The OECD recently published an update on key biotechnology indicators, an opportunity for us to delve into the top-performing countries in the field. With the highest number of active biotech companies (2,840) and an R&D intensity added value of 17%, the U.S. remains a strong leader in the industry. But other nations have arguments to put forward: The UK’s impressive 2023 third quarter strengthening its position as an innovation driver in Europe, or Belgium’s impressive 35.7% in biotech R&D added value, show an uneven yet promising biotechnology landscape. Here are the best countries for biotech according to the OECD.

Table of contents

The biotechnology uneven growth landscape among countries

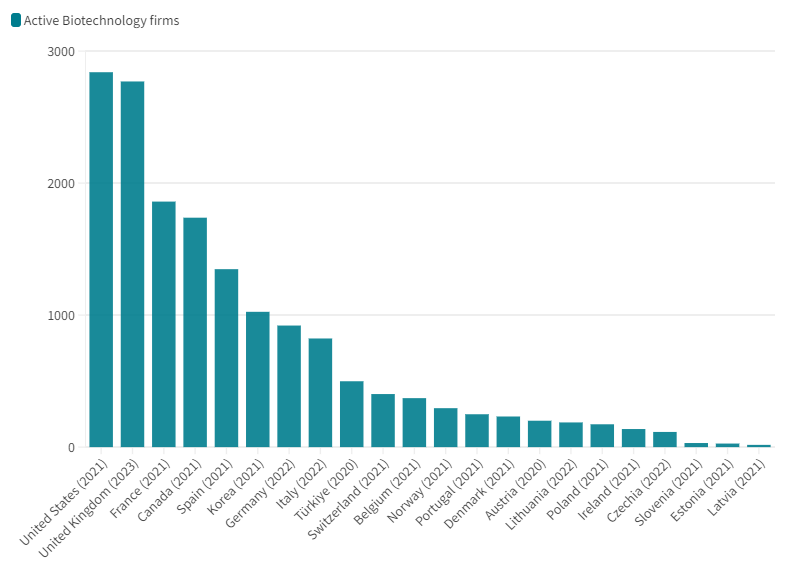

Among the criteria evaluated by the OECD, the number of active biotech companies contributing to the field is a significant indicator of biotechnology’s dynamics within each country.

The OECD did not feature data about the U.K. or China in its key biotechnology indicators. According to Biotechgate, the U.K. counts 2,770 biotechs. We were not able to find a precise number of biotech companies in China. However, the China Pharmaceutical Innovation and Research Development Association estimates that 4,441 companies are operating in the domestic pharmaceutical sector, but how many of these are to be considered biotech companies remains hard to determine.

As the graph illustrates, the biotech sector in the United States leads the world by a considerable margin, with an impressive number of active firms far exceeding 2,500. This figure is a testament to the country’s robust innovation ecosystem, which is supported by a confluence of venture capital, research institutions, and a regulatory environment conducive to biotech development. The U.K. is a close second with just under 2,800 active biotech firms confirming its position as a major life science cluster.

France emerges as a distant third, but with a respectable showing that underscores its commitment to fostering a competitive biotech scene within Europe. Notably, the presence of leading pharmaceutical companies and a strong culture of scientific research contribute to France’s prominent position in the biotech industry. Let’s not forget it is a much smaller country too.

Canada and Spain follow, highlighting the importance of national policies and investments in biotech as a means to stimulate economic growth and address pressing health and environmental challenges. Canada’s collaborative approach between academia, industry, and government, alongside Spain’s strategic biotech clusters, serve as foundations for their substantial biotech firm counts.

Germany’s standing reflects its historical strength in chemical and pharmaceutical industries, which naturally extends into biotechnology. However, its position relative to the U.S. and France suggests room for growth.

The drop-off in firm counts as we move down the list. From Italy to Ireland and beyond, a picture of a highly stratified global biotech sector. Smaller economies, such as Latvia and Estonia, while making the list, demonstrate the challenges faced by emerging markets in cultivating a significant biotech presence. These disparities may be influenced by various factors, including the size of the economy, research and development funding, government support, and the maturity of the biotech ecosystem.

Investing in the future: The spectrum of biotech R&D intensity

Once again the OECD did not include the U.K. or China in their key biotech indicators. However, they are essential players in the industry.

