Newsletter Signup - Under Article / In Page

"*" indicates required fields

Funding is the lifeline of innovative ventures. In an increasingly uncertain environment, looking at the records of past investments can be essential for making sense of the future and getting closer to discovering what’s next for the life sciences industry.

Exploring the differences between the two major groups of life sciences investors and the funding flow between their locations is essential for understanding the current global industry trends and getting the sense of the direction the life science space is heading in the years to come. We leveraged the CipherBio investment database to dive deep into two of the most influential life science markets in the world — the US and Europe — and discover emerging trends that will help understand the existing landscape and decipher the future of the funding flows across the Atlantic.

We set out to answer questions such as who are the top US and European firms investing in the life sciences across the Atlantic? Which sectors draw their attention the most? How do the European and US ecosystems compare? The data covers deals closed from the beginning of 2019 to September 2020 across four life science verticals: biotech; digital health and artificial intelligence; medical devices; and diagnostics.

Top investors

The US and Europe are two of the world’s largest life science markets. Tracking the activities of their most influential life science investors and untangling what sectors, companies, and markets they select can help decode where the global industry is heading.

Since the beginning of 2019, the Danish investor Novo Holdings, UK firm Janus Henderson Ventures, and NexTech Invest in Switzerland were the top three European investors in terms of both total number of investments (Figure 1) and of investments in US companies (Figure 2). This data indicates that the most active European investors tend to engage more in overseas investment.

However, that is not the case for some of the other top investors, with names such as HBM Healthcare Investments and Leaps by Bayer, which respectively occupy fourth and fifth place, predominantly engaging in the US, with most of their investments since 2019 located there.

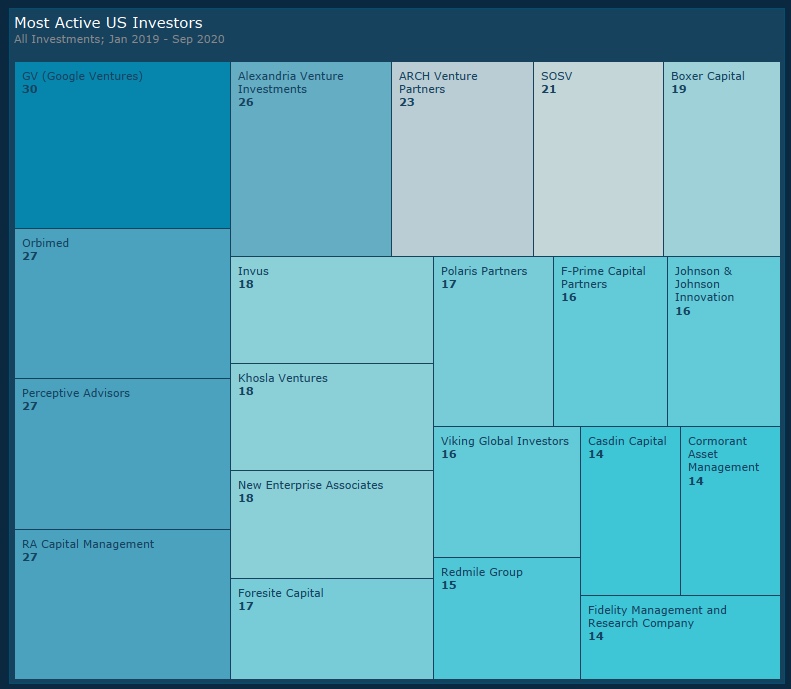

Overall, the top US investors placed more deals globally than their European counterparts (Figure 3). Unlike their European peers, the most active US investors don’t tend to look overseas for investment opportunities. The most active US investors investing in Europe are Perceptive Advisors, RA Capital Management and Invus, each closing three deals in Europe since the beginning of 2019 (Figure 4). On the list of the top life science investors located in the US, they rank third, fourth and ninth, respectively.

