Newsletter Signup - Under Article / In Page

"*" indicates required fields

As 2016 was a tough year for biotech, 2017 was under pressure to turn things around. Although there has been an improvement, there were some notable speed bumps for the industry.

2017 started brightly, with 14 FDA approvals by April – a big improvement on 2016, which only saw 22 in the whole year. The good news continued, with stocks in biotech companies among the best performing healthcare funds of the year, but this couldn’t paper over the cracks emerging in the drug development field.

Pharma’s business model is still a mess: Biotech is way ahead when it comes to innovation despite pharma spending big on R&D, and subsequently struggling to make returns its investment, which could drop to 0% in 2020.

On top of this, concerns over the clinical trial process were raised by a study at King’s College London and the London School of Economics. It found that 57% of cancer drugs did not improve survival or quality of life and just 35% boosted overall survival – the main aim of a new cancer drug.

Christmas and the fresh start that is 2018 are fast approaching, so let’s get this over and done with: here are 2017’s biggest clinical disappointments.

CureVac’s Prostate Cancer Candidate Misses Primary Endpoint

The year did not get off to the best start, as CureVac’s prostate cancer therapy missed its primary objective during a Phase II trial in January despite backing from JP Morgan. Although CV9104, the company’s mRNA treatment, met its secondary safety endpoint, it did not significantly improve overall survival.

CureVac no longer sees mRNA as a stand-alone therapy, but CEO, Ingmar Hoerr, remains positive: “What we’ve learned here is that mRNA is not enough on its own – you have to break tolerance and you have to make it more immunogenic.” Instead, mRNA can be combined with checkpoint inhibitors, an approach also being investigated by Moderna and BioNTech.

Innate Pharma’s Checkpoint Inhibitor Fails Phase II

In February, Innate Pharma’s checkpoint inhibitor, lirilumab, failed to meet the primary endpoint of a Phase II trial testing the candidate’s ability to treat acute myeloid lymphoma. The drug had been licensed from Bristol-Myers Squibb back in 2011 in a deal worth up to €400M. Despite investigating the antibody in six other trials against several cancer indications, the company’s stock dropped by almost 25% with the news of its failure.

This development forced Innate to focus on the use of lirilumab in combination with nivolumab, another checkpoint inhibitor sold by Bristol Myers Squibb under the tradename Opdivo.

Actelion’s Drug Linked to Patient Deaths

The acquisition of Actelion by Johnson & Johnson was supposed to give the big pharma a boost. Instead, Actelion’s drug for pulmonary arterial hypertension (PAH), Uptravi, is under review by the EMA after five patient deaths in France. The drug, which costs €150,000, is a major part of Actelion’s portfolio, and it will have contributed to J&J shelling out almost €30B for the biotech.

This follows the failure of Actelion’s lead candidate, Opsumit, in a Phase III trial during which it was beaten by a placebo. Despite this, the drug brought in €780M in sales in 2016. J&J was not put off by this; instead, it subsequently added another €2B to its offer for Actelion.

Cerenis Therapeutics Fails to Repair Broken Hearts

March saw French biotech Cerenis Therapeutics fail to meet the primary endpoint of a Phase II trial investigating its candidate, CER-001. It is targeted at the treatment of post-acute coronary syndrome, a condition where bloodflow to the heart is decreased, leaving it unable to function properly or causing it to die.

This was the candidate’s second Phase II trial, having already failed to reduce atherosclerotic plaques back in 2014. But the company has not given up hope on CER-001, with it undergoing a Phase III trial for the treatment of patients with genetic HDL deficiencies.

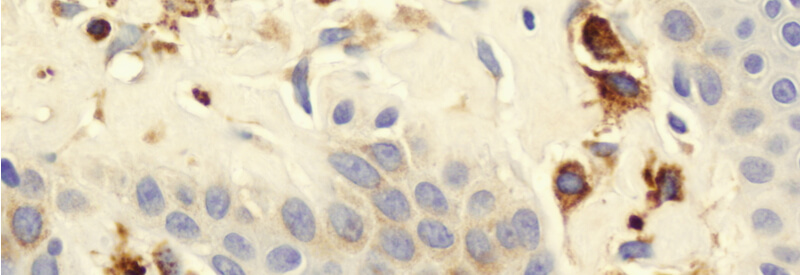

CHMP Wasn’t a Fan of AB Science’s Mastinib

In May, the Committee for Medicinal Products for Human Use (CHMP) had a “negative opinion” of masitinib, AB Science’s treatment for smoldering or indolent systemic severe mastocytosis – a rare genetic disorder characterized by an abnormal accumulation of mast cells. The condition can affect a number of systems around the body, most commonly the skin, but also the bone marrow, the liver, and the spleen.

