Newsletter Signup - Under Article / In Page

"*" indicates required fields

TiGenix is entering the Nasdaq with an IPO aimed at funding clinical trials. Will this move allow the company to make it through clinical trials?

TiGenix is a Belgian company behind ChondroCellect, the first cell therapy approved on the European market. The biotech has now announced a Nasdaq IPO that aims to raise €39.8M in order to fund a US Phase III trial in Chron’s disease for its lead candidate Cx601.

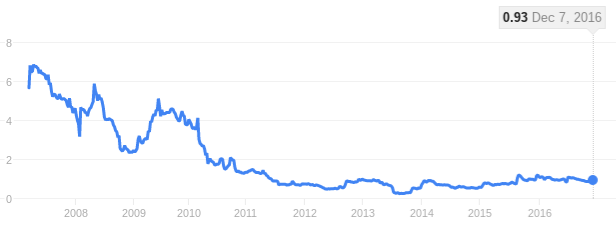

This IPO might boost TiGenix’ financial situation, which hasn’t been particularly good in the last 5 years, reaching the extremely low stock price of 22 cents back in 2013. The share price has risen since then but it’s still under €1; its market cap is currently €188M, a low figure for a late clinical stage company.

A deal with Takeda earlier this year injected extra cash in exchange for exclusive commercialization rights of Cx601 worldwide excepting the US. This IPO could give TiGenix the final push it needs to reach the market, which the company estimates is valued at up to €5.5B ($5.9B) in Europe and the US combined.

TiGenix withdrew ChondroCellect from the market last week for commercial reasons, notably the lack of reimbursement in key European countries. The Belgian biotech is now focusing on allogeneic expanded adipose-derived stem cell (eASC) therapies.

Cx601, currently awaiting EMA approval, employs these cells to treat perianal fistulas in Chron’s disease, for which there is currently no effective treatment. Two other candidates derived from the eASC platform, Cx611 and Cx621, are currently undergoing early-stage trials.

A second platform of transplanted allogeneic cardiac stem cells (AlloCSC) that the company acquired last year generated AlloCSC-01, currently in Phase II for acute myocardial infarction. With this strong portfolio, TiGenix seems hopeful for an oversubscribed IPO that helps it make it out of the slump. Will its technology convince the exigent US investors?

UPDATE (Original Publication 07/12/16): TiGenix has priced its IPO at €34M, raising doubts that going public in the US is worth the trouble.

Featured image from Wrangler/shutterstock.com; figure from Google Finance