Newsletter Signup - Under Article / In Page

"*" indicates required fields

The FDA recently approved an antibody-drug conjugate drug from ADC Therapeutics as a treatment for blood cancer. This has given a major confidence boost to other European companies in the field as the deal mill picks up speed.

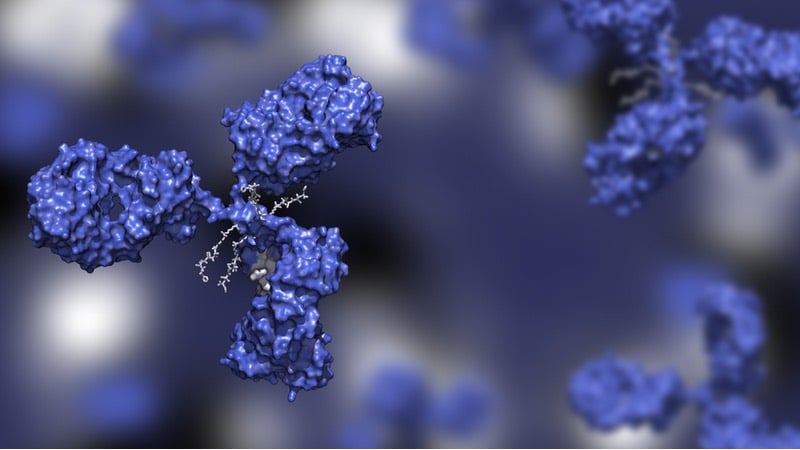

Last month, ADC Therapeutics in Switzerland broke into the mainstream when its lead candidate Zynlonta received FDA approval to treat the rare blood cancer diffuse large B-cell lymphoma (DLBCL). This makes Zynlonta the fourteenth approved antibody-drug conjugate (ADC), a type of treatment where small molecule drugs are attached to anti-cancer antibodies.

Europe has seen a bunch of ADCs approved in the last few years. In 2021, the green light went to Lumoxiti, which was developed by the UK giant AstraZeneca, and Enhertu, which was developed by AstraZeneca and the Japanese company Daiichi Sankyo.

ADC Therapeutics’ approval was achieved without the help of a big pharma partner, a rare feat for an ADC company. To fuel the commercialization, the Lausanne-based firm raised cash with a €215M Nasdaq IPO and a €194.7M follow-up offering last year.

ADC Therapeutics touts its first-in-class drug as a sorely needed treatment for DLBCL patients whose cancer has repeatedly relapsed after previous treatments.

“New insights and refinements of ADCs, like those we have pioneered, have helped them to evolve into an exciting class of potent, targeted therapies that are garnering more attention, acceptance, and use by physicians,” said a spokesperson from ADC Therapeutics.

Last year, the ADC space defied the uncertainty caused by the Covid-19 pandemic and experienced a deals boom. This was especially the case in the US, where Gilead closed a colossal €17.8B acquisition of the ADC developer Immunomedics in September. In the same month, Seattle Genetics (now Seagen) landed a hefty collaboration deal worth around €2.6B with MSD. In November, MSD also took over the firm Velos Bio for €2.2B.

On a smaller scale, European ADC deals also had an energetic year. In addition to ADC Therapeutics’ IPO, we saw Boehringer Ingelheim purchase the Swiss ADC company NBE Therapeutics for a neat €1.2B. European ADC startups also reaped a big funding harvest, including seed rounds from the French-German firm Emergence Therapeutics, the Cambridge spinout Spirea, the Swiss company Araris, and a Series A round raised by the German company Tubulis.

“There is excitement in the ADC field due to the many acquisitions of ADC companies and licensing deals that happened during 2020, in particular during the last quarter,” said Philipp Spycher, CEO and co-founder of Araris.

At the start of 2021, the European ADC funding scene seemed to slow. But a €4M seed round from French firm Mablink and a huge €51M Series A round from the Danish biotech ADCendo — reportedly the largest Series A for a Danish biotech company — suggest rebounding ADC investments in the second quarter of this year.