British biotech companies have generated approximately $3,444 million (£2,723 million) in revenue in 2021. In 2020 the U.K. ranked third behind the United States and Japan in terms of budget attribution to health-related R&D in proportion of GDP with 0.12% ($3.4 billion).

China has transitioned from primarily focusing on generic drugs to investing heavily in innovative drug development. This shift is driven by strong national industrial policies and increased participation in the global market. China’s biopharmaceutical industry, bolstered by governmental support and significant investment in R&D, is emerging as a key player in the global biotech landscape, showcasing a strong focus on innovation and international competitiveness.

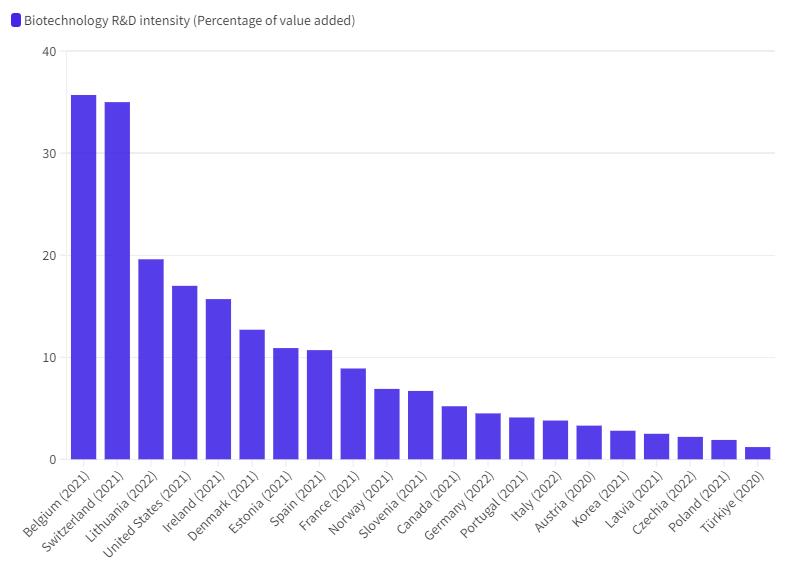

The graph before us maps out a critical metric: the intensity of R&D investment in the biotechnology sector across different nations. It provides a clear indication of how countries prioritize biotech within their economic landscapes, with Belgium and Switzerland taking a leading position that far outstrips their peers.

Belgium and Switzerland’s staggering R&D intensity, surpassing the 30% mark, suggests a strategic focus on biotech as an engine for growth and innovation. This could be attributed to the countries’s targeted policies that encourage research and development, including tax incentives for R&D and a strong network of public-private partnerships. Switzerland’s position is unsurprising, given its reputation as a hub for pharmaceuticals and life sciences.

Lithuania and the US follow, each with over 20% R&D intensity. The US remains among the leading nations in the field, while Lithuania’s significant investment highlights its ambition to become a key player in the European biotech arena.

Moving down the graph, we see a gradual decrease, with countries like Spain, Norway, and Canada showcasing moderate but noteworthy R&D intensities. These figures reflect a balanced investment approach, integrating biotech as one of several pillars of a diversified innovation strategy.

At the lower end of the spectrum are countries like Austria, Latvia, the Czech Republic, and Poland, where biotech R&D intensity falls below the 5% threshold. This could signal a range of scenarios, from different national priorities to emerging biotech sectors still in their infancy.

This disparity in investment intensities not only informs us about current standings but also prompts questions about future trends. Will countries at the lower end ramp up investment to catch up with leaders? How will these investments translate into economic growth and societal benefit?

The OECD data thus opens up a dialogue on the global commitment to biotech and its potential to drive future prosperity. As we discuss the evolution and trends within the sector, these R&D intensity figures will serve as key indicators of where innovation is likely to flourish and where there may be untapped potential waiting to be explored.

Belgian biotech soars

The biotech industry in Belgium thrives on robust research capabilities, a favorable regulatory environment, and strategic collaborations, positioning it as a key player in the global biotech landscape. Renowned for its expertise in pharmaceuticals, diagnostics, and medical technology, Belgium attracts significant investments. Key biotech clusters include BioVille in Hasselt, the Brussels South Charleroi Biopark, and the Ghent Bio-Energy Valley, each specializing in different biotech domains.

