Newsletter Signup - Under Article / In Page

"*" indicates required fields

Ablynx has rejected a generous acquisition offer from Novo Nordisk. As a result, its stock has soared and is now worth more than what Novo offered in the first place.

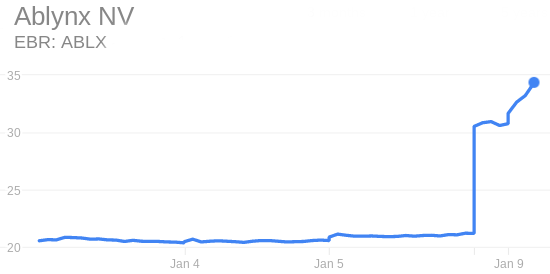

Early this morning, Novo Nordisk has made public an offer to acquire Ablynx, a Belgian biotech that has recently joined the European billion-euro biotech club. Novo offered €30.5 per share, which supposed about a 43% increase from its price before the announcement. In response, Ablynx has issued a press release indicating that the unsolicited proposal “fundamentally undervalues” the company, its pipeline, its platform and its strong growth prospects.

The news has triggered an increase of over 60% on its Euronext Brussels stock and 49% on the Nasdaq, surpassing the offer and setting the company’s market cap over €2.5Bn.

Turns out that this is not the first offer Novo makes. Ablynx has confirmed that the big Danish pharma made a proposition of €26.75 on December 7, which was turned down a week later. The decisioin of making this second offer public might have been a tactic to put pressure on the shareholders, but Ablynx doesn’t seem impressed.

Ablynx seems determined to keep independent. In a recent interview about its rise to the top of European biotech, CEO Edwin Moses told me: “For us, the goal is to show our shareholders and stakeholders that the future of an independent Ablynx is extremely interesting, and has great potential. Our business plan revolves around being a sustainable, independent business.”

Moses also mentioned that the company is planning on launching its first drug, caplacizumab, without the help of a bigger partner. The drug has shown promising results in treating the rare bleeding disorder acquired Thrombotic Thrombocytopenic Purpura (aTTP), and has drawn the attention of Novo Nordisk, which stated its intention to combine it with its own hematology drugs.

Expected later this year, the launch of caplacizumab will finally establish Ablynx as a commercial-stage biotech. The Belgian biotech seems confident that this will only be the first step of a strong growth trend that can far exceed what Novo Nordisk is offering.

Images via Jamesboy Nuchaikong /Shutterstock; Google Finance

Partnering 2030: Biopharma Report