Breakdown by sectors

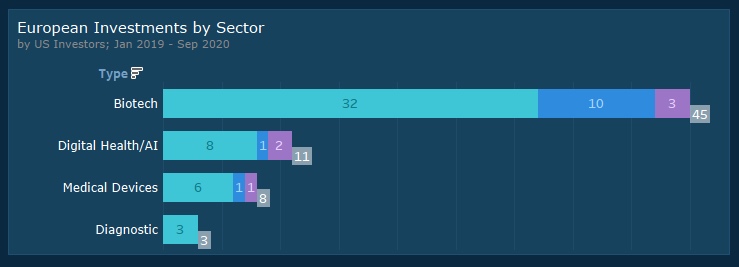

To discover what kind of companies attract the attention of European investors the most, we took a deep dive into the four core verticals of the life science landscape: biotech; digital health and AI; medical devices; and diagnostics.

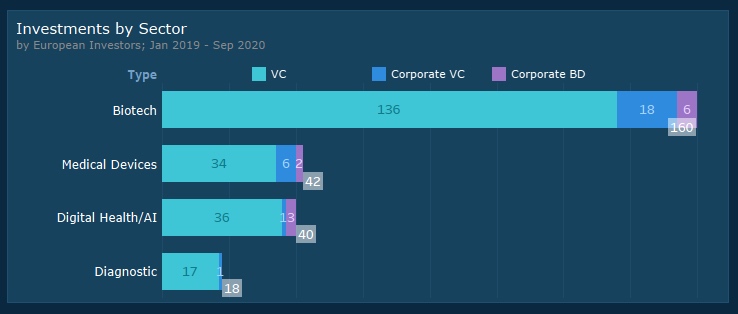

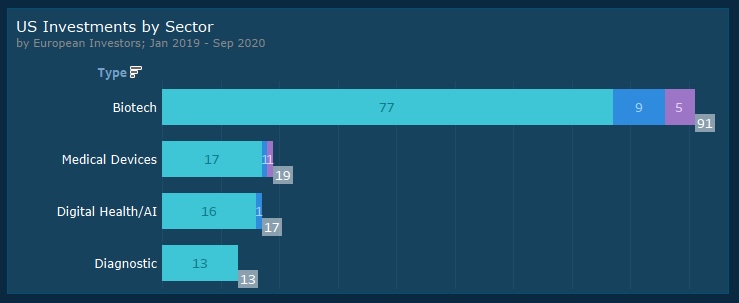

Since 2019, the biotech sector has attracted 61% of the funding of European life sciences investors, with 137 out of 222 transactions involving biotech companies (Figure 5). The same outcome holds for US investments by European investors — 76 out of 118 of their investments in the US market involved biotech companies, which is equivalent to 64% (Figure 6). No matter where you are, biotech gets the lion’s share of investment deals

When investing in companies of the biotech sector, European life science investors tend to look disproportionately more at the US market than at the rest of the world. Around 55% of their total investments in the biotech sector is located in the US — 76 out of total 137 investments since 2019.

Medical devices, as well as digital health and AI, follow the biotech sector in terms of the total number of deals, with the diagnostics vertical attracting the least attention from European investors. These investors tend to look predominantly to the US when investing in these verticals. Nine out of 13 investments made in diagnostics by European investors were located in the US, and almost half of all investments in medical devices and in digital health and AI went to the US.

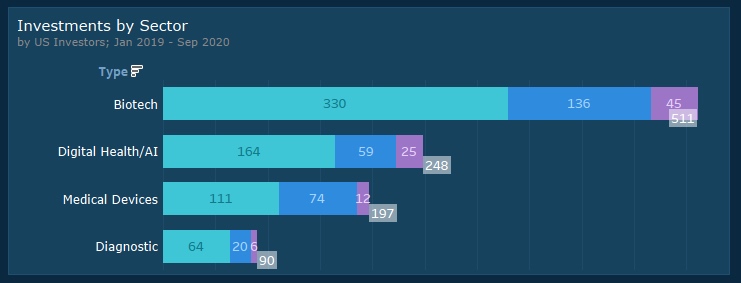

Just like their European peers, US investors mostly invest in biotech companies, with 440 out of total 953 transactions corresponding to this vertical (Figure 7).

A closer inspection of those US investors that invest in Europe reveals that they also gravitate towards the biotech sector, with 40 out of 60 transactions belonging to this life science vertical (Figure 8). As is the case with European investors, the diagnostics vertical is the one getting the least amount of attention.

