Roche is poised to blow away the competition for the new multiple sclerosis drug with its leading candidate, Ocrevus (ocrelizumab). Phase III data shows it outperforming Merck’s Rebif, the standard therapy for MS.

Competition for a new MS drug has been stiff, but new promising data from the Phase III trial of Ocrevus (ocrelizumab) suggests Roche may corner the market. The drug outperforms the leading therapy, Rebif, from Merck and could be used to treat most MS patients. This potential means that Roche may collect up to €6.2B in revenue from the drug, making it the largest in its late-stage pipeline.

Competition for a new MS drug has been stiff, but new promising data from the Phase III trial of Ocrevus (ocrelizumab) suggests Roche may corner the market. The drug outperforms the leading therapy, Rebif, from Merck and could be used to treat most MS patients. This potential means that Roche may collect up to €6.2B in revenue from the drug, making it the largest in its late-stage pipeline.

So what did the numbers from the clinic reveal? Ocrevus was shown to eliminate MS by an additional 75% of patients over 96 weeks compared to Rebif. Furthermore, primary progressive multiple sclerosis (PPMS), for which there is currently no approved treatment, was halted in 47% more patients than those given a placebo.

The leader of the studies, Professor Gavin Giovannoni at Barts and The London School of Medicine and Dentistry, says,

These new data suggest that ocrelizumab consistently impacts disease progression and has the potential to change how we approach treating both relapsing and primary progressive MS.”

A decision from the FDA on marketing is expected by the end of this year, and it may be critical to Roche’s revenue stream. The company is facing a hit as several patents on its top biologicals are due to expire soon, leaving the medicines they cover vulnerable to generic and biosimilar competitors.

Roche is also not the only one trying to wrest Refib’s sizeable market share from Merck: Biogen (Tecfidera), Novartis (Gilenya) and Sanofi (Aubagio) are also vying for it. Market approval would solidify Roche’s position as the leader in the race, and given the company’s exciting new results, it could come early.

Featured Image: decade3d anatomy online/shutterstock.com

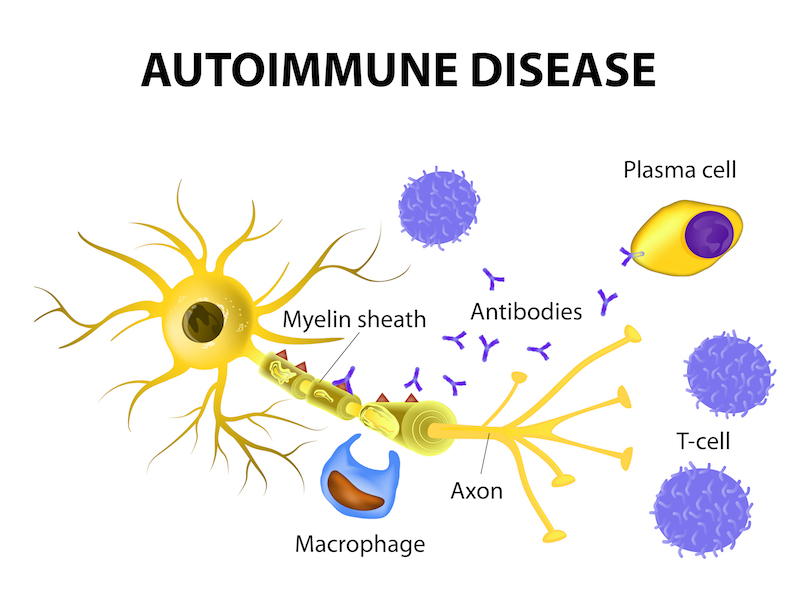

Figure 1: Designua/shutterstock.com