Newsletter Signup - Under Article / In Page

"*" indicates required fields

UPDATE (12/01/2017): J&J and Actelion have reportedly settled on a price: $260 (€245) per share, totaling more than $28 (€26) billion. The Swiss biotech’s R&D assets will be spun out into a new company that will remain independent.

UPDATE (03/01/2017): The deal has veered towards splitting Actelion into two companies, one for its commercialized portfolio that J&J would acquire for $260 (€250) per share and the other for R&D that would be publicly traded. Both companies have declined to comment, but the deal could be finalized by the end of the month.

UPDATE (19/12/2016): J&J is back in the game as announced in another extremely short press release stating that Actelion has entered exclusive negotiations with the big pharma. While Sanofi and J&J fight over the now most wanted European biotech, Actelion’s stock keeps rising.

UPDATE (14/12/2016): Sanofi is still negotiating acquisition, with an offer of €28B ($29.6B) that made Actelion’s shares jump by 10% last Friday. According to Bloomberg, a transaction could be announced as soon as next week, although it is not clear if an agreement will be reached.

UPDATE (06/12/2016): Actelion has confirmed that J&J has withdrawn from talks, but the Swiss biotech remains in discussion with another unnamed party (which we all know is Sanofi) “regarding a possible strategic transaction.” Of course, the press release adds, “here can be no certainty at this point that any transaction will result.

UPDATE (30/11/2016): We joked about a bidding war, but the first shot has been fired as Sanofi is reportedly considering a counterbid for Actelion.

UPDATE (29/11/2016): FiercePharma reports that Actelion is exploring a deal with J&J that is more complex than an outright buyout. The Swiss biotech is bent on maintaining its independence as it declined a €25Bn bid from J&J.

Original publication date 29/11/2017

Actelion, the biggest European biotech, is entertaining the advances of J&J. However, it will likely reject this latest US offer and remain on its quest to be the first European-born biopharma to make it to the major league.

Actelion is the largest biotech in Europe and one of the only 9 to make it to the billion-euro club in 2016. In an extremely short press release, the company has announced that J&J approached the Swiss biotech “about a possible transaction”, immediately clarifying that there’s no certainty this will occur.

Now valued at €18.5B and with sales for the first 9 months of 2016 rising to €1.7B, Actelion is doing pretty well. The final statement in the press release, giving no hint at the outcome, might actually reflect the intentions of the CEO, Jean-Paul Clozel, who has said repeatedly he wants the company to remain independent.

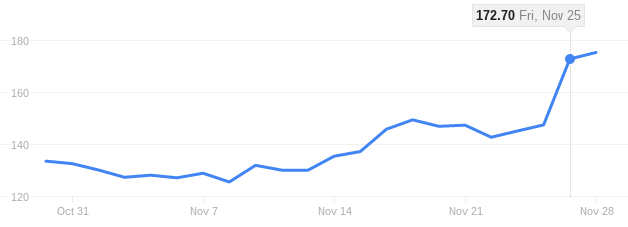

Independently from the final decision, the announcement made Actelion’s stock jump up by 17% on Friday, and it keeps going up today.

This is obviously not the first offer the biggest European biotech has received: last year, the company rejected Shire’s €16.8B bid. The independent spirit of the company goes back to 2011 when it rejected demands for sale from Elliot Advisors. Since then, Actelion’s shares have grown nearly 570%.

The secret behind the success of the Swiss biotech seems to be its strong focus on rare diseases, which represent a huge unmet clinical need. The company is now well established as a leader in pulmonary arterial hypertension (PAH) and is planning to enter the crowded multiple sclerosis (MS) market, projected to reach €18B by 2024, with the first-ever combination therapy for MS.

By staying strong, the biotech is reinforcing its position and could someday compete with the biggest players. In the words of Jean-Paul Clozel, founder and CEO of the company:

Actelion could be the First European-born Biopharma to make it to the Major League.”

Featured image by Lisheng2121/shutterstock.com; figure from Google Finance.