French Servier and Pfizer have already had independent partnerships with Cellectis on various R&D areas. But now the two have signed a joint partnership on Cellectis’s leading product UCART19 for blood cancer.

![]() This unusual move only further feeds the rumours of Pfizer’s potential future acquisition of Cellectis. As we’ve discussed before, Cellectis has moved most of its team over to a New York base (just down the road from Pfizer’s HQ…) and the two were rumored to maybe – or maybe not – be about to sign a €1.5Bn deal earlier this year. Indeed, Pfizer already owns around 10% of Cellectis, after signing a €2.6Bn deal…so why not just go all the way?

This unusual move only further feeds the rumours of Pfizer’s potential future acquisition of Cellectis. As we’ve discussed before, Cellectis has moved most of its team over to a New York base (just down the road from Pfizer’s HQ…) and the two were rumored to maybe – or maybe not – be about to sign a €1.5Bn deal earlier this year. Indeed, Pfizer already owns around 10% of Cellectis, after signing a €2.6Bn deal…so why not just go all the way?

Similarly, Servier is another of Cellectis’ love interests, whose investment last year saved ‘the French CAR-T Micracle’ from bankruptcy following the CRISPR out-competition of Cellectis’ own gene-editing platform in the field, TALEN. Indeed, without Servier’s help, the development of Cellectis to become one of Europe’s Top 9 Billion-Euro Biotech company simply wouldn’t have been possible – and not because of a lack of innovation!

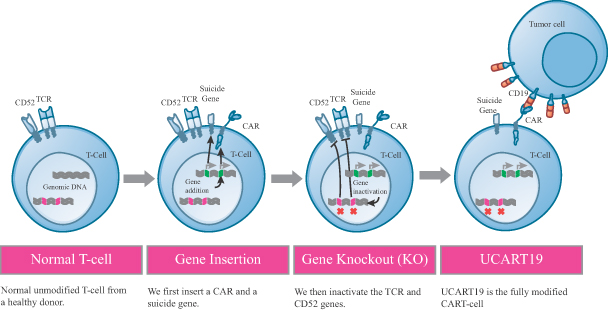

Now, Cellectis’s Universal CAR-T pipeline (UCART) is truly a new feat in therapeutics for blood cancers (including acute lymphocytic leukemia – ALL). This allogenic approach is revolutionary for T-Cell Therapies, and has since been demonstrated as capable of mass-production under GMP standards. Servier has therefore signed a €35.8M deal with Cellectis on its UCART19 candidate, with around €281M in potential milestone payments.

Indeed, its UCART19 exploded across headlines earlier this month after it was used to save a little girl’s life in a last-resort treatment of her ALL at Great Ormond Street Hospital in London. To put this in perspective, their share price has quadrupled in the last year (from around €10.00 in December 2014 up to €40.00 when this news was released last month) and their market cap currently stands at €1.22Bn. So understandably, UCART19 licensing is hugely desirable at the moment!

However, I find this new partnership a little strange…and I don’t mean to be closed minded, but Biotech-Pharma monogamy over a particular product has been the status-quo in the industry business for a long time. Rarely is the competition between pharmas settled with a joint-partnership to develop and commercialize a single product.

And with regards to a potential Pfizer acquisition, honestly, this feels more like a gossip column for Pharma. Will they – won’t they? My inclination is yes, this acquisition being an eventuality for Cellectis more than anything.

I mean, surely by now the time to be coy about their affections has long since passed…?