Newsletter Signup - Under Article / In Page

"*" indicates required fields

Here’s a closer look at the French biotech ecosystem in 2017, which remains one the leading industries in Europe along with Germany and the UK.

France’s biotech ecosystem is relatively dynamic and well-developed. Young companies harboring exciting technology are encouraged into the industry by support from Bpifrance, i-LAB, and iBionext. Once a company gets off the ground, France is home to Sofinnova, the largest VC in Europe with a strong track-record of successful investments, including Actelion and DBV Technologies.

French biotechs may have endured a difficult 2017 in the clinic, but France Biotech’s panorama of the year indicates that the industry continues to grow. Back in 2015, France could lay claim to around 400 biotechs, including approximately 50 with a market cap totaling €4.2B. This time around, 302 companies took part in the study the association’s study alone, compared with 223 in 2015, indicating that the industry has grown.

Now, let’s find out what has changed. Where are French biotechs setting up shop, which diseases are they fighting, and how much longer before they enter the market?

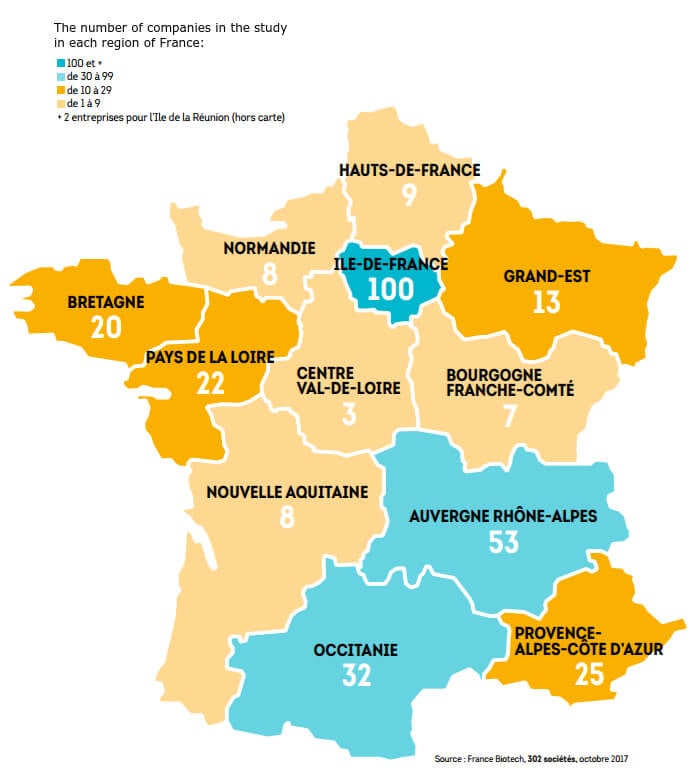

Where can we find all of these French biotechs?

As was the case in 2015, the two main clusters of biotechs are located in Paris and in the Rhone-Alpes region, in and around the city of Lyon. However, the most notable change comes in the other regions of France. The number of biotechs in Bretagne and the Pays de la Loire has more than doubled, from 9 to 20 and 8 to 22, respectively. In Provence-Alpes-Cȏtes d’Azur, there has also been an impressive jump from 14 to 25 companies.

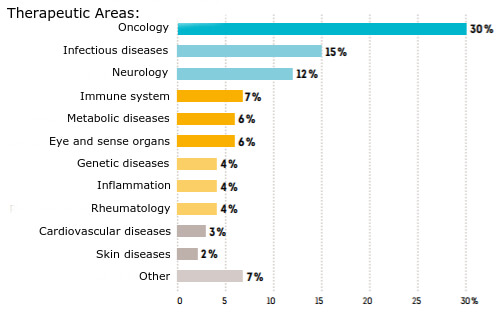

Which diseases are French biotechs targeting?

The top 3 areas from 2015 – oncology, infectious diseases, and neurology – have kept their places at the top in 2017. Oncology now commands the attention of 30% of the biotechs that took part in the study – a 7% increase vs 2015 – while infectious diseases and neurology hold 15% and 12%, respectively. Diseases of the immune system, metabolic diseases like obesity and diabetes, and problems with eyes and other sense organs also received more than 5%

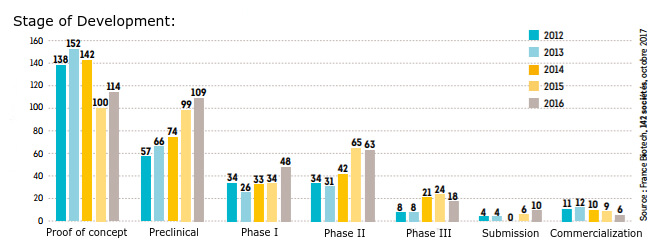

How long until we see these biotechs enter the market?

Using data from 2016, of the 368 products that are under development by the companies in the study, 2/3 are currently at the proof of concept or preclinical stages, so are yet to begin testing in patients. One hundred and twenty-nine are in Phases I-III, while 16 have been submitted to regulatory bodies or commercialized – both numbers offering marginal improvements on 2015.

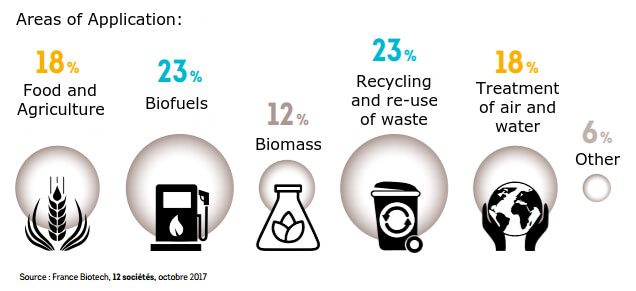

What else are French biotechs up to?

A big area of interest for French biotech – and for us here at Labiotech – is finding solutions to environmental problems, including the sustainable production of food, environmentally friendly fuels, and cleaning the air we breathe. The biggest areas are biofuels, and the recycling and re-use of waste, perhaps driven by biotechs like Global Bioenergies and Carbios, respectively.

French biotechs vs French pharma:

The case remains the same as in 2015 that the pharma industry’s business model is faltering, and these large companies are being outperformed by highly innovative biotechs. But this problem is not unique to France, with the same trend being seen across Europe and around the world. Kelvin Stott, writing for Endpoints News, believes this is down to the Law of Diminishing Returns. He feels that pharma companies are having to take on difficult targets like neurological diseases as biotechs pick off the ‘low-hanging fruits’ like cancer, diabetes, and heart disease.

Originally written by Nicolas Sainte-Foie.

Images – Alessandro Storniolo / shutterstock.com; France Biotech Panorama 2017