Newsletter Signup - Under Article / In Page

"*" indicates required fields

The next generation of DNA sequencers has arrived, and with it, a clash of titans: Illumina, Thermo Fisher and Qiagen are all competing for the clinical diagnostics market.

Next-generation sequencing (NGS) companies are redefining DNA sequencing. What began as small-scale PCR and Sanger sequencing efforts have now mushroomed into a $20Bn market with broad medical implications for cancer and chronic disease, including FDA-approved tests for cystic fibrosis and large-scale cancer genome studies that have led to new targeted therapies.

Illumina controls 75% of this market with its sequencing-by-synthesis (SBS) method. Its closest competitor is Thermo Fisher, which rides on ion semiconductor sequencing (Ion Torrent), followed by Pacific Biosciences’ single molecule real-time (SMRT) sequencing. Together, Thermo Fisher and Pacific Life Sciences control the remaining 25% of the market.

With such a tightly locked market, what role does Qiagen envision for its GeneReader system? To understand Qiagen’s bid to join the field of NGS, we’ll need to understand the competition to make genomic sequencing bigger, faster, and cheaper.

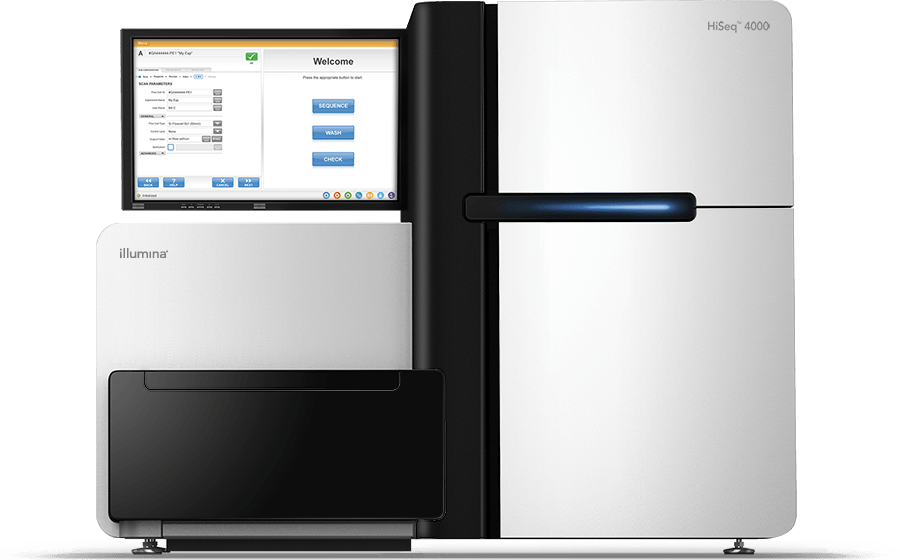

Illumina’s light-based SBS has led to great success in scaling to whole genome sequencing with reliable data. The company now offers a range of three major instrument classes, the low-throughput MiSeq, mid-level NextSeq, and high-scale HiSeq.

The introduction of the HiSeq X10 set the bar at $1,000 per genome, but the more subtle costs lie in million-dollar equipment and running hundreds of samples at once. The HiSeq X10 alone represents a $10M investment, which is out of reach for most institutions.

Enter Thermo Fisher’s Ion Torrent. While the technology is meant to directly rival Illumina’s SBS, ion sequencing has found a niche in smaller markets with players looking to sequence specific segments of a genome instead of its whole.

Thermo’s hydrogen-ion reading machines, known for speedier sequencing, have a more attractive price tag, too. Its Personal Genome Machine (PGM) roughly squares off with the MiSeq for half the investment, and its Proton rivals the NextSeq. Unfortunately, Thermo’s ion technology may never be able to scale up to HiSeq-level sequencing, and there are still some hiccups in data quality compared to that from SBS.

Instead of scaling up to match HiSeq, Thermo has dug itself a trench in cost-effective sequencers. In the summer of 2015, it unveiled a new machine, the S5, that uses cheaper sequencing reagents and explores more specific needs than HiSeq, and for a more manageable list price of $65,000. Thermo’s strategy remains to target smaller sequencing customers and lower the costs for upstarts.

A few months later, in January 2016, Illumina launched a counterattack, the MiniSeq. The new instrument is a stripped-down version of its sister sequencer, the $100,000 MiSeq, with near-identical capabilities for half the price. This development puts Illumina and Thermo neck and neck in the competition for smaller sequencing customers like clinics and biotech startups.

So if Illumina and Thermo Fisher have a stranglehold on the market, where does Qiagen fit in? The German giant’s GeneReader piggybacks on SBS, which Qiagen purchased from a smaller company, IBS, in a 2012 acquisition.Now a limited release, GeneReader claims to automate much of the manual sample prep and computational analysis that can be burdensome for clinical users.

Already an expert in the production of sequencing reagents and bioinformatic tools, Qiagen brings a wide array of reagent offerings and targeted research panels, mostly in the cancer realm. With its acquisition of Enzymatics, the company responsible for providing the enzymes used in 80% of NGS reactions, Qiagen appears fully committed to muscling in on the market.

As far as strategy goes, Qiagen’s CEO Peer Schatz says the company is streamlining the sequencing process through the optimization of automation, foundation in bioinformatics, and introduction of plug-and-play sequencing for less-experienced NGS users.

The company still has a long road ahead. Qiagen will have an uphill battle wresting just 10% of the market from its competitors within 5 years. Even more worrying is the legal slap from Illumina: the titan sued Qiagen over its use of SBS in 2015. A month later, a court-ordered injunction forced Qiagen to arrest US sales of the GeneReader. But for all of the fuss, the device generates relatively little revenue, as it has yet to make an appearance as a line-item in Qiagen’s Financial Reports.

With US sales halted and lawsuits underway, Qiagen’s bumpy ride into the NGS market has already begun. The competition for the smaller-scale, clinical markets is as fierce as ever. However, with automated sequencers bearing the same cost as a new car, those standing to benefit will be the biotech upstarts and clinical users just beginning to adopt their first desktop instrument.

Ernie Doherty is a strategy consultant in life sciences, a biotechnology enthusiast, and science fiction aficionado. His goal is to transition the biology space to the revolutionary pace of the tech world.

This post was originally published in November 2016 and has since been updated.

Images via Gio.tto/Shutterstock; Illumina; Thermo Fisher; Qiagen