Newsletter Signup - Under Article / In Page

"*" indicates required fields

Serial entrepreneur John Beadle is now at the helm of PsiOxus, an Oxford biotech with some promising virus-based cancer treatments.

Oncolytic viruses have been around for a while without much to show for themselves besides Amgen’s Imlygic, but PsiOxus, one of our top Oxford biotechs, has some ideas to make them bear fruit. The company has so far raised over £50M and made an €850M deal with Bristol-Myers-Squibb on its second candidate, NG-348, following one for enadenotucirev, which is now undergoing a collaborative combination study with Opdivo in over 180 patients.

I caught up with CEO John Beadle to hear more about the company’s strategy and what makes a round of R&D into oncolytic viruses different. Beadle has had nearly 15 years of entrepreneurial experience. His first company was PowerMed, which he co-founded in Oxford around 2003 and sold to Pfizer in 2007. “So I guess I’ve been a successful entrepreneur,” he mused.

After that, he began working with smaller companies in universities within England’s Golden Triangle until he was approached by Imperial Innovations, now Touchstone Innovations, to become an Entrepreneur-in-Residence. It was there that he got to know the company that would become PsiOxus…

So your time at PsiOxus dates back to when you were an entrepreneur-in-residence at Touchstone Innovations…What was that about?

The objective was for me to be inside Imperial Innovations to look at the companies that they were either already invested in or considering it in the future. I was there to advise them as well as the companies in terms of the best strategies to take their technologies forward, and whether or not technologies were actually going to form successful companies.

The idea was always that, eventually, I would choose one of those companies and join its team – which is ultimately what happened. I was advising on Myotec Therapeutics, which then went on to become PsiOxus Therapeutics; when they needed a CEO, I agreed to step into the role.

Tell me about your virus: What makes it different?

Our virus will replicate in tumor cells that are derived from epithelial cells. We’ve looked at a wide range of different epithelial cells – epithelial-derived cancer cells. The virus does replicate in all of them, though at different rates. It doesn’t replicate well in non-epithelial-derived tumors, for example, in melanoma cells or glioblastoma cells, or sarcoma cells, but in epithelial-derived tumors, it replicates very well.

The virus is developed using directed evolution, meaning it was selected from the random library specifically because it replicated well within tumor cells and not in normal cells. The reasons are quite complex, but essentially, the virus has lost a number of genes that are necessary to replicate within normal cells but not in the tumor cells. There’s one particular gene, or set of genes, that vary from the wild-type and make this virus replicate particularly quickly within tumor cells.

So its specificity for epithelial tumors is why it works so well for solid ones?

Yes, because most of the solid tumors are epithelial-derived — colorectal, prostate, and breast cancers are all this kind. And this, really, relates back to the parent virus, which likes to replicate within an epithelial cell: That’s just what the wild-type virus does.

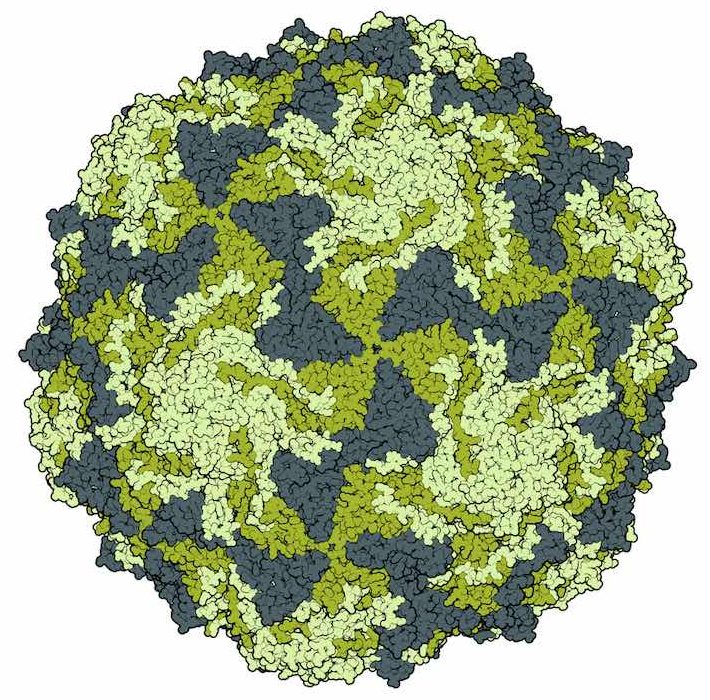

It’s an adenovirus, so it’s a common virus that causes things like colds, or urinary tract infections – relatively minor illnesses. But all of those illnesses relate to the virus infecting epithelial cells, which we have throughout the body in solid tissue. So, when those tissues become cancerous, that is a very friendly environment for this particular virus.