Belgium’s biotech sector has seen significant growth over the past decade, with a notable increase in direct jobs and research and development investments. To continue leveraging its unique strengths, Belgium aims to make targeted policy choices to remain competitive on the global stage. Attracting well-trained talent is a fundamental challenge, highlighting the need for a differentiated and effective approach to STEM education and lifelong learning.

The financial performance of the Belgian biotech industry has experienced fluctuations over the past year. Despite recent drops, the industry has gained overall in the past year, with expectations of earnings growth in the coming years.

China’s growing influence as a biotech country

The Chinese biopharma industry is poised to have a greater influence on the global market by 2028, driven by a focus on innovation in oncology and specific modalities such as monoclonal antibodies and small molecules. Several prominent China-originated companies, like WuXi AppTec, BeiGene, Legend Biotech, and Jiangsu Hengrui Pharmaceuticals, are expanding their presence in the United States and Europe, indicating China’s growing footprint in the biopharma sector. These companies’ increasing visibility in the West suggests a redefinition of China’s role in the global biopharma industry.

China’s biopharma sector has demonstrated strengths in manufacturing, with a fast ramp-up in modalities such as antibodies. Additionally, the concept of affordable innovation, which offers therapeutically comparable molecules at lower prices, positions China as a potential major supplier of prescription medications to the developing world over the next decade.

In terms of innovation trends, China’s biopharma market is increasingly aligning with global development, driven by national policies and advancements in digital technology. Innovative biologics, including cell and gene therapies (CGTs), are being valued more by government agencies, accelerating R&D and market access. Moreover, China is emerging as a significant market for CGTs, with innovative companies encouraged to consider diversified and innovative payment models.

Yet, China’s biopharma industry still needs to improve in basic research and talent development. Despite these challenges, government support and policy initiatives are helping to transform China from a major generics manufacturer into an innovator in pharmaceuticals, with aspirations to become a global pharmaceutical powerhouse in the coming years.

These developments suggest that China is not only catching up with global biopharma innovation trends but also enhancing its own innovation capacity. This dual approach is helping to prove the innovation power of China’s biopharma companies on the world stage. With government agencies working to create a conducive environment for innovation, China’s biopharma industry has seen dramatic development and expansion of its footprint, with a potential trajectory towards becoming a global leader in the biopharma sector.

France, building upon its momentum

The biotechnology industry in France has been gaining momentum, particularly in Paris which is becoming a burgeoning hub for health-technology startups. One example is DNA Script, which has innovated with the launch of SYNTAX, one of the world’s first DNA printers. This advancement is emblematic of the dynamic environment that Paris offers for biotech companies, providing them with a platform to attract foreign talent and gain visibility among government officials.

Globally, the biotechnology market is projected to continue its growth trajectory. With groundbreaking advancements in cell and gene therapies (CGTs), the industry is expected to see a more than 20% increase from 2023 to 2024, reaching approximately $11 billion. The CGT market is buoyed by a significant number of clinical trials and anticipated approvals, with Europe playing a notable role in this expansion. France, with its strategic biotech clusters like Paris-Saclay and Lyonbiopôle, and companies such as Sanofi headquartered in the capital, remains an integral player in this global market.

Overall, the French biotech sector appears to be on an upward trend, supported by a combination of government backing, research excellence, and a vibrant ecosystem that fosters innovation and attracts substantial investments. Despite the obstacles, the foundation for growth and advancement in healthcare, agriculture, and sustainability through biotech seems well-established in France.

Switzerland: Biotech R&D leader country

Western Switzerland has emerged as a key biotech cluster, driven by its strong focus on research and innovation. The region’s life sciences sector, characterized by world-leading universities and research institutions, contributes significantly to the country’s economic growth. The presence of major biotech companies and university spin-offs further highlights the region’s thriving ecosystem. The area’s strategic location at the heart of Europe and its access to exceptional talent have been instrumental in its success.

Investments in Swiss biotech companies have been substantial, with capital investments almost tripling from 2019 to 2020, reaching $3.7 billion. The increased R&D spending and high-quality patent output have contributed to maintaining Switzerland’s top position in the Global Innovation Index. The sector has seen significant advancements in genome editing tools like CRISPR/Cas9 and micro technologies, supporting developments in immuno-oncology, neurosciences, and infectious diseases.