The CHMP’s opinion was based on concerns over good clinical practice after a visit to the study site that unearthed serious failings in the way that the study had been conducted. In particular, it was unhappy with changes to statistical analysis for the study’s primary analysis.

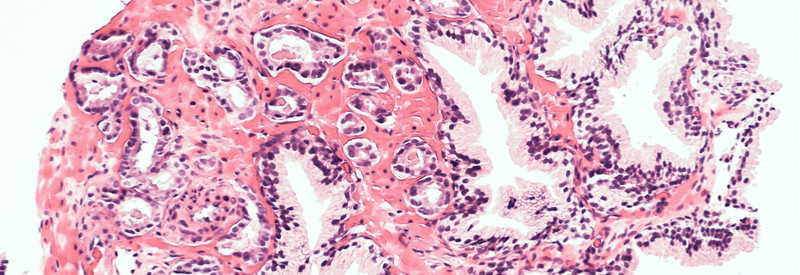

Onxeo’s Nanoparticle Therapy for Liver Cancer Doesn’t Impress at Phase III

In September, Onxeo’s nanoparticle chemotherapy, Livatag, failed to improve the outcome of patients with hepatocellular carcinoma compared to other available treatments. The study had hoped to see Livatag significantly boost patient survival in comparison with other anticancer treatments, including oxaliplatin, gemcitabine and tyrosine kinase inhibitors.

Livatag is a nanoparticle formulation of the chemotherapy, doxorubicin. Encapsulating the drug into nanoparticles is hoped to overcome resistance in tumor cells by delivering it into the cells.

DBV Technology’s Peanut Allergy Treatment Fails Phase III

DBV Technologies developed a patch, ViaSkin, to non-invasively treat child peanut allergies. However, in October, the candidate missed its primary endpoint. After 12 months, 35% of children responded to DBV’s therapy in comparison with 14% that responded to a placebo. Although this was a significant difference, the placebo performed better than expected.

Circassia encountered the same problem, which forced the company to turns its back on its whole allergy immunotherapy pipeline. However, DBV Technologies will continue to pursue the treatment following discussions with the FDA, which had already granted the candidate Breakthrough Therapy and Fast Track designations. Now, we are awaiting the results of the second trial in children between 1 and 3 years old is expected.

Auris Fails to Treat Sudden Deafness

Auris Medical’s treatment for sudden deafness has failed to meet its efficacy endpoint, causing the company to terminate the trial early. The candidate, AM-111, was unable to produce a statistically significant improvement in hearing after 28 days when compared with a placebo in patients suffering from severe or profound sudden deafness.

Auris will discuss the possibility of approval despite the results of this trial, suggesting that it believes the results of the study are down to problems with study design rather than the drug itself. If it succeeds, it wouldn’t be the first to try or even succeed without demonstrating clear efficacy.

Five out of the 8 were French companies, and that was without including Cellectis, which was put on hold by the FDA after a patient died during a Phase I trial for its CAR-T cell therapy. This will be a little worrying for the country, whose industry has performed well until now.

It is worth mentioning that Merck had difficulty with its checkpoint inhibitors, including Avelumab, which failed to outperform chemotherapy in a Phase III trial. Last month, British Unicorn Immunocore released disappointing results for a company leading the T-cell receptor field.

Let’s hope that biotechs around Europe can learn from their peers who may not have enjoyed success in the clinic this time around so that they can make big steps forward in 2018.

Before you get too down, don’t worry! 2017 wasn’t all bad. Have a read of our top 12 clinical successes of 2017, which is out now.

Images – lightwavemedia, David Litman, Kateryna Kon, Liya Graphics, artskvortsova, GiroScience, Ewais, Alexander Raths / shutterstock.com

Oncology R&D trends and breakthrough innovations