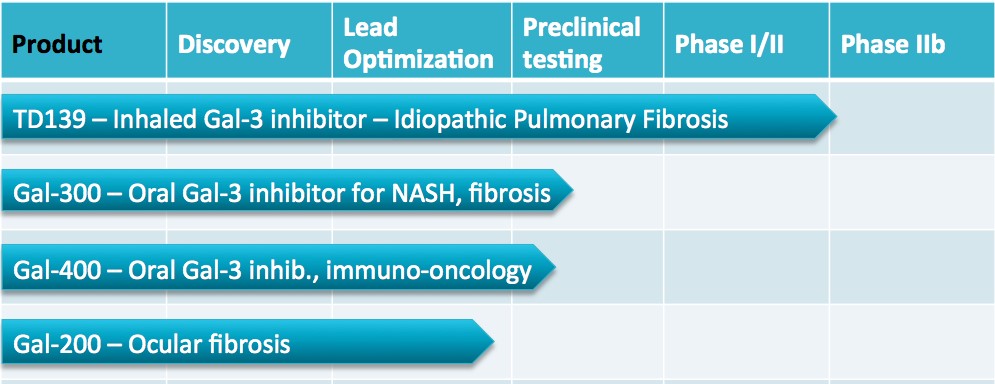

Galecto Biotech is developing galectin modulators, which show promising effects in several disease entities including pulmonary fibrosis, inflammation and cancer. Its only clinical candidate is TD139, a galectin-3 inhibitor. Galectin-3 plays a role in modulating immune processes and has pro-fibrotic activity.

TD139 is currently in clinical development for the treatment of pulmonary fibrosis and the new Phase Ia/IIb results have revealed good tolerability as well as substantial efficacy of the compound in patients with idiopathic pulmonary fibrosis (IPF).

Although Galecto Biotech was not actively searching for a partnership, the company was approached by BMS in 2013 for its asset TD139, which quickly lead to a deal signed in 2014. The exact financial details were not disclosed, but BMS gained the exclusive option to buy its partner following publication of Phase Ib/IIa data for TD139. The total value of the agreement is a huge sum of €413M ($444M) and should BMS choose to use its option, it must do so no later than 60 days after the publication of the data.

No matter what happens now, we are in a great situation – an extremely strong situation. Either BMS decides to buy us or we are free to pursue other options, and in that regard we are in a much stronger position than we were two and a half years ago,” commented Galecto Biotech’s CEO Hans Schambye

The company is backed by a broad base of investors including Novo Seeds, Sunstone Capital and SEED Capital in Denmark, as well as MS Ventures. In fact, the investors might have the chance to further support the aspiring biotech, since so far BMS’ decision to take over Galecto is still awaiting.

BMS is definitely not the same company it was back in 2014. The pharma giant has been facing some pressure in the past year, with PD-1 inhibitor Opdivo receiving serious competition by Merck & Co in the lung-cancer niche. Moreover, its CSO Francis Cuss is set to leave and will be replaced by the external candidate Tom Lynch.

Galecto is planning to move forward regardless of the decision and is already planning a larger Phase II trial with TD139 in about 300 patients. Also, the company is planning to advance its entire portfolio, backed with projects in cancer and eye diseases as well as opportunities within the NASH field.

Undeniably, Galecto Biotech now is in a fortunate position. Still, both management and investors will have to lean back and wait for BMS’ final decision.

Images via Magic mine / shutterstock.com and Galecto Biotech