The Swiss biotech industry is globally recognized for its advanced capabilities, particularly in biopharmaceuticals, medical devices, and precision medicine. Key biotech clusters include the BioValley in the Basel area, the Biopôle in Lausanne, and the Technopark Zurich, each fostering innovation in their respective specialties. These clusters are vital in supporting the industry’s growth and maintaining Switzerland’s position as a leading biotech hub.

The United Kingdom’s consistent position in the biotechnology industry

The UK’s biotech sector continues to demonstrate strong growth and investment appeal, as evidenced by recent financial data. In the first quarter of 2023, the sector raised $372 million (£295 million), showing resilience despite global economic challenges. This investment activity suggests steady investor confidence in the sector’s potential and a commitment to supporting companies with proven track records. Notably, a Manchester-based biotech firm focusing on respiratory diseases and an immuno-oncology company were among those securing substantial funding in Series C and B rounds, respectively.

Further attesting to the sector’s vitality, the UK biotech industry recorded its best quarter since 2021, with a remarkable total of $700 million secured in venture capital and public financing between June and August 2023. This marked a significant 48% increase from the previous quarter and solid quarter-on-quarter growth. In this context, UK biotech firms are seen as leaders in Europe for venture capital raised, with the industry poised for continued formation and growth through 2024.

The UK biotech ecosystem is not just focused on the health sector but is also expected to impact non-health biotechnology significantly. The broader adoption of engineering biology can support the UK’s goals for environmental sustainability, including reaching net-zero emissions. The diverse applications in areas such as bio-based manufacturing of chemicals, additives, materials, and even biofuels underscore the country’s ambition to be at the forefront of the biotech industry and sustainable innovation.

The United States: Biotechnology powerhouse

The biotechnology sector in the United States is a powerhouse of innovation and economic impact, navigating through a complex landscape of challenges and opportunities as it advances. In 2021, the industry employed 2.1 million individuals across more than 127,000 business establishments, reflecting an 11% growth in employment since 2018 despite the overall economy shedding jobs during the same period. This growth highlights the sector’s resilience and its critical role in economic recovery, especially during the COVID-19 pandemic, where it was instrumental in developing vaccines and therapeutics.

The market landscape is highly competitive, with major companies like AstraZeneca, Gilead Sciences, and Pfizer, to name a few, actively engaging in mergers, acquisitions, and strategic partnerships to drive growth and innovation. These strategic developments are not only crucial for the expansion of established players in the country but also offer growth pathways for emerging biotech firms.

However, the U.S. biotech industry has encountered significant funding challenges. Venture capital funding, IPOs, and other financing methods have decreased, partly due to heightened interest rates and a cautious investment climate. The Federal Reserve’s interest rate hikes in 2023 have notably affected companies, making fundraising more complicated. Moreover, the number of life sciences companies going public has seen a substantial decline, with only 28 companies making their public debut in the past 12 months, which is less than half the historical average.

Despite these short-term hurdles, the sector is poised for growth. This optimism is supported by sustained collaborations between big pharma companies and smaller biotech firms, indicating a continued belief in the sector’s potential. Moreover, emerging areas such as AI and machine learning integration into R&D processes, regenerative medicines, and scalable allogeneic therapies are attracting significant investment and paving the way for new therapeutic approaches and medical breakthroughs. The U.S. remains the leading country in biotech.

Leaders continue to spearhead the biotech industry

The United States continues to lead in the number of active biotech firms, a reflection of its dynamic innovation ecosystem and substantial market size. France, with its growing biotech scene, especially in Paris, is becoming a significant European hub for health-technology startups. Belgium, known for its robust research and favorable regulatory environment, is making strategic policy choices to stay competitive globally. Switzerland, with record revenues and substantial R&D investments, remains a leader in biotech R&D, supported by its strong academic and research infrastructure.

These countries’ contributions to the biotech sector are not just about economic figures but also about their impact on global health, environmental sustainability, and the future of medicine. Their continued investment in biotech R&D, supportive policies, and nurturing of talent and innovation ecosystems are pivotal in addressing current global challenges and paving the way for future breakthroughs.

This global landscape of biotech innovation, as detailed in the OECD update, presents a picture of a sector at the forefront of scientific advancement and economic development. The ongoing evolution within these leading biotech countries signifies a bright future for the industry, promising transformative impacts on our lives and societies in the years to come.