As increasing attention turns to microbiome-based therapeutics, the Scottish biotech Enterobiotix has closed a Series A fundraising to potentially treat a myriad of medical conditions by improving gut health.

Last week, EnteroBiotix raised €18M (£15.5M) in Series A funding to further develop a pill to restore the patient’s gut microbiome to a healthy state using stool samples from healthy donors. The technology could potentially tackle a plethora of seemingly unrelated diseases, including infections, metabolic disorders, and cancer.

The Scottish investment firm Thairm Bio led the financing, with US-based Kineticos Ventures joining existing investors including SIS Ventures and Scottish Enterprise, Scotland’s national economic development agency.

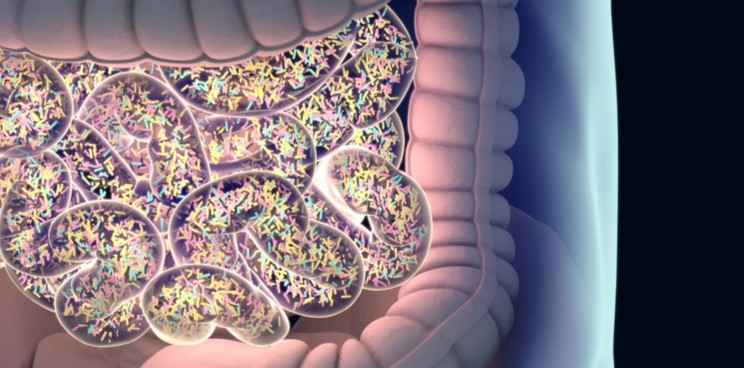

This is the latest example of increasing interest in the human microbiome — the ecosystem of viruses, bacteria, and other microbes in and on the body — and its potential to treat a wide range of conditions including cancer, diabetes, Covid-19, and depression.

“The microbiome is now considered a key area for innovative healthcare, and we believe that the momentum is growing,” said Hervé Affagard, CEO of MaaT Pharma. The French biotech’s phase III-stage microbiome therapy candidate is the most advanced for blood cancer globally.

Last year alone, approximately 575 new clinical trials in the microbiome field were launched, with nearly 2,000 now ongoing. The global value of its therapeutics market is expected to reach €340M by 2030.

“The investor base has grown, and their interest has deepened, as shown from a growing number of successful private fundraises in the US and Europe in the past two years as well as recent public fundraising in the US,” Affagard told me.

“There was also an exponential growth of consumer awareness thanks to TV, exhibitions, articles, commercials, cosmetic and nutritional branding, and education,” added Isabelle de Cremoux, CEO and Managing Partner at the venture capitalist Seventure Partners, which has a fund exclusively dedicated to the microbiome field that has invested in MaaT Pharma among other companies. “Consumers and especially millennials now expect microbiome-friendly products.”

Another active player in the microbiome field this year is eureKARE, one of a new breed of companies set up to translate academic research into a successful commercial format.

According to eureKARE’s Vice-President of Business Development, Kristin Thompson, there have been ups and downs in the field.

“The microbiome investor market was quite hot around 2015, then due to some missed clinical trial endpoints, regulatory uncertainties, and perhaps a lack of scientific evidence, it cooled off considerably,” she said.

Renewed interest in the field came when Swiss company Ferring Pharmaceuticals took over clinical microbiome company Rebiotix in 2018, with positive clinical trial results convincing investors further.

“In the meantime, scientific publications have soared on the microbiome, startups have sprung up everywhere and we see growing willingness from big pharma to dip their toes into the microbiome pool. Very few though are taking the entire plunge,” explained Thompson.

In one of the major collaborations to date, US Gilead and Second Genome last year embarked upon a four-year deal to investigate the microbiome role in inflammatory disease, in a deal that could head towards €1.79B.

January this year saw Pfizer invest €21.1M ($25M) in clinical-stage microbiome company Vedanta to fund a phase II study investigating microbiome modulation to treat inflammatory bowel disease. That same month, Eligo Bioscience entered into a deal with GSK potentially worth up to nearly €190M for a skin microbiome treatment to treat acne.

The race is now on to develop the first approved microbiome therapy. In the lead are Seres Therapeutics and Rebiotix/Ferring, which are clearing phase III trials for their microbiota treatments targeting Clostridium difficile infections.

“In the microbiome field, as it was the case for every disruptive medical innovation, successful phase II and phase III clinical trials are key to convince a few big pharmas to sign expensive deals and make expensive acquisitions,” pointed out de Cremoux.

“These first transactions are generally the inflection point for a new segment to attract big investment and other big deals and turn hope into hype.”

“As we learn more about the microbiome’s complexity and its interaction with the patients and their disease, we expect to see the emergence of more complex products driven by more and more academic research, as well as the emergence of more specific regulatory pathways to support their development,” Affagard added:

“We also expect to see some consolidation in the industry, as companies reach proof-of-concept stages and larger companies jump onto the microbiome bandwagon.”

Cover image via Elena Resko. Body text image via Shutterstock.