Newsletter Signup - Under Article / In Page

"*" indicates required fields

With a €49M ($60M) Series A, the French firm eureKARE debuted this month with the goal of priming the translational pump in hot areas where European academics have already made a mark, particularly the microbiome.

Strong public funding in Europe often generates great science, but the relative lack of private funding resources leaves more opportunities stranded than in the US.

“There are many opportunities to extract this research and build new companies, but we definitely need new funds and new investment structures,” says Rodolphe Besserve, eureKARE’s CEO.

To meet this need, the Parisian company will use its Series A winnings to seek out cutting-edge academic research and spin it into successful companies. The spotlight will be on novel areas of research like the microbiome and synthetic biology.

“We wanted to bridge a gap that we see in Europe between academia and where the actual research comes to light,” says Alexandre Mouradian, eureKARE’s founder and chairman.

Instead of an investment fund, eureKARE is set up as a company. According to Besserve, this provides some natural advantages. For example, funds are regulated and beholden to internal rules set when courting investors for their single initial fundraise. In contrast, eureKARE is eligible for grants, can leverage its balance sheet for debt, and can raise money as needed at regular intervals and at increasing valuations.

“We can be much more flexible and adjust at any time to seize the best opportunities,” Besserve added.

Having a company structure also means eureKARE can think about longer horizons than a typical VC, says Besserve, with the potential to invest in a company over decades — something that was very important to stakeholders. In keeping with this long-term model, eureKARE aims to avoid maximizing profits at the expense of the founders.

“We’re not philanthropists, but at the same time we think it’s important to respect the science and the scientists, so we can bring the most value to the companies,” Besserve says.

The launch of eureKARE comes as multiple microbiome companies near market approval. Positive phase III data have been announced for two experimental microbial treatments for Clostridioides difficile infection; namely by Seres Therapeutics last August and Ferring Pharmaceuticals subsidiary Rebiotix this month. Both firms are on track for regulatory filings soon.

“There’s a lot of clinical proof-of-concept that wasn’t there five years ago,” says Savita Bernal, CBO for Lyon-based MaaT Pharma, “and some companies will be entering the market extremely soon.”

MaaT’s own microbiome therapy for acute graft-versus-host disease following a bone marrow transplant will soon enter phase III trials, joining a growing class of drug candidates for indications like chemotherapy-related infections and Alzheimer’s disease.

While incubators, venture funds, and accelerators address part of the translational gap, eureKARE aims to combine aspects of all three. The company thus aims to develop an ecosystem that will support intellectual property (IP) development from idea through company formation.

Besserve says the team was inspired by the structure of the US investment and incubator firm Flagship Pioneering, which has spun out early players in the microbiome field like Evelo Biosciences and Seres Therapeutics. However, eureKARE will have a laser focus on developing European IP for microbiome and synthetic biology therapies — areas the firm thinks are ripe for a disruptive approach.

Typical startup incubators often rely on motivated scientists to drive a project forward through tech transfer and patenting. In contrast, eureKARE first zeroes in on an unmet medical need, then sifts through scientific literature to identify promising academic teams and projects. The company then assists the academics with startup formation and day-to-day operational needs. The idea is to de-risk the burgeoning spaces and draw in non-traditional investors.

“The biotech sector is still growing up,” says Besserve. “We need to find ways to convince people to invest in these fields.”

There are already investment funds dedicated to the microbiome space with a track record of success. This can benefit startups in the long term, says Isabelle de Cremoux, who is in charge of one such fund as CEO and Managing Partner of the Parisian VC investor Seventure Partners.

“If the company would like to do an IPO later on, having a regulated fund – managed by a regulated management company – brings much more credibility to the banks and financial investors on the listed market,” she says.

Seventure was an early investor in MaaT Pharma, Paris-based Enterome, and US-based Vedanta Biosciences, all of which now have assets in phase II. Seventure’s latest microbiome-focused fund, now worth €250M, was launched in 2019.

The first batch of companies funded by eureKARE include Stellate Therapeutics and Novome Biotechnologies, which are developing microbiome-based therapies for neurological and digestive diseases, respectively, and Omne Possibile, which is developing synthetic nucleic acid analogues. The plan is to launch up to five companies, and to invest in up to five existing companies, each year.

Besserve says when it comes to microbiome research, European academics outpublish their US or Chinese counterparts, but translation hasn’t followed suit. One growing area of research is the gut-brain axis – the connection between the gut microbiome and neurological disease. Paris-based Stellate Therapeutics is one of at least 16 companies with programs in the space, but only two others – London’s 4D Pharma and Bordeaux-based Ysopia Bioscience – are based in Europe.

Stellate’s lead asset is a metabolite produced by gut bacteria with neuroprotective qualities. The candidate is on track for clinical trials for Parkinson’s disease next year. At least seven companies outside of Europe already have clinical programs for autism spectrum disorder, Parkinson’s disease, cerebral palsy, hepatic encephalopathy, and Alzheimer’s disease.

At worst, European microbiome companies are subject to the same headwinds as the rest of the biopharma space, says de Cremoux. “But not more, not less – in the same proportion.”

Bernal notes that there have been several microbiome company launches in Europe in the last two years. “I’m not saying they had it easy, but there are opportunities to launch companies in the field.”

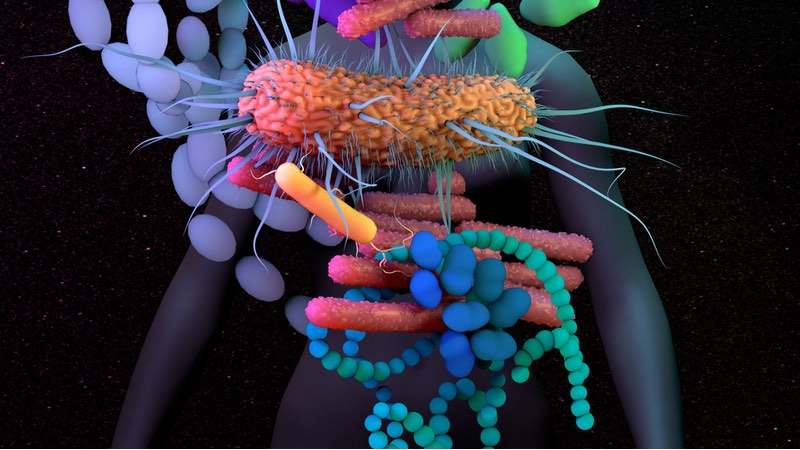

The science is clear about the relationship between the microbiome and human health. This has drawn major interest from investors and big pharma to biotechs working on the gut and skin microbiome. However, many investors are still skittish about living organisms as therapies.

“There’s still a lot of education to do; it’s very similar to when the biotech industry first emerged,” says de Cremoux.

Article updated on 29/05/2021 to correct the size of Seventure’s Health For Life Fund II.

Cover image from Elena Resko. Body text image from Shutterstock.