Health for Life Capital, managed by Seventure Partners, has invested $8M (€7.15M) as part of a $50M financing round completed by Boston-based Vedanta Biosciences. This seems to be a great match between one of the most influential Microbiome investors and one of the most successful Microbiome biotechs.

![]() The basis for the financing is a live-bioproduct from Vedanta, which is what makes this news particularly exciting, as it’s one of the first of its kind within the Microbiome field.

The basis for the financing is a live-bioproduct from Vedanta, which is what makes this news particularly exciting, as it’s one of the first of its kind within the Microbiome field.

Managed by Isabelle de Cremoux, the CEO of Seventure Partners flew out to Boston to sign the deal directly after our first conference Labiotech Refresh. We interviewed Isabelle shortly before the event too, on how the World’s First Microbiome Fund was doing.

Vedanta is famous for its approach to live-therapeutics relating to microbiome dysregulation and disease, but is also particularly well known for the impressive team which run it. Founded by PureTech Health, the board includes Pfizer, Merck and Ivy-League elite – even the former CEO of Sanofi, Chris Viehbacher.

Why? Well, it was work led by Kenya Honda, a researcher at the RIKEN Center for Integrative Medical Sciences in Japan and scientific co-founder of Vedanta, which served as the basis for the company.

Honda and team uncovered that a community of microbes belonging to the genus Clostridium (some of the most abundant microbes in the gut of healthy humans) are essential for the development of regulatory T-cells in the gut.

Therefore, deregulation in these communities provided a platform from which therapeutic ‘corrections’ could be developed using live cultures.

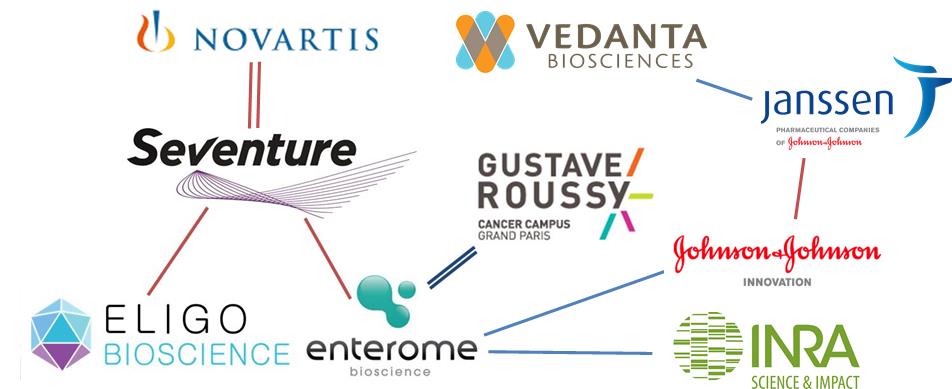

Keeping tabs on the Growing Network in EU Microbiome Research…

This was published in Science and secured the biotech’s name for itself within the Boston ecosystem. Johnson & Johnson even went on to invest in the startup through their innovation center over there, which last year led to a $339M deal for Janssen to obtain rights to develop Vedanta’s lead programme, VE-202 for inflammatory bowel disease.

As their CEO, Bernat Olle, explained, this deal will help Vedanta to expand its pipeline to new indication areas (including infectious diseases, like hospital acquired infections) and to double its employee base to 30.

This financing positions us to advance multiple candidates that have emerged from our discovery platform into clinical trials.”

Indeed, given the Microbiome’s surge in popularity over just the last 12 months, this meant Vedanta was actually one of the first biotechs in the Microbiome hype to make a significant deal.

Other investors in this $50M round included new US and UK players (Rock Springs Capital and Invesco Asset Management).

What does this show for the field? Well, that Vedanta are onto something big…is run by big names, and is attracting big investment – even those from across the Atlantic.

Here Vedanta’s CEO Bernat Olle gives a TED-X Talk on the Microbiome…

Feature Image Credit: Petri Dishes/Bacteria (CC 2.0: M J Richardson)