Biotech is still breaking funding records. A new report by EY provides an interesting analysis of how Biotech is doing, globally and in Europe.

Although 2015 was the best for Biotech yet, but there is a slowdown coming – that’s the gist of EY’s recent report: ‘Beyond borders 2016: Biotech financing‘.

Although 2015 was the best for Biotech yet, but there is a slowdown coming – that’s the gist of EY’s recent report: ‘Beyond borders 2016: Biotech financing‘.

This well-known auditing and strategy company looked into the fundraising, number of IPOs, innovation capital and venture capital raised by Biotechs in the US and Europe, to form a better picture of what’s going on in the industry.

For the second year in a row, the total of the sector’s financing reached unprecedented heights. Biotechs raised close to $71Bn in 2015 – way more than the record $56Bn of 2014.

How’s Europe doing?

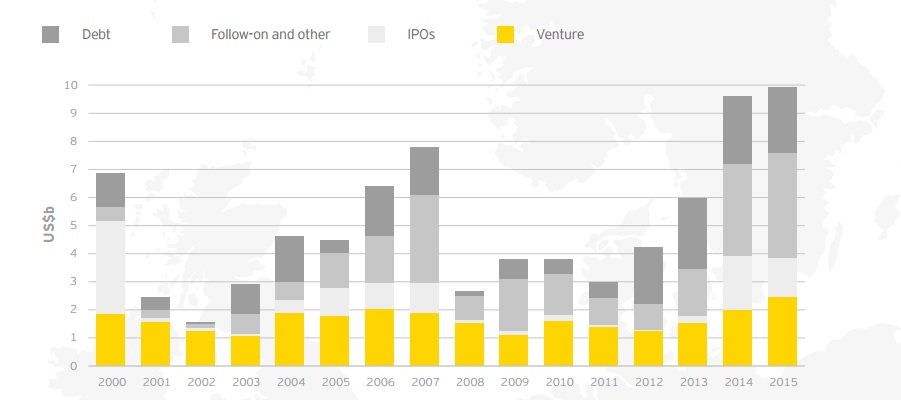

The financials in 2015 was a record for Europe too, even if only by a slight increase – especially considering the jump in 2014.

Europe saw an increase in venture capital and follow-on offerings, whilst the money raised in IPOs was slightly reduced – a sign that the approaching financial storm might get to the rest of Europe.

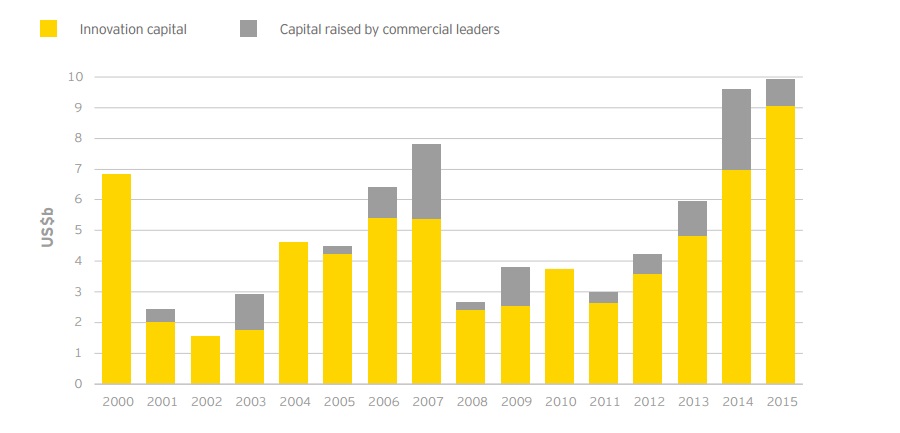

What about innovation?

Innovation capital is the cash raised by companies with revenues of less than around €440M ($500M). In Europe, it represents 91% of all the capital raised.

Unlike the US, the capital raised by commercial leaders (big companies like Actelion, Novozymes and Qiagen) shrinked considerably, to less than $1Bn.

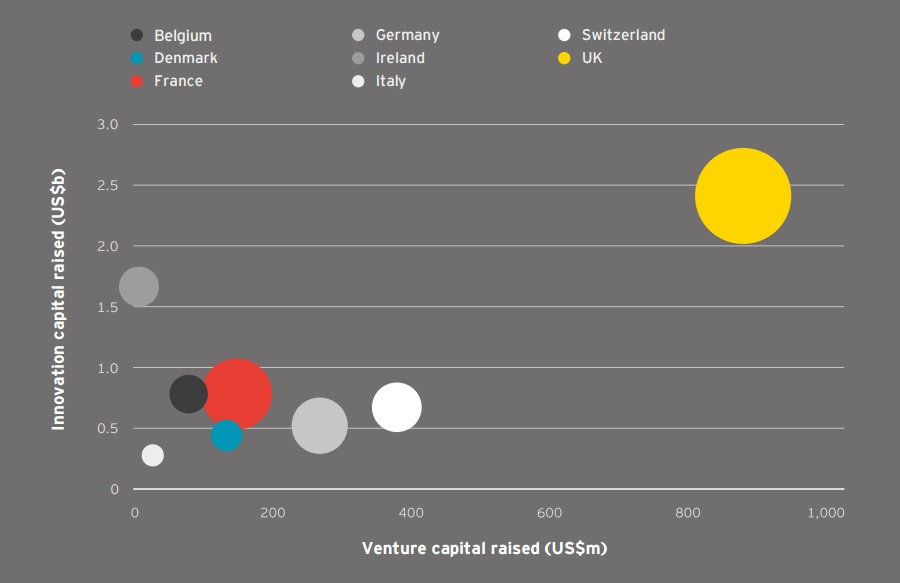

Who’s leading European Biotech?

The UK wins (by a considerable margin) in both innovation capital and venture capital. After all, it had the largest private Europe Biotech financing ever, and was helped by the rounds of Biotechs like Kymab (Cambridge) Mereo BioPharma (London) and Autolus (Cambridge).

The UK’s total funding actually reached €2.1Bn ($2.4Bn).

Ireland took second place in the total innovation capital raised ($1.7Bn), but not much of this cash came from VCs.

This second place is mostly due to Horizon Pharma (Dublin), which may have struggled in acquisitions, but was still the most successful in raising money, with €1.2Bn ($1.38Bn).

France and Belgium get 4th and 5th place, with around €680M ($780) each.

Switzerland and Germany trail behind, but lead in the venture capital raised in continental Europe (surprise surprise). This is in part because Germany has which has CureVac (Tübingen) – one of the few European Unicorns who we interviewed at BIO-Europe in November.

Still, there seems to be a ‘winter’ approaching Biotech finances, with fewer (and less successful IPOs). However, EY believes that Biotechs are well-stocked to last through it. And in Europe, VCs are seeming to also maintain their enthusiasm…