Geographical breakdown

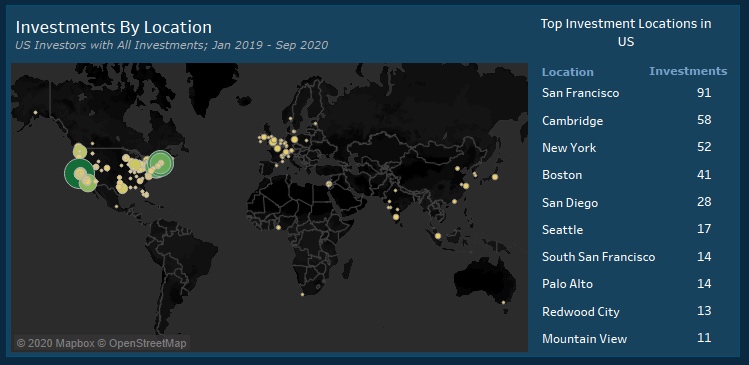

Looking at the location of life science investments is a useful indicator of the funding flows between Europe and the US. Most of the activity of European investors was centered around the usual life science suspects. In the US, it focused on the West Coast and East Coast, with Boston-Cambridge and the San Francisco Bay Area being the biggest hubs. In Europe, the main location was the UK with 26 investments, followed by France and Germany with 16 and 15 investments, respectively (Figure 9).

In contrast, the largest market for US life science investors was the US (Figure 10). All top investment locations for US investors are in the US, with San Francisco, Cambridge and New York topping the list.

The favorite location for both European and US investors alike is undoubtedly the US, with 634 out of 802 deals involving US companies (Figure 11). In contrast, all European companies combined closed 150 deals during the same time period.

Within Europe, the UK attracted the biggest number of investments, with a total of 43 deals, of which 18 included investors from across the Atlantic and 25 from Europe. Next in line is France, with 11 companies attracting US investors and 18 European, followed by Germany, where 10 US investors and 15 European investors closed deals.

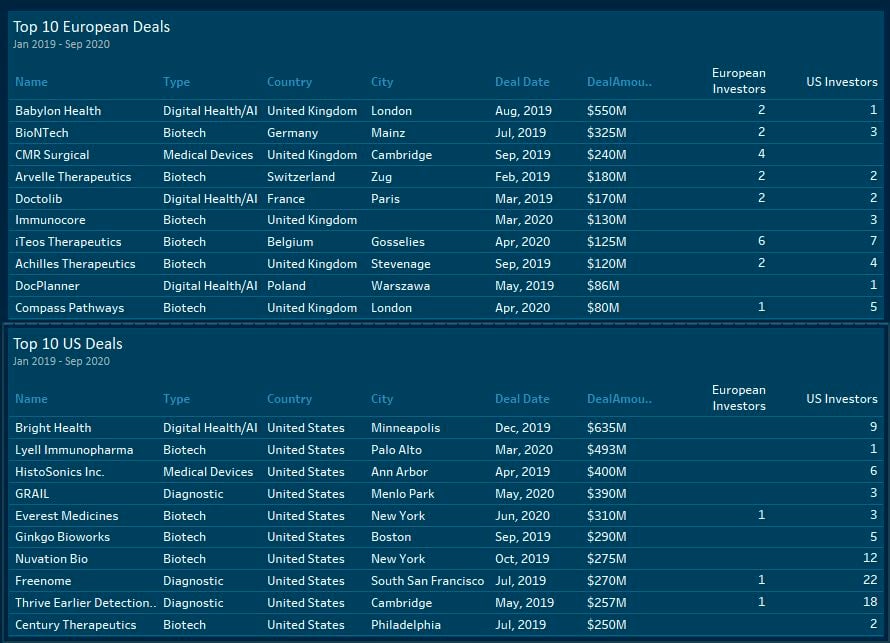

Top transactions

With massive private funding rounds and gigantic IPO exits often exceeding hundreds of millions, the life sciences industry features some of the biggest deals globally. Looking at the top 10 deals in the US and in Europe since 2019, it becomes evident that the size of US deals exceed by far the size of the top European deals (Figure 12).

The European list of largest transactions is topped with investment deals in 2019 such as the €465M round raised by the UK AI health service specialist Babylon Health and a €290M Series B for the mRNA giant BioNTech in Germany.

