Newsletter Signup - Under Article / In Page

"*" indicates required fields

The FDA has handed out a Fast Track Designation to AMO Pharma for its key asset AMO-02 to treat congenital myotonic dystrophy.

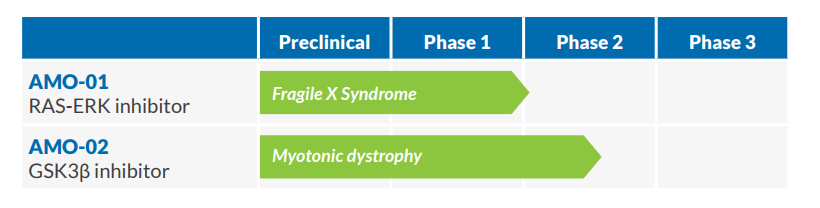

The British-American biotech hybrid AMO Pharma is advancing a small pipeline of drugs for rare genetic disorders. The biotech, which is backed by famous UK Investor Neil Woodford, is currently pushing its lead candidate AMO-02 through Phase II as the first-ever treatment for myotonic dystrophy. Now, AMO will also be backed by regulatory agencies, after the FDA today announced that it has granted Fast Track Designation for AMO-02.

The Fast Track Designation paves the way for an accelerated approval process for AMO’s lead drug and includes a priority review that clips four months off the FDA’s decision process. This is great news for patients suffering from the disease, which represents the most common form of muscular dystrophy, and for which there is currently no approved therapy available.

AMO-02 tries to tackle the most severe form of myogenic dystrophy known as congenital DM1. The drug works by inhibiting the glycogen synthase kinase 3 beta (GSK3ß), which is extra active in patients with DM1 as well as duchenne muscular dystrophy. So far, the inhibitor was able to demonstrate pre-clinical efficacy in transgenic models.

“Our ongoing Phase II clinical trial for AMO-02 in the UK is the first sponsor-led clinical study in the treatment of congenital myotonic dystrophy and represents a historic milestone in research and a new era of hope for patients and their families affected by this serious condition,” commented Michael Snape, CEO of AMO Pharma.

The company only has one other preclinical candidate in its pipeline, which is being developed for the treatment of Fragile X syndrome. Yet, competition-wise AMO Pharma seems to have good chances on the market.

Since US-based Ionis Pharmaceuticals, which was partnered up with Biogen, failed Phase I/II trials with its DM1 drug earlier this year, there are not many biotechs left in the space. Moreover, after BioMarin‘s recent Phase III failure with its ProSensa buy-out for the treatment for Duchenne, AMO could be all set to tackle this disease as well. It’s maybe not surprising that the early-stage company was able to rake in an impressive €25M from Woodford.

Images via shutterstock.com / Choksawatdikorn and amo-pharma.com