Newsletter Signup - Under Article / In Page

"*" indicates required fields

BioMoti is enhancing cancer treatments via drug delivery innovation and it was one of the companies we visited during Labiotech Tour UK. Its Oncojan platform has caught the eye of Physiomics, a computational system biology Biotech listed on the London Stock Exchange.

Oxford-based Physiomics develops computational models of cancer, allowing to simulate the effect of their drugs in a ‘Virtual Tumour’ during preclinical and clinical stages.

Oxford-based Physiomics develops computational models of cancer, allowing to simulate the effect of their drugs in a ‘Virtual Tumour’ during preclinical and clinical stages.

Now, Physiomics is aiming to expand its strategy from service provider to having its own oncology pipeline. So, it has proposed to acquire a Biotech already developing cancer therapies – BioMoti, currently based in the Queen Mary Bioenterprises Innovation Centre (London).

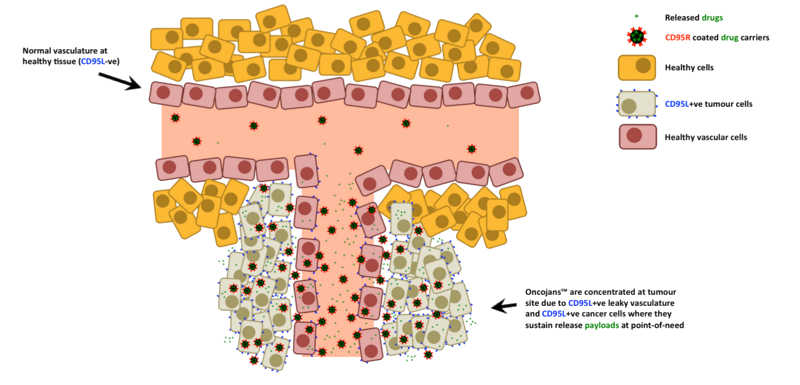

BioMoti owns Oncojan, a platform to create nanoparticles packages for cancer drugs, coated with tumour-specific antigens. Targeting the therapy to the tumour area both increases and narrows its effect – sparing healthy tissue from toxicity (same strategy that Nanobiotix has, which combines nanotechnology with radiotherapy.

A range of cancer drugs could be adapted to this strategy, from small-molecule therapeutics to larger biologicals – including those already tested and approved.

Physiomics was attracted by the lower risk of Oncojan platform (compared to normal drug discovery), as development is no longer about proving a drug works, but demonstrating the pharmaco-economic and patient benefits of the modified therapy.

If the acquisition goes forward, BioMoti’s drug development would be supported by the ‘Virtual Tumour‘ technology. In the immediate future, this could apply to MOTI1001, its lead candidate targeting ovarian cancer with well-know Taxol drug.

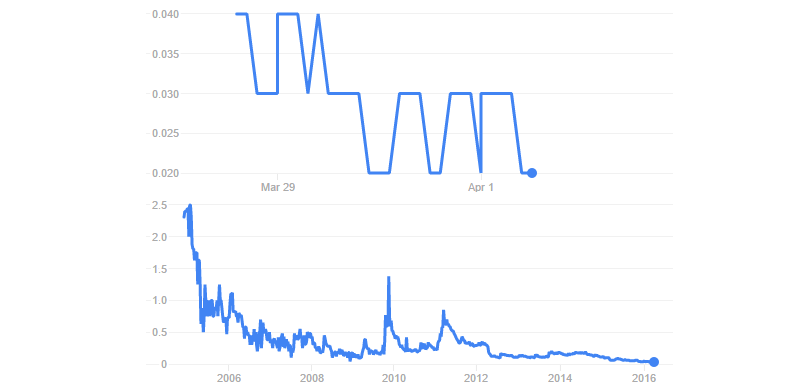

The acquisition proposal will be on the table for the next 6 months, and Physiomics will need to raise £4M (€5M) . This may be a challenge, as this company has seen its value continuously decrease since it was listed on the London Stack Exchange – from a market cap of around €90M in 2005 to just over €1M now, and with stock price oscillating between 0.02 and 0.03 pence (so 0.00002 to 0.00003 pounds – very surprising to have such a low stock price).

This could be an interesting combination of oncology technology platforms. Physiomics intends to conclude the acquisition in August 2016.

Want to know more about BioMoti? Watch our interview of CEO Davidson Ateh – or attend Labiotech Refresh, where he will be one of the speakers…

Featured image credit: Mix of Graphics. Cancer Cell © Krishnacreations (Dreamstime ID45675334). Colloidal particle from Zherebetskyy et al. (2014) Hydroxylation of the surface of PbS nanocrystals passivated with oleic acid. Science (doi: 10.1126/science.1252727)

Oncology R&D trends and breakthrough innovations