Newsletter Signup - Under Article / In Page

"*" indicates required fields

Bayer’s and Regeneron’s blockbuster Eylea could be facing serious competition, as Novartis boasts with positive Phase III results for AMD.

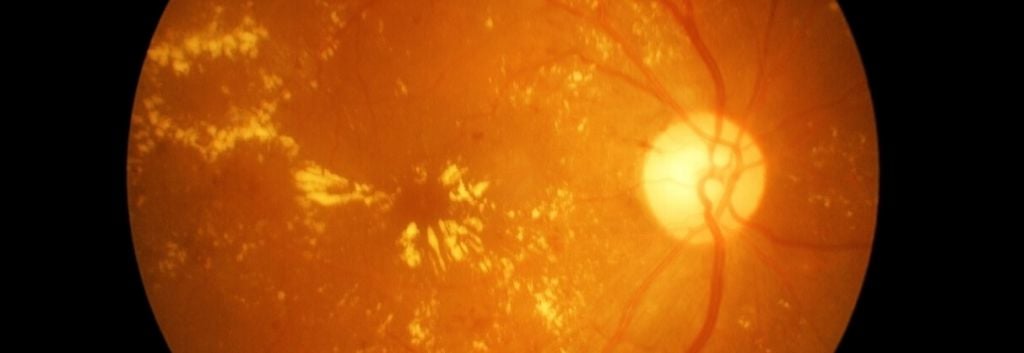

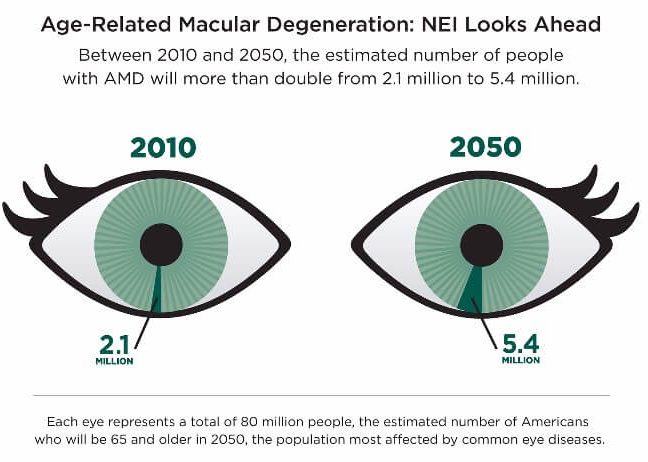

Novartis has been struggling on the age-related macular degeneration (AMD) market since its Roche-partnered VEGF-A inhibitor Lucentis was outperformed by Eylea from Bayer and Regeneron, which required a less-frequent dosing schedule and was placed at a lower per-dose price. Now, the Swiss drug maker is set to reconquer the space, after its new VEGF-A inhibitor RTH258 won a head-to-head race against Eylea in two pivotal Phase III trials.

According to Novartis, its drug candidate was able to match Eylea in the average change in best-corrected visual acuity (BCVA) over 48 weeks, meeting its primary and secondary endpoints. While the drug also had a comparable side-effect profile, RTH258 only required a dosing every 12 weeks, compared to Eylea which is dosed every 8 weeks, thus, reducing the need for injections to four times a year.

In a note to investors, analysts at Jefferies called this “a significant differentiator and competitive advantage for RTH258” and subsequently Novartis shares have climbed 1.2% by 16:04 GMT. Detailed analysis of the data is ongoing and Novartis is now heading for regulatory filing in 2018 with analysts predicting the new drug to rake in peak sales of $2B (€1.8B) if it also claims approval in diabetic macular edema.

RTH258 is a humanized single chain antibody fragment that is much smaller (26kDa) than its competitors, allowing for better tissue penetration and more rapid clearance from the systemic circulation. The drug was moved to Novartis’ pharmaceutical business in early 2016 when the company revamped its beleaguered Alcon eye care business, which might soon be shed by the Big Pharma.

If all goes well, RTH258 could revive Novartis’ AMD pipeline, after Lucentis’ sales dropped by 11% in 2016, missing analysts expectations. Novartis could also use the blockbuster to bolster its pharma division as its bestseller Gleevec is facing generic competition. However, competition could become even more fierce as Allergan is also running Phase III trials with a new VEGF-A inhibitor for AMD. Allergan expects to release results in 2018.

Images via shutterstock.com / memorisz and CC 2.0 / National Eye Institute

Are you interested in eye disease R&D?