Figures for the amount raised for EU biotechs since 2010 suggest although crowdfunding is considered a massive springboard for small startups, in reality, it has a much more limited range of use. Perhaps we have too high an ambition for crowdfunding as a financial tool for biotech?

Crowdfunding is in the general media so often these days that you don’t have to come from a business or industry background to have a decent conversation about it. Famous crowdfunding platforms such as Kickstarter have famously been used to fire up productions for movies to prototypes for gadgets such as the Pebble Watch to be produced.

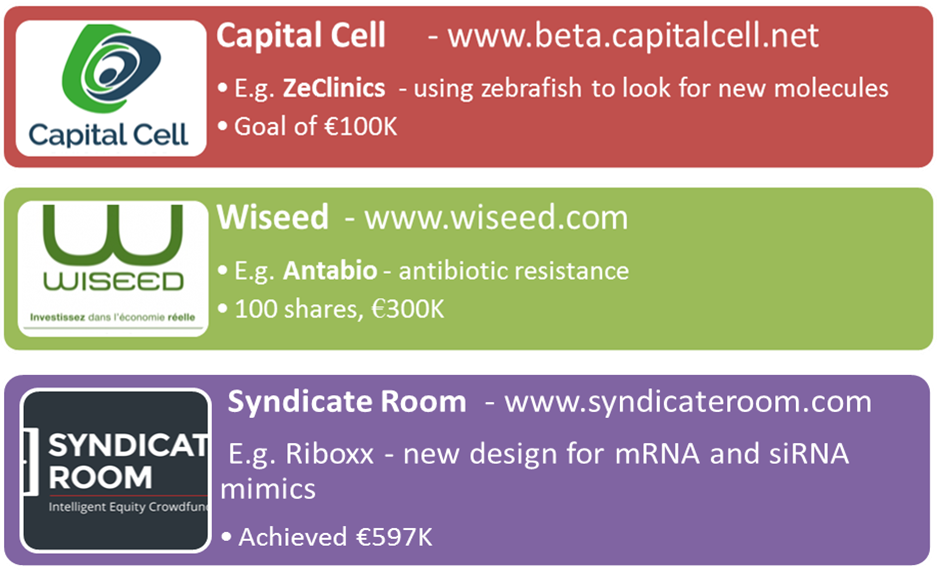

It wasn’t long before the application for crowdfunding Biotech companies arrived on the horizon. So it seems its popularity is on the rise as well – with up to 18 platforms being identified as the most applicable to the biosciences sector (read more of our in-depth review here), most of which work on an equity basis.

One example is WiSeed, a French crowdfunding platform which allowed biotech Antabio to follow up a research idea on how to combat bacterial resistance to antibiotics. Accumulating up to €300K from 100 shareholders, these shares were eventually bought out by the Wellcome Trust. Initial funding was actually rejected by venture capital, and it was WiSeed which provided the springboard necessary for a start-up to reach full-Biotech status in a €4M research success story.

Despite the fact that the total value of crowdfunded projects from within the EU since 2010 was as large as €23M (Source: BIOCOM AG), the total EU annual value for private investments within the biotech industry was around €2B for 2014 (Source EY) – a ridiculous comparison. Despite this, the average milestone achieved per crowdfunding campaign was €550K, suggesting that perhaps there is a threshold value before the project becomes unfeasible due to its size.

This suggests that whilst crowdfunding within the Biotech industry is indeed doing better than anticipated, particularly for start-ups, it has a limited application with regards to much larger funding goals…simply due to to the sheer number of people who would need to invest and the size of pledges. It seems the hype surrounding crowdfunding may indeed be misleading as a comprehensive financial tool for biotechs.