One reason ADCs are drawing interest is their potential to hit tumors more selectively than classical chemotherapy drugs. This is because the ADC drops its chemical cargo close to tumors like a ‘guided missile’ system. This in turn has the potential to reduce common chemotherapy side effects, such as fatigue and nausea.

Another reason for the big investor interest is that the ADC field has gained a steady foothold in the cancer treatment space. The continuing stream of ADCs entering the market is proving the potential of the technology, with more coming through the pipeline. For instance, the Dutch ADC player Byondis expects phase III data for its own lead candidate around the summer.

“In recent years, research in the ADC field has finally delivered on the promises and expectations from when the ADC drug class was first introduced decades ago,” said Henrik Stage, CEO of ADCendo. “We have great expectations for the further development of the ADC field in the next 12 months and beyond.”

“Historically, the ADC space has seen several cycles of success and failure, and it finally appears to have entered a period of maturation,” added a representative from NBE Therapeutics.

With the ADC space still growing, there are many limitations to the technology that startups can tackle. One is that it is difficult to find a dose that will be high enough to be effective but low enough to prevent side effects. In technical circles, this is known as having a narrow therapeutic window. It was potentially the reason why the Danish company Genmab abandoned one of its ADC candidates in November.

“If you look at the ADCs that have been approved thus far, to be honest, most of them have only a very limited improvement in the therapeutic window compared to the classical chemotherapeutics,” said Marco Timmers, CEO of Byondis.

One explanation for the small therapeutic window seen in current ADC drugs concerns the molecules that join together the antibody and its chemotherapy drug payload, called linkers.

“One challenge has been the lack of stability of ADCs in the body because the chemical linker connecting the antibody to the payload discharges the payload prematurely due to chemical interactions in the body,” said Jonas Helma-Smets, co-founder and CSO at Tubulis. He added that this causes adverse side effects and can reduce the benefits of the drugs.

Another reason is that, once the ADC drops its payload at the tumor site, the toxic drugs can make their way into the blood. Because they can’t be broken down fast enough, they accumulate in the bloodstream, causing side effects.

European companies are working on this problem in a variety of ways. Byondis focuses on developing a payload drug that breaks down much faster in the blood than current payload drugs do.

“We actually see hardly any toxicity for blood cells, which is the most common toxicity for all other ADC platforms,” noted Timmers.

Araris is developing better linkers, which could improve the therapeutic window of ADC drugs.

“We know from preclinical data in cancer models that with the same dose, we see better treatment response rates compared to conventional ADCs. Additionally, early data suggests that our ADCs are much better tolerated in animals, so we can dose much higher,” said Spycher.

ADC Therapeutics, on the other hand, aims its cancer treatments at different populations of patients whom current ADCs can’t treat.

“The clinical trials are being carried out with patients who are relapsing or not responding to current treatment regimens, therefore addressing an unmet medical need,” said Chris Martin, ADC Therapeutics’ CEO. “There are no head-to-head studies which can show you how much better our candidates are compared to approved drugs.”

As to why the European ADC scene is thriving, it’s probably part of a global acceleration in the technology.

“The trend is coincidental, possibly. Europe has many old-guard companies developing ADCs like Heidelberg Pharma and ADC Therapeutics, but it seems to be evolving,” said Timmers. “I think what is really going on is new insights into types of payloads, refinements that we put forward in making the payload … and things like molecular engineering of old concepts. We’re good at that in Europe.”

Going forward into 2021, more bright ideas will likely propel the ADC field. Anticipated innovations on the ADC horizon include antibodies that are more selective to tumors than current ones, drugs that are able to treat a wider range of cancers, and payloads that can overcome drug resistance in cancer.

Further into the future, ADCs could expand beyond cancer treatment and tackle other conditions such as autoimmune disorders.

“You would be able to really selectively target a blood cell or an immune cell that is involved in an autoimmune reaction and basically attacking your own healthy cells,” said Timmers. “If you were able to reach that specific immune cell that’s doing a bad job, you would be able to reprogram that cell or selectively kill that cell.”

This is an updated version of an article published on the 27th of October, 2020

Image from Elena Resko

Oncology R&D trends and breakthrough innovations