The German firm Tubulis has raised a €60M Series B round to advance cancer drugs called antibody-drug conjugates (ADCs) to clinical trials. This takes place as the ADC space is heating up with rapid approvals and investment deals.

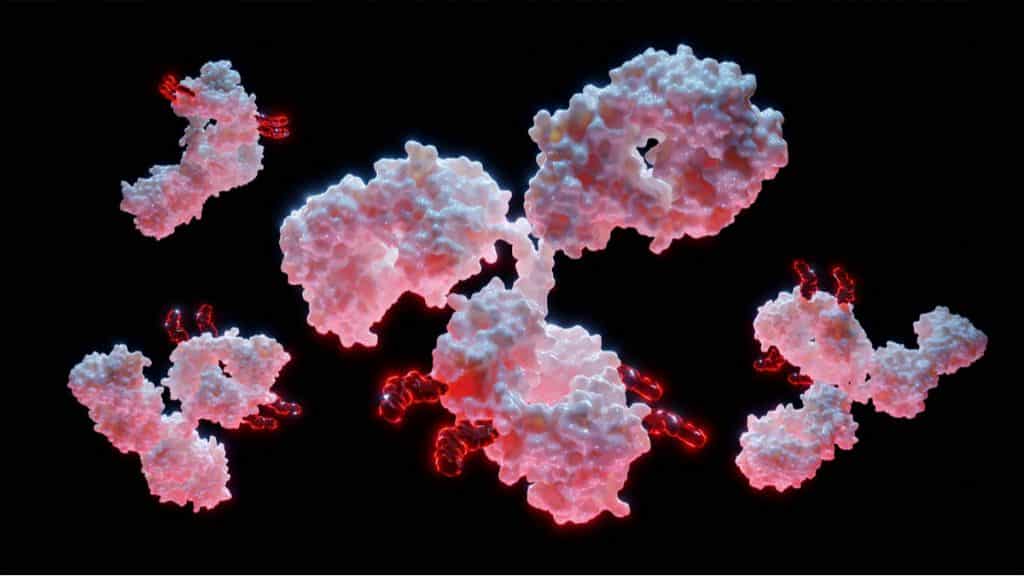

ADCs are the product of attempts to make more selective, safer versions of traditional chemotherapy. They consist of toxic drugs attached by a so-called ‘linker’ molecule to an antibody that can guide them to tumor cells. This drug class has been researched for decades, but has only come into its own in the last few years with the rapid-fire approvals of drugs including Blenrep, Todelvy, Enhertu, and more.

“There is high momentum in the ADC space and it is exciting to see the increase in ADC approvals and to see that these molecules provide benefit for patients,” said Dominik Schumacher, CEO of the German ADC player Tubulis.

As enthusiasm mounts in ADCs, Tubulis raised a €60M Series B round this week led by newcomer Andera Partners. The cash will let Tubulis move its pipeline towards clinical trials for the treatment of lymphoma and undisclosed solid tumors.

A vast amount of innovation is pouring into ADCs around the world. European heavyweights include Byondis, Heidelberg Pharma, Sanofi, and ADC Therapeutics, whose drug Zynlonta got the FDA green light last year. However, there are still common challenges to solve, such as ADCs releasing their payload too early, or the drug hitting healthy tissue close to tumors.

“While recently approved ADCs in that area represent an important step forward, they still have issues with unstable linker chemistry and premature loss of payload,” said Schumacher.

To overcome these limitations, Tubulis researches novel cancer targets in addition to tweaking antibody and linker designs. In one technique, Tubulis engineers carrier antibodies to make them less prone to dropping toxic drugs near healthy tissue. Schumacher told me that the company’s ADC candidates proved more stable than some approved competitor drugs in preclinical experiments.

Another challenge for ADC makers is that tumors come in many shapes and sizes, so drug discovery platforms need to be very flexible. Tubulis’ multi-pronged approach means that the company has many ways to tailor its drugs depending on the type of tumor in its crosshairs.

“The tumor biology dictates the choice of payload and the choice of payload dictates the design of an ADC, including the drug-to-antibody ratio as well as the linker chemistry of the ADC,” said Schumacher. For example, ADCs with very toxic payloads should pack fewer molecules per antibody, whereas candidates with milder payloads need to load each antibody with more molecules to be able to kill the tumor.

Tubulis’ financing is just the latest of a steady stream of deals taking place in the ADC field. Another high-profile example was an impressive €87M Series A round raised by the German startup Emergence Therapeutics in December 2021. And earlier this year, the Dutch player Synaffix entered a €555M ($586M) pact with the US firm MacroGenics in an effort to create best-in-class ADC drugs.

As the field continues to gain traction, Schumacher expects a splurge of ADC approvals around the world in the next couple of years. The next generation could build on existing drugs, many of which have been using unspecific payloads and less advanced antibody carriers.

“We foresee that the field will develop towards more differentiated approaches, including alternative binder formats and novel payload classes that integrate deeply with disease biology,” concluded Schumacher.

Cover image via Shutterstock