You’ve been fundraising a lot — over £50M in total now. What’s your business plan?

Obviously, it depends on what exactly we do with the platform and how we take it forwards. The £50M that we’ve raised at various times has had some help from grant funding. Then, of course, last year we generated $60M in non-diluted capital from the deal with BMS. (It was two deals, actually — one in $10M upfront, and the other brought in $50M upfront.)

That will be our model going forward: We do aim to do additional partnering deals, as well as taking our own products forward. Certainly, there will be further fundraising, but also, further partnering revenue as well.

Why did you pick BMS as a partner for your checkpoint inhibitor combination trials, and do you have any regrets now that Opdivo seems to be lagging behind Keytruda?

Well, the deal that we did with BMS was ahead of any of those more recent events — when we did the deal, it was certainly not the case that it was behind. But even saying that I remain convinced that BMS is an outstanding immuno-oncology company, and I remain to be convinced that there is actually any difference between these checkpoint inhibitors.

I think we may potentially see some differences between the anti-PD1s and the anti-PD-L1s, but I see little convincing evidence that the anti-PD-1 molecules themselves are actually different from each other. I think there is certainly a likelihood that there are some clinical trial differences, and we know of some of those; but I’m less convinced that this is actually going to turn out to be a difference in the actual molecular entities themselves.

I think the biomarker story is going to be critically important going forward, and I think we’re learning a lot about what that’s going to be; but I don’t believe it’s going to be as simple as PD-L1-positive or PD-L1-negative.

Of course, we’ve seen all sorts of complexities in terms of what PD-L1 level we choose as the cut-off point for exclusion or inclusion in the clinical trials. In Roche-Genentech’s data, we see the complexity of looking at the inflammatory cells versus the tumor cells. We also need to look at the additional complexities of the tumor-infiltrating lymphocyte count, the nature of that infiltration, and the tumor mutational load.

All of these factors, I think, are going to come into play, and I think we’re really seeing the first moves in this story. At the moment, Merck has been able to pull ahead in terms of the biomarker profile that they chose for their initial study, but I don’t think that’s anywhere close to the end of the story – I think this has got a long way still to run.

So oncolytic viruses seem to be having a second spring. Who would you say your competitors are?

As you said, there are a lot of companies looking at oncolytic viruses, and some of them are farther through the clinical trial process than ourselves – Tocagen, for example, is in Phase 3 clinical trials at the moment and Amgen already brought Imlygic to market.

The difference between us and many of the other oncolytic viral companies is that, first of all, we’ve been able to show that we can deliver the virus intravenously, which really opens up the market potential for our virus compared to those that have to be delivered into the tumor. Next, the fact that we cover all epithelial tumors and not just things like melanoma or glioblastoma, really makes that potential so much larger.

The lack of the ability to deliver systemically has been a problem for oncolytic viruses. We know that Amgen’s Imlygic virus, the old BioVex herpes virus, has positive effects on melanoma such that we do see responses in patients; the problem is that it has to be injected into the tumor directly.

That’s true for all herpes viruses, as far as we know, because they’re enveloped viruses. Enveloped viruses don’t survive in the bloodstream, because of complement-mediated destruction. That is almost certainly going to be a limitation for any company working with herpes-based viruses, as well as a lot of other types of viruses. Finding a virus that survives in the human bloodstream is actually not an easy task.

Finally, we’ve been trying to push this idea of gene therapy for tumors further than most others have done so far. We have the concept of our second candidate, NG-348, in which we genetically modify tumor cells to actually phenotypically change the tumor cell and light it up to the T-cells, then activate the T-cells — I think it’s a concept that others just haven’t considered, and that’s given us a step forwards on the competition.

So what’s your plan to stay ahead of the competition?

After the BMS deal, we’re really looking to make sure that the viruses that come through after NG-348 are innovative as well. Two of our other programs will have INDs filed next year, and a third in the year after that. It’s important that we keep that innovation going, we keep new products coming through. We’re a platform-based company, we need to make sure that we innovate on that platform and prove its worth by bringing candidates forward.

Images via Crevis, Kateryna Kon, molekuul_be, ranjith ravindran / shutterstock.com , PsiOxus

Oncology R&D trends and breakthrough innovations