Aside from a €117M Series B by the UK firm Immunocore, all the European companies listed were funded by syndicates with a notable presence of European investors. They are often present in at least the same proportion as their US peers and sometimes dominating, as in the case of CMR Surgical, a medical device company based in Cambridge, United Kingdom, whose €220M Series C round was financed by only four European investors.

Meanwhile, the US market dominates when it comes to the biggest ticket deals. Although Europeans have star deals to show, they are relatively rare compared to the US. While there are two deals exceeding $300M at the top of the European list, the top deals on the US list greatly exceed this mark.

Although the biotech sector clearly dominates the European life sciences space, the table turns when it comes to the biggest deals, which are dominated by European companies in the digital health and AI as well as the medical devices verticals.

A similar finding holds true for the US as well. Although the biotech sector continues to dwarf other verticals in the US, the top three transactions involve companies from the digital health and AI, medical devices, and diagnostics verticals.

Investment stage

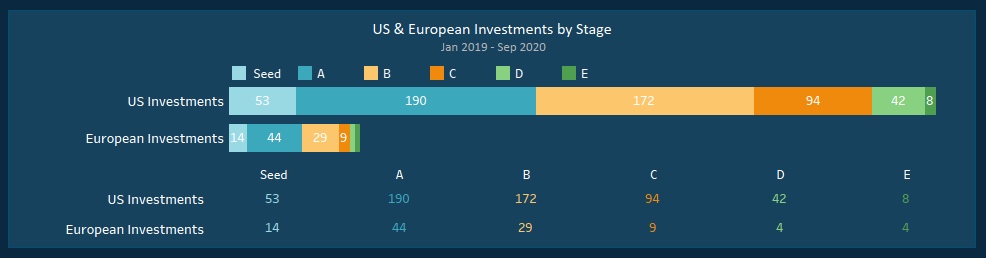

Early-stage companies tend to be riskier than more advanced ones. As a trade-off, they usually offer higher returns and more control for investors. In comparison, later-stage companies present less of an uncharted territory for investors, but at that point investment syndicates tend to be already well-formed.

To investigate the preferences of European and US investors when it comes to the investment stage, we explored how their investments are split across the life cycle of life science companies, from the seed stage to Series E.

Across all locations, US investors dominate across all stages of funding. This dominance is stronger in later stages of funding, from Series C onwards (Figure 13). At this point, the participation of US investors in a deal jumps to around 10 times that of European investors, with 87 deals involving at least one US investor versus 8 deals involving at least one European investor. This indicates that many Series C and D deals are done without the intervention of any European investor. Series E transactions, although few and far between, are still disproportionately more populated by US investors than European ones.

Navigating the global life sciences landscape

As the world emerges from the economic pause brought by the Covid-19 outbreak, investors and companies are trying to make sense of what the future will bring. As the two major life science markets, there is no doubt that both Europe and the US will play a vital role in shaping that future.

The data reveals that although the US is by far the largest market, the European life sciences space is also thriving, with both companies and investors playing an essential role in the international landscape. Overall, the top three European investment locations include the UK, France, and Germany.

One big similarity between the US and Europe is that the biotech sector attracts the most interest of all the core verticals. Still, the top deals since 2019 predominantly involved companies from other verticals. From the three largest European deals, only one transaction involved a biotech company — BioNTech in Germany. In the US, all top three deals went to companies in the diagnostics, digital health and AI, and medical devices verticals.

However, unlike their US peers, the most active European investors are those that most often look across the Atlantic for investment opportunities, while the most active US investors tend to stay closer to home. Although US investors dominate European investors across all stages of investments, the gap starts to be more evident from the Series C stage, when the US participation surges to 10 times that of European investors.

The aggregate view enabled by our data casts light on the European life science landscape, bringing into the spotlight innovative European companies that were successful in attracting the attention of US investors, such as Babylon Health and BioNTech. This provides an opportunity for other companies in the life sciences sector to leverage the experience of those that were able to attract the interest of investors in the most competitive life science market in the world.

Images provided by CipherBio. Written by Matthew Gibbs, find him on twitter @CipherBio_gibbs