Newsletter Signup - Under Article / In Page

"*" indicates required fields

Acerta Pharma is an elusive Netherlands based Biotech with pipelines in Blood cancer and solid tumors which has somehow wrangled the biggest Biotech deal of 2015 with Pharma Giant AstraZeneca.

![]() Acerta Pharma is a Biotech start-up founded in 2012 which combines two technology platforms in drug discovery and development with a broad target range, from hematological malignancies to solid tumors. Now AstraZeneca has spied their potential in Oncology…

Acerta Pharma is a Biotech start-up founded in 2012 which combines two technology platforms in drug discovery and development with a broad target range, from hematological malignancies to solid tumors. Now AstraZeneca has spied their potential in Oncology…

The elusive Acerta has operations at the Pivot Park in Oss (Netherlands) and the US, with a VC backing to include BioGeneration Ventures and development under the LifeSciences@Work accelerator in the Netherlands.

The total amount being considered in the deal is around €6.42Bn, consisting of €3.67Bn upfront staggered between now and 2018, dependent on milestones with their key candidate’s R&D.

Upon close of the transaction (acquisition of 55% of the company), Acerta will initially be a majority-owned subsidiary of AstraZeneca, with the later option of becoming a wholly owned subsidiary for an additional €2.75Bn.

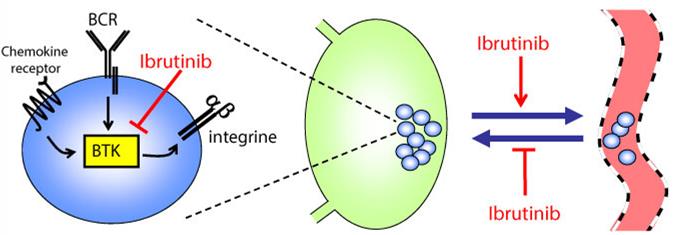

Acerta’s potentially best-in-class oral Bruton’s tyrosine kinase (Btk) inhibitor, acalabrutinib (ACP-196), is currently in Phase III development for B-cell blood cancers, and in Phase I/II clinical trials in various different kinds of solid tumor.

As a highly selective, irreversible, second generation candidate, it has been used to treat around 1,000 patients to date in over 20 clinical studies, ranging from blood cancers (e.g. multiple myeloma and leukemia) to solid tumors (e.g. non-small cell lung cancer). So it is understandable acalabrutinib is such an attractive development option.

Indeed, phase I/II data showing a favorable safety profile and strong efficacy in relapsed/refractory chronic lymphocytic leukemia patients was presented at the American Society of Hematology (ASH) Annual Meeting earlier this month.

A new paper was also published in the New England Journal of Medicine last week on the superior selectivity of acalabrutinib compared to the first generation Btk inhibitor in question – ibrutinib (which was approved last year in the EU under Janssen’s brand ‘Imbruvica’).

So clearly a more specific class of Imbruvica-like drug is a very attractive option given its potential range of applications with a reduced toxicity (read more in the WSJ). Still, the sheer size of this deal (surely making it the biggest in 2015?) is unexpected.

Perhaps AstraZeneca can see some greater potential in the drug in the future, and we have to wait and see whether this will be enough for them to wholly acquire this small US-NL biotech.

Feauture Image Credit: This Big Pharma clearly sees plenty of potential in Acerta’s Oncology Pipeline… (Source: AstraZeneca)

Oncology R&D trends and breakthrough innovations