Newsletter Signup - Under Article / In Page

"*" indicates required fields

Aprea raised a huge €46M for a first-in-class drug that targets the deadliest form of ovarian cancer. The company just started Phase II trials after positive results from Phase I. But will it be able to outperform all its competitors?

Aprea is a spin-out company from the Karolinska Development, the portfolio company of the Institute, in Sweden. It became famous earlier this year with its huge fundraising. The interest of the investors stems from its novel drug candidate for serous ovarian cancer, APR-246.

Aprea is a spin-out company from the Karolinska Development, the portfolio company of the Institute, in Sweden. It became famous earlier this year with its huge fundraising. The interest of the investors stems from its novel drug candidate for serous ovarian cancer, APR-246.

Now, results from Phase Ib trials have confirmed that the treatment shows “minimal additional toxicity” when combined with chemotherapy. Although researchers don’t rule out a contribution of the new drug to the reported side-effects, the company has already launched a Phase II trial and the first patients have enrolled.

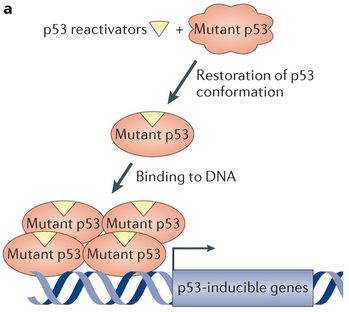

Aprea’s therapy targets p53, the most commonly mutated protein in cancer, to restore its tumor-suppressing activity. Mutations in p53 appear in 50% of cancers and is associated with resistance to antitumoral drugs. And in the case of high-grade serous ovarian cancer, the deadliest form of the disease, this gene is mutated in mostly all cases.

Despite the plethora of therapies targeting this molecule, most do it at the gene level, whereas APR-246 directly alters the faulty 3D structure of the mutated protein. Despite the possible side-effects, Aprea is optimistic about the advantages of this first-in-class treatment and considers studying the use of this drug to treat other types of cancer.

The ovarian cancer drug market is expected to increase to €1.3B in 5 years. However, novel therapies like Aprea’s might have it difficult to compete with Roche, Genentech or Amgen, which are expected to dominate the market with angiogenesis inhibitor drugs.

In addition, Aprea is not the only one targeting p53 in deadly types of cancer. It will have to compete with giant Eli Lilly, whose drug candidate prexasertib, a checkpoint inhibitor, started Phase II trials for breast, ovarian and small cell lung cancer in August. However, Aprea’s novel strategy might still grant it access to the top elite in the future if the treatment proves effective.

Featured image: Tinydevil/shutterstock.com

Figure 1: Kian Hoe Khoo et al., Nature Reviews Drug Discovery 13,217–236

Oncology R&D trends and breakthrough innovations