Newsletter Signup - Under Article / In Page

"*" indicates required fields

Update (2/11/2017): uniQure has closed its public offering raising over $91m (€78M) on the Nasdaq, taking advantage of a massive stock jump triggered by the announcement that an improved version of its gene therapy for hemophilia B will enter Phase III trials.

Originally published on 24/10/2017

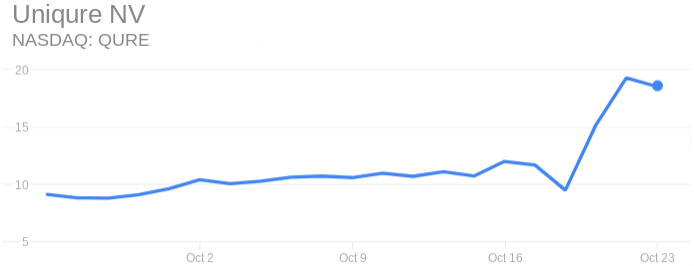

UniQure launched a public offering, perfectly timed with a rise in its stock last week after it announced a pivotal trial with a gene therapy for hemophilia.

UniQure has announced it is launching an additional 5 million shares on the Nasdaq. At its current stock price, this would result in an investment of over $92M (€78M). The underwriters will then have an option to buy an additional 750,000 shares in the following 30 days, which would amount to an additional $13M (€11M). In total, the company could raise a massive amount of over $100M if everything goes well.

This announcement comes right after the company’s stock skyrocketed last Thursday when it announced the FDA and the EMA have cleared uniQure to start a pivotal Phase III trial with a new version of its gene therapy for hemophilia B that could greatly improve its efficacy. The stock has since doubled the price previous to the announcement.

UniQure’s stock has been low for the past year, after it presented Phase I/II data of its gene therapy for hemophilia AMT-060. Though promising, the data was released at roughly the same time than its US rival Spark Therapeutics, whose data indicated a better efficacy.

The Dutch biotech has decided to step up its game with a new version of the therapy, called AMT-061, in which a change of just two nucleotides in the DNA sequence is expected to increase the activity of the gene therapy by up to 9 times. The FDA and EMA have extended their accelerated approval programs granted to AMT-060 to AMT-061, allowing uniQure to go directly into a trial that will determine whether the therapy will be approved.

With the public offering, uniQure is surely aiming at funding its upcoming Phase III trial, as well as boost its other gene therapy candidates for Huntington’s disease, heart failure and hemophilia A, which are all still in preclinical stage.

Meanwhile, Spark Therapeutics is about to complete Phase I/II trials with its gene therapy candidates for hemophilia. Another US competitor, BioMarin, is planning to start Phase III later this year, but in its case with a gene therapy against hemophilia A.

Images via Dimitriy Raznikov /Shutterstock